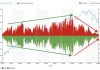

In my first note, I asked the question, will the yield curve invert? With 5s30s and more importantly the 2s10s inverting on 31/03/22, the guessing game is over! The inversion although an important part to start a countdown on a risk off set up. It’s a steepening of the yield curve that comes after an inversion that hurts risk assets. We might be seeing the first signs of this taking place as the curve starts to steeper.

As the months have rolled on the bond market selloff has been unrelenting, as the market prices in more and more hikes from the Fed! In times like these, it’s sometimes best to see if there are any historical reference points? There are plenty when it comes to US10Y.

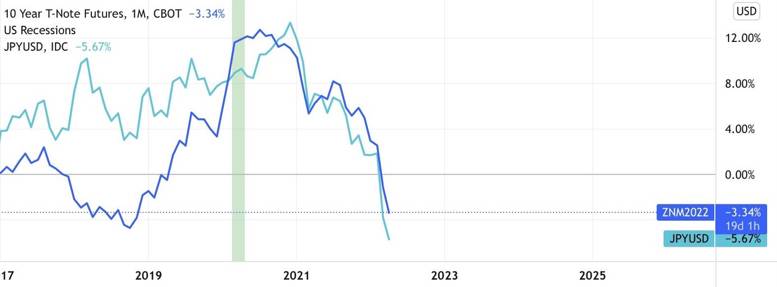

The first and most obvious one that comes to mind is 93-94, when the Fed took the market by surprise by hiking, US10Y yields jumped 2.7% in 12 months. Although, the more relevant period might be 98-00. In 1998, we had LTCM and the Asian debt crisis where 2s10s inverted in a not so dissimilar manner to the 2019 repo crisis and the Covid crash both short lived events. US10Y went up 2.6% in 24 months, quite like the bond market sell-off we have seen recently, currently sitting around 2.4% since the Covid lows. 2s10s inverted again in 2000 and as noted earlier this happened again in 2022 shown highlighted below.

Something to take note of, it’s not only sovereign bonds that have been selling off, it’s also high yield debt. We are currently sitting below December 2018 which for the most part equities have seemingly ignored.

This is similar to investment grade LQD, where we have gone below the Covid crash and diverged away from equities which one is correct? I’m sure we will find out sooner rather than later.

FX

DXY

The DXY hit 100 supported by rising US yields and an even more hawkish Fed with QT coming in the next meetings. Although it’s hard to fade a trend, we are coming up for some important levels from 2015, the last start of the hiking cycle and the peak in dollar funding problems related to Covid.

EUR

All eyes this month on the French election with Macron and Le Pen sentiment is around a weaker EUR but I would be cautious being too entrenched as headlines of a win for Macron could undo some badly positioned shorts.

JPY

The Yen has been following US yields. I don’t see that correlation breaking down anytime soon unless we have some intervention from the BOJ. Be aware though any hint of a slowdown in the US will send the JPY higher, something to be cognizant of!

GBP

We broke 1.30 in cable with the Fed minutes coming out. Like other countries, the cost of living is getting worse with higher inflation. National insurance tax has risen which will impact consumers. Expect a selloff in risk to put pressure on sterling.

CHF

Months of consolidation have appeared in USDCHF; it’s been range-bound from 0.90-0.94 since the beginning of last year. A break over 0.9450 could see some buying pressure! If we get more clarity around RUS-UKR it will especially impact on gold.

AUD

We saw some selling coming into the AUD for the first time as commodity prices started to come down, in particular, copper! Whether or not this is a trend reversal is to be determined but something to keep an eye on!

CAD

WTI and Brent have started to take a breather, the former going under $100 a barrel and with it so has the loonie started to sell off slightly. I’d be playing attention to the current lockdowns in China as that will be limiting demand on the other side of the equation. With the US gov releasing more of their reserves it should start a decent rally in the USDCAD.

The post <h5>Macro Research</h5> <h3>After Inversion Comes?</h3> appeared first on JP Fund Services.