The phrase “Don’t fight the Fed” is normally attributed to the reaction function of central banks once a crisis is underway. What does it mean? Simply put, once risk assets have been sold off, normally the Fed would step in and buy bond, i.e., quantitative easing plus cut interest rates, this would provide liquidity therefore making investors pile in further along the risk curve.

The question then comes: can we use this phrase in reverse? i.e. once the backstop from central banks comes to an end and they start raising interest rates and commence quantitative tightening which decreases the amount of liquidity, investors with this change in policy should not be the time to be brave! Interest rates are beginning to rise, and the net effect should be that risk assets continue to get sold off. “Don’t fight the Fed”.

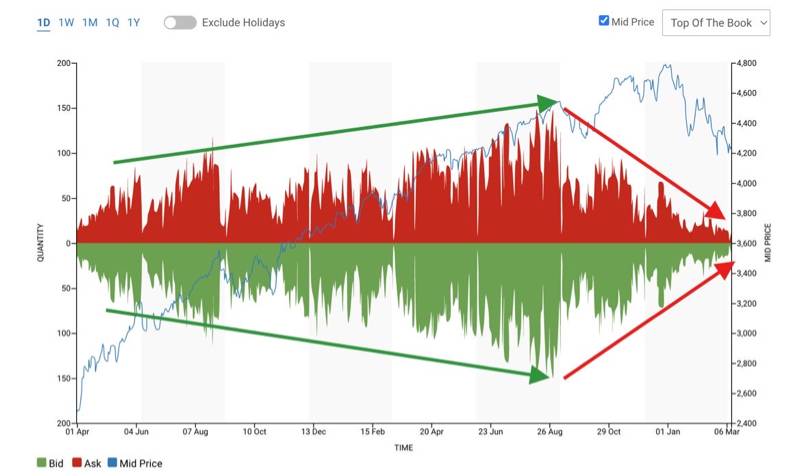

Liquidity, the double edge sword. When we have an abundance of liquidity, volatility remains subdued. Investors are comfortable taking on risk as they know there is a backstop and a buyer of last resort, central banks. In this chart, we can see how liquidity has started to dwindle in S&P futures if this is because of Geopolitical risk or simply the world waking up to central bank tightening at the start of this year. Who is to know but it’s something to pay attention to.

(CME Group, Liquidity Tool)

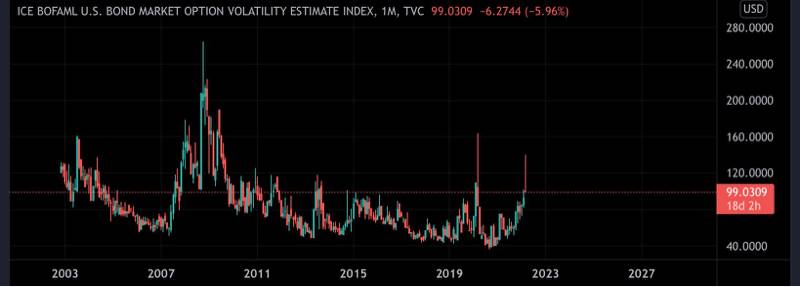

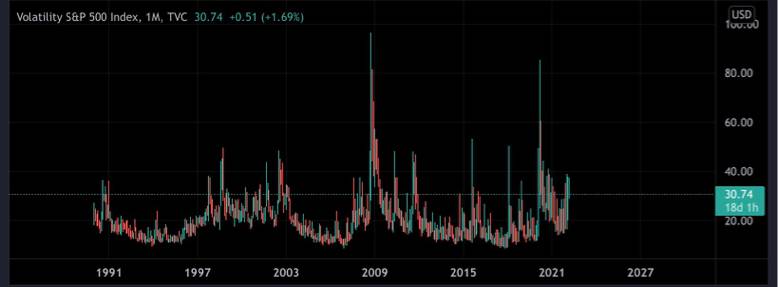

Volatility

With each headline dropping of the invasion of Ukraine, the VIX index (volatility index S&P) and the MOVE index (Bond Volatility) have both spiked in recent weeks leading to larger moves in both asset classes. Shown in the charts below.

(MOVE Index)

(VIX Index)

Bonds

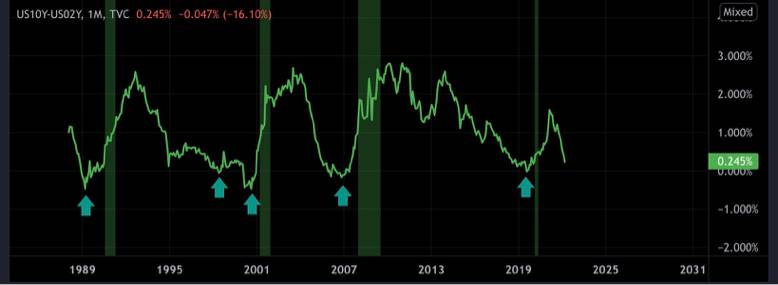

With curves continuing to flatten, we have started to see inversions namely US10-7s and US30-20s. We have yet to see US10-2s invert yet but it’s currently sitting at around 25BPS this has been the lowest before any hiking cycle in recorded history. We are in no man’s land, interesting times ahead for policy makers.

(US10-2Y)

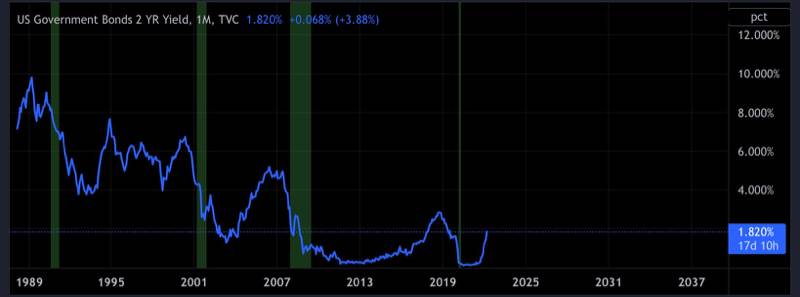

Most of the move has come from the front end US2Ys as displayed below. We have breached 2020 levels but still within the 40-year trend.

(US02Y)

US inflation this month came in at 7.9%, with the recent conflict this looks to go higher as lots of commodity moves have yet to feed into the data. Something that I personally think is the most important chart is inflation overlayed with the Fed funds rate. Where inflation goes the Fed follows this is one of the most dramatic divergences I have ever seen.

(Fed Funds light green, Inflation blue)

FX

USD

As dollar funding markets have been getting stretched with the selloff in risk. The USD broadly has found a bid as the safe haven trade ratchets up with every headline. My view is this trade is now getting overdone. We should start seeing some relief in other pairs once clarity comes from the Fed.

EUR

Euro currency has been a proxy play with the tensions in Ukraine. Partly driven by location and the reliance on Russian exports such as energy. EUR crosses currently at historical levels, any positive developments don’t be surprised to see a rally especially with the pivot from the ECB.

GBP

Cable still has a lot of selling off to do relative to the Euro. BoE this week, money markets have a probability of 10BPS hike at 100%. Anything more will come to be read as more hawkish and would expect a pop to the upside. If it comes inline expect the reaction to be muted.

AUD

Surprisingly, the Aussie has been one of the better crosses over Feb/Mar. This has been a pure commodity play, going forward we may seem selling of the AUD. Mainly as China adopts a zero covid policy in areas such as Shenzhen so manufacturing will slow as a result.

CAD

The pure correlation with the Loonie and Oil has broken down recently. There is a lot of War risk baked into Oil at the moment that natural supply/demand dynamics as Chinese consumers cut back on energy demands with lockdowns. Should see Oil and if correlations come back also affect the CAD, I would expect downside especially against the EUR.

JPY

As Japan is the creditor of the world being the largest holders of US bonds. The Yen is a proxy to US bonds especially the long end 10s and 30s hitting the 118 range as the curve starts to balance out at around 2% level. As the Fed start hiking it’s more a game of the short end catching up with long end once recession start to kick expect the long end to be bought as the curve inverts being net positive for JPY crosses.

The post <h5>Macro Research</h5> <h3>Don’t Fight the Fed</h3> appeared first on JP Fund Services.