When market themes change, they can be very subtle from one sector to the other. For example, tech to oil short term bonds to long term or from one region to another. A few of these types of changes happened over the last couple of months I think are worth exploring.

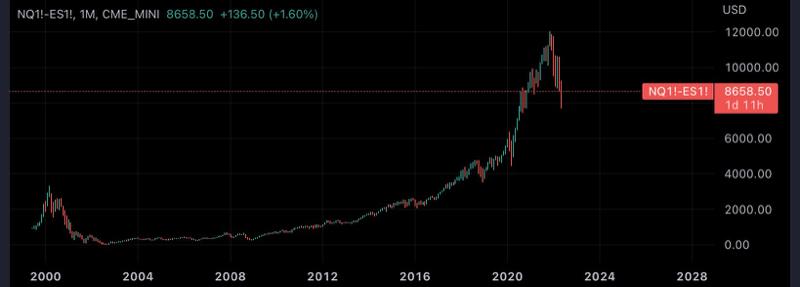

The last decade equity markets have been driven by two forces: mega tech and low cost ETFs also sometimes referred to as passive investing. As more investors have switched from mutual funds to ETFs the stock picking element of the market has lost its dynamic so naturally more money flows to bigger market cap stocks. Underneath is the long-term chart of the Nasdaq minus the S&P 500. I’m thinking there is a bigger rotation at play here similar to 2000.

Bonds

For the first time in 5 months people look to be buying bonds. Now is this recession jitters or people thinking the Fed will start to pause hiking by year end. Who is to know but as I said in my last article I think US 10s and 30s look attractive here if only as a hedge for the more risky side of a portfolio.

It’s not only long-term bonds that have been going up Eurodollars have been getting a bid recently reducing the market pricing for the most hawkish views.

FX

DXY

The dollar looks like it could be turning a corner to the downside which is following US yields. This could give relief to risky assets as well if the Fed pauses CFTC positioning has started to turn culling bullish dollar bets which could weigh on the dollar going forward.

EUR

Lots of talk and jawboning by the ECB but yet to see much in the way of actual action from Lagarde. Most of the UKR/RUS situation has been priced and so the logical conclusion is there might be support for the EUR.

JPY

I’ve seen lots of chatter about the BOJ and how that’s going to hurt the JPY. My take is the bond market is much more important than anything the BOJ does. As at the end of day Japan is the biggest buyer of duration so if bonds go bid so will the Yen.

CHF

We got parity and reversed pretty quickly as with the JPY I see participants reversing dollar positions into these pairings. The moves in USDCHF shouldn’t be taken lightly as quickly as it’s going down. I wouldn’t be surprised to see some squeezes to the top side. Patience for shorts will be rewarded at better levels.

AUD

The Aussie will be the barometer in FX for risk on/off behavior we see in equities. Bear market rally’s will give support to the AUD but don’t get too bullish if you believe equities have yet to bottom. The other headwind will be China and it’s zero covid policy mixed with some fear of a Taiwan invasion. Whether or not that happens I’ll leave to GeoPol experts but it’s a risk, nonetheless.

The post <h5>Macro Research</h5> <h3>The Great Rotation</h3> appeared first on JP Fund Services.