It’s quite clear certain parts of the market such as crypto, saas and other duration linked assets in Tech has recently had a fall from grace reminiscent of the .com bust. How deep this goes will depend purely on central bank policy, of which I’ve tried to argue a fall in risk assets is actually what the federal reserve wants currently. This has a knock effect in the wealth effect that will impact inflation.

So when will the Fed feel comfortable again supporting markets? It’s quite clear they realised they were too late to hike and unlike previous cycles when they could bail out markets because price stability (Inflation) was under 2% the money printer might not get turned on for a while. Here is J. Powell speaking in an interview with Marketplace “It’s unfortunate, I wish they weren’t, I wish that all of this hadn’t happened, and we still had 2% inflation.” I would say until you see CPI to come closer to 2% level don’t be to eager to jump in and buy the dip because it might have a few more layers to go.

Something that hasn’t been mentioned recently with the rise in the dollar. Is that the NY Fed conducted Swap lines to both the ECB and the BoE this could be a way to keep the dollar in check as a wider divergence happens between different rate cycles at central banks. Although it’s very small it’s worth keeping an on especially if we have a shortage of dollars within in the system.

Source: New York Federal Reserve

Bonds

US10s spiked over 3% at the beginning of the month and have now started to come down. This may be the start of a reach for safety as equity’s have woken up to what the bond markets have been screaming the last 12 months. For those with patience it’s my opinion that this might not be a bad place to pick up some duration to weather the storm in more risky assets especially as economic data comes in weaker.

Eurodollars have started to look to form a bottom both in the 2022-2023 contracts. This is something I would be paying attention to as a clue to when the Fed might pause. I personally believe the Fed can’t get much past 2018 cycle. Before we will be in recession and as a result rate hikes might quickly turn to rate cuts if something breaks.

FX

DXY

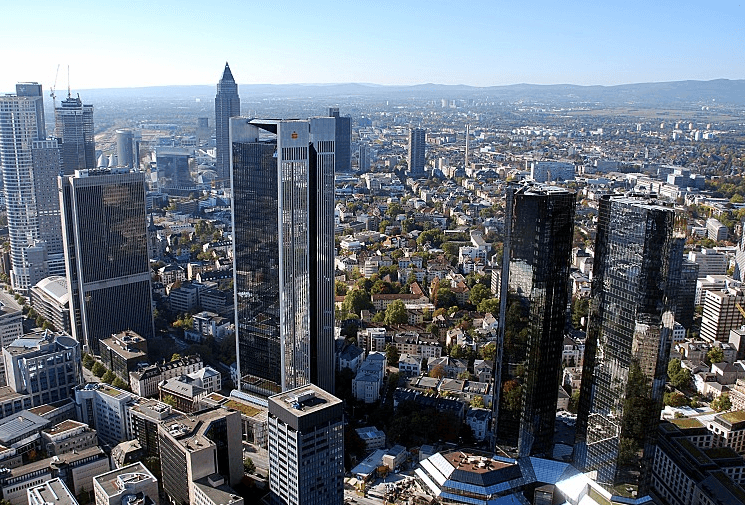

The Dollar has been on a tear against all major currencies mostly as the Fed has been one of the only countries to actually raise. Although the dollar keeps rising, I would be on the look for turning points especially as bullish sentiment gets crowded how quickly consensus can change 12 months ago lots of analysts were calling for the death of the dollar.

EUR

Weaker currency’s import inflation and although the “Smart folk” at the ECB at points have enjoyed a weaker EUR for export reasons. That doesn’t really jive well when places such as China are running zero Covid policies. I find it hard to get bullish on the EUR until Largarde transforms from an Owl to a hawk.

GBP

The cost-of-living crisis as it’s being dubbed by the media. Keeps on going with the data coming in weaker and the nature of cable being a more volatile version of finding currencies I would see further dislocations. If risk keeps getting sold off expect more pain for GBPUSD.

JPY

The Yen has started to come off its highs especially crosses outside USDJPY. This I believe is because US fixed income has taken a pause on pricing in higher rates. Any hint of the Fed not being as aggressive as what is priced in the JPY could go heavily bid that is something I don’t think many participants are positioned for.

The post <h5>Macro Research</h5> <h3>Tech Wreck 2.0</h3> appeared first on JP Fund Services.