When Royal Bank of Scotland Group Plc agreed to sell Williams & Glyn in 2009, it hoped to do so within months. Nearly seven years later, it’s

still struggling to divest the unit, with a tangled web of technology causing six branches scattered across its home country to become an important issue. There’s a financial burden from the delay too, with 6,000 people working to create the new unit. Though RBS benefits from cash generated by the Williams & Glyn, the disposal costs will probably be “significantly greater” than the 1.6 billion pounds it had planned for, RBS has said. That could exceed the amount the unit would fetch in a sale or initial public offering. In the seven years since RBS agreed to separate the branches to bolster competition, smaller British lenders such as Metro Bank Plc have opened and gone public. Nissan has been accused of manipulating emissions tests for its popular Qashqai model by the South Korean government. The allegations follow a probe of 20 diesel car models by the environment ministry. South Korea said it found a so-called defeat devices had been fitted to the Qashqai. It plans to fine the Japanese vehicle manufacturer 330 million won (£195,000; $279,920) and sue the head of Nissan’s Korean operations. Royal Philips NV is seeking to raise as much as 970 million euros ($1.1 billion) from the initial public offering of its lighting unit as it pushes ahead with a plan to list on Amsterdam’s stock exchange after a private sale didn’t result in a buyer. Philips is planning to sell 37.5 million shares at a range of between 18.50 euros and 22.50 euros per share, the Amsterdam-based company said in a statement on Monday. That values the lighting business at as much as 3.38 billion euros. A listing could come into effect as early as May 27, the company said.

Currencies

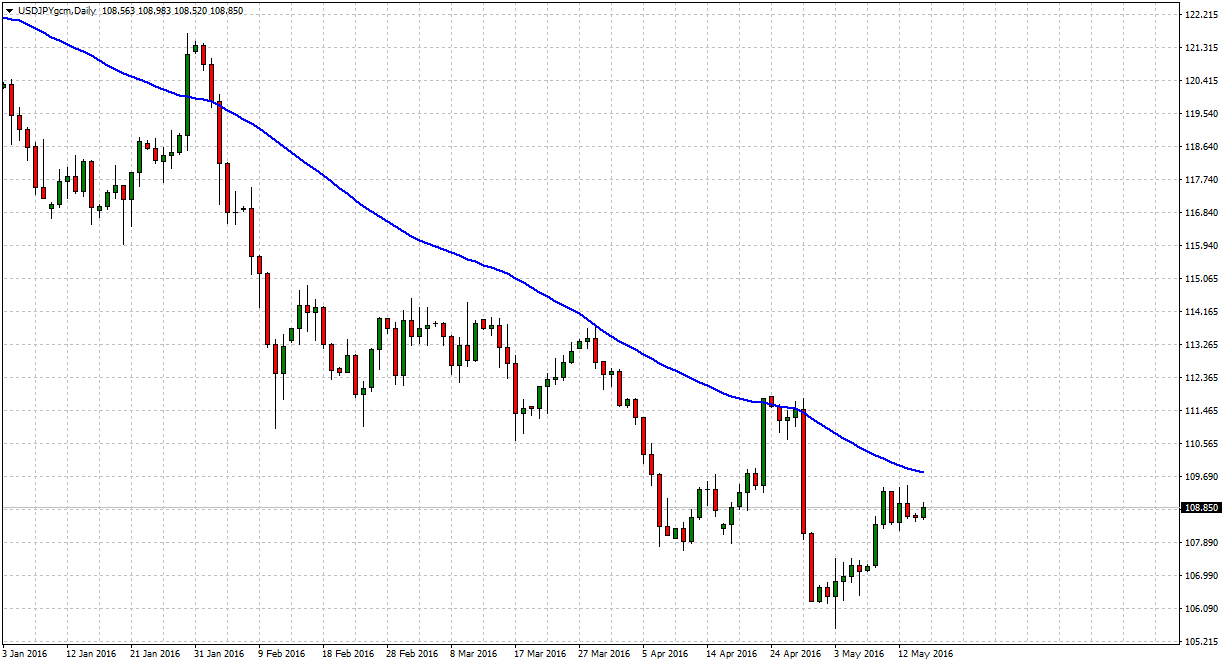

The dollar was moderately higher against the yen in directionless Asian trade on Monday, with investors avoiding making major moves given a lack of fresh trading cues. The U.S. currency USDJPY, +0.19% was changing hands at ¥108.85, compared with ¥108.65 late Friday in New York. A better tone in crude oil prices has forced USD/CAD to abandon the area of earlier tops and return to the 1.2930 regions. The EUR/JPY pair now trades +0.18% higher at 123.05, retreating from session highs previously posted at 123.22. The cross in the EUR/JPY pares gains as the USD/JPY pair paused its upbeat momentum and receded lower in tandem with moves witnessed in the Japanese benchmark index, the Nikkei 225. The single currency is alternating gains with losses vs. the dollar on Monday, now taking EUR/USD to the low-1.1300s.

Metals and Commodities

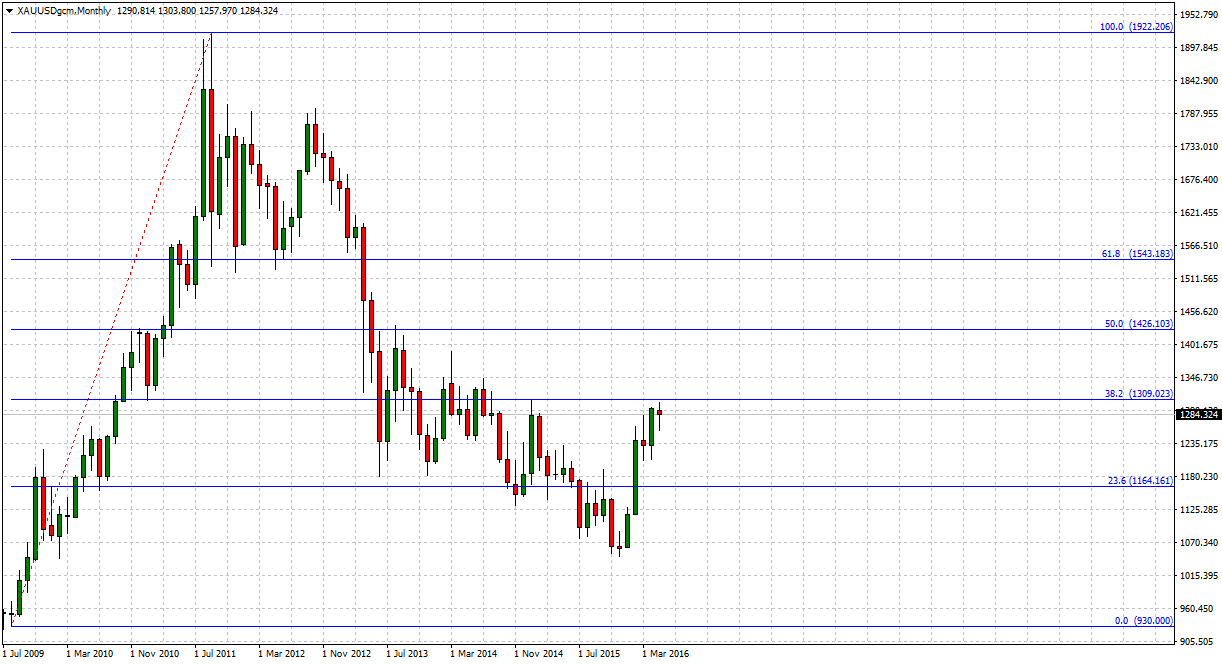

Oil benchmarks on both sides of Atlantic resumed its recent upsurge after a brief drop seen last Friday, in response to the optimistic comments from long-time bear Goldman Sachs on oil fundamentals. Currently, both crude benchmarks extend further to the upside, with Brent up 1.38% at $ 48.50 while WTI oil rallies 1.34% to $ 46.83. Oil prices jumped higher and kicked-off the week on a stronger footing after markets cheer a drastic turnaround in Goldman Sach’s forecasts on the oil supply. Against the backdrop of weak oil prices and weakness witness across global equity markets, gold turns out to a principal beneficiary of a boost in demand for safe-haven assets. Moreover, the US Dollar Index (tracked by the US Dollar Index), which seems to lose some momentum at higher levels, is also supporting higher gold prices.

Source: Michalis Markides, Senior Market Analyst – OX Markets

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.