Mirroring the developments across major regional indices, the Dutch AEX 25 equity benchmark is struggling to overcome key levels even though the accommodative monetary policy environment should support more upside in valuations. However, looking at performance over the last year, the -12.10% return generated by the index leaves a lot to be desired by investors despite the commonly held notion that asset purchases lead to higher valuations for risk assets. With component performance also weak over the same time period, there are a number of factors clouding the AEX outlook even with looser lending conditions expected to prevail over the medium-to-long term. Anemic local fundamentals combined with the downshifting global trade conditions will continue to weigh on AEX returns going forward despite a favourable atmosphere for equity investors.

Central Bank Boost

Although the commonly held wisdom is that quantitative easing or asset purchases encourage greater risk-taking amongst investors, buttressed in part by results from the United States and Japan, European equities have not experienced the same momentum higher from balance sheet expansion. Although monthly easing allocations have not yet been entirely ramped higher despite the expanding purchases announcement back in March, price upside in the AEX has been rather limited. Echoing risk assets globally, the Dutch benchmark has risen approximately 18.20% from February lows, but year-to-date performance has been weak, clocking in at 2.35%. Component performance in particular has been disappointing over the last 52-weeks with three-fifths of the constituents trading in negative territory. The major drags have come from communications services, financials, and companies with substantial exposure to commodity prices such as steelmaker Arcelor Mittal and energy company Royal Dutch Shell.

On the whole the Netherlands economy is performing admirably, and although sluggish remains an outperformer in the currency bloc with unemployment improving and GDP growth remaining positive. The rate of Dutch joblessness has fallen from 7.00% a year ago the present rate of 6.40%, the lowest rate since December 2012 and trending well below the Euro Area’s figure of 10.30%. Helping the economy is positive wage growth which has increased at a 1.70% annualized pace and headline inflation which is trending steady at 0.60%. Additionally, thanks to monetary policy which is super accommodative, lending is back on the upswing after outstanding loans plunged by nearly EUR 50 billion from levels recorded in April of 2015 before beginning to recover in January. Although generally the Netherlands macroeconomic backdrop has managed to outperform comparable EMU performance, this momentum has failed to inspire higher risk asset valuations.

Though it might be too early to determine whether or not the European Central Bank’s negative interest rate policy and asset purchase program are effective in generating upside momentum to inflation and growth, the impact on stocks has been limited at best. The real impact has been felt in fixed income as borrowing costs continue to plunge, especially for highly rated corporations. To put borrowing costs in perspective for these major multinationals, Unilever, one of the globes largest consumer goods manufacturers just managed to issue a bond offering with a 0.00% coupon, projecting a yield of 0.06%. Yields may fall even further, considering ECB President Mario Draghi’s most recent promise to begin buying corporate bonds in June under the auspices of the Corporate Sector Purchase Programme (CSPP). However, lower borrowing costs have not yet contributed to sustained upward momentum in share prices.

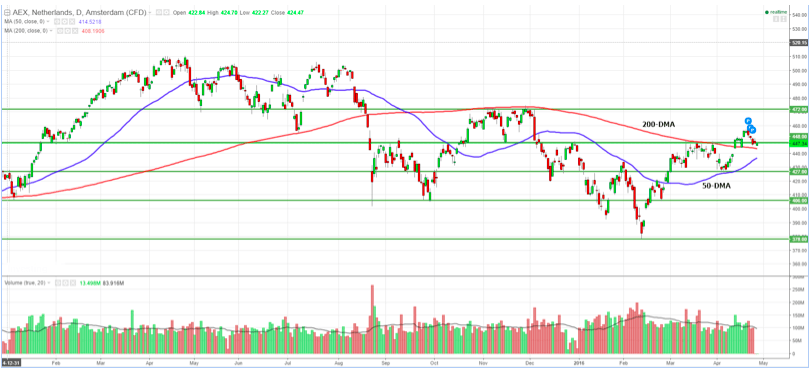

Technically Speaking

From a technical point of view, the Dutch AEX remains at a serious crossroads thanks in large part to conflicting indicators. While the moving averages are currently acting as support for the index with both the 50-day and 200-day moving averages trading below the price action, the AEX has been trending lower since the last ECB announcement on the 21st of April. The moving averages are producing a mixed signal owing to the fact that the longer-term moving average is currently trending lower, rapidly reaching towards a point of convergence with the medium-term moving average which is trending higher. Should these moving averages remain mixed and fail to provide support for AEX prices, it could be an indication that the index’s correction in play for the better part of 2015 remains intact.

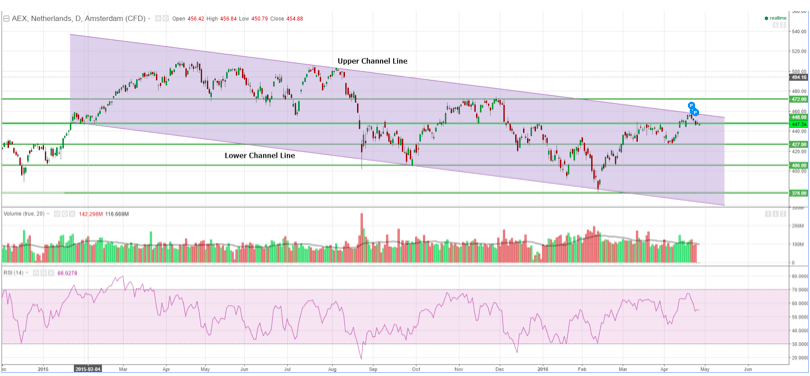

The emergence of a longer-term downward trending equidistant channel pattern also has implications for the Dutch AEX. After forming for over a year, the AEX recently just bounced off the upper channel line of the formation. The ongoing bearish bias of the channel indicates that ideal positions established closer to the upper channel line should be targeting the lower channel line for an exit. However, should AEX prices rise above the upper channel line and manage a candlestick close above the level, it suggests a reversal higher that could be accompanied by more momentum and confirmed by higher than average trading volumes. Key resistance at 472 could stand in the way of a continued uptrend, with 448 the first level to cross. On the downside, support sit at 427 and 406 with any tumble below 52-week lows at 378 confirming an ongoing correction lower.

To Conclude

With the index trading at a critical point when it comes to future direction, AEX momentum will be contingent on several factors going forward. Balance sheet expansion on the part of the ECB should be a healthy driver of valuations, but poor performance from certain sectors, namely commodities, will continue to weigh on the benchmark’s outlook. Strengthening fundamentals and accommodative policies build a supportive backdrop for appreciation, however, the technicals tell a different tale and may echo the external weakness that continue to prevent greater upside momentum. Whether or not the correction lower is over or not depends on a host of factors that are largely outside the control of local fiscal policy in the Netherlands. However, developments in corporate borrowing could prove the catalyst for greater growth in the nation’s largest corporations, a development that could spur AEX valuation expansion over the medium-term.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading