European stocks rebounded from a two-day skid Monday, while the euro declined against the dollar after St. Louis Fed President James Bullard said a rate hike was possible for October.

A broad-based rally helped lift European stocks from their worst decline in two weeks Monday, despite underlying volatility in Asia. The pan-European STOXX 600 advanced 1.2% in the London session, reversing an earlier drop. Eurozone blue-chip STOXX 50 also added 1%.

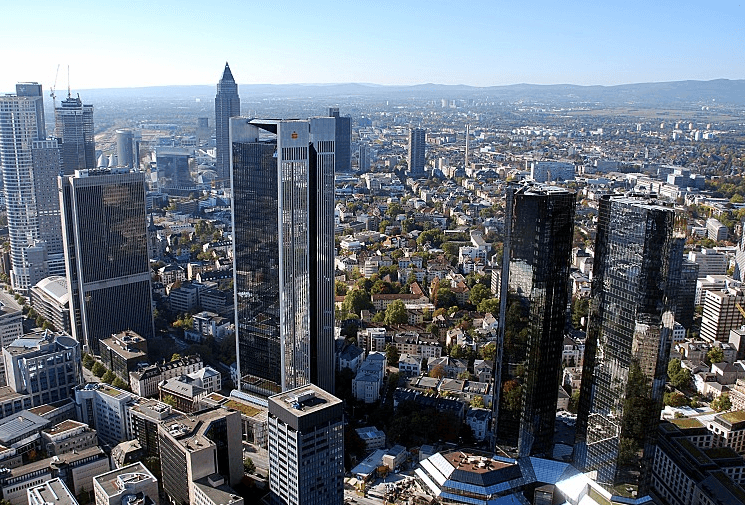

All of the benchmark gauges across Europe rallied, led by a 1.2% gain for the CAC 40 in Paris. The FTSE 100 Index in London rose 0.8%, while the DAX in Frankfurt gained 0.2%.

Global stock prices declined sharply at the end of last week after the US Federal Reserve kept its overnight rate unchanged, citing heightened risks internationally. The Fed upgraded its near-term GDP outlook, but said growth in 2016 and 2017 would be slower than previously expected.

In an interview with CNBC on Monday, Fed Bank of St. Louis President James Bullard described the FOMC’s decision as a “close call,” leaving the door open to an October rate rise.

“I would have dissented on this decision,” said Bullard, who is not a voting member of the Federal Open Market Committee.

The FOMC voted 9-1 in favour of maintaining the key interest rate near zero. The lone vote in favour of a rate rise was Richmond Fed President Jeffrey Lacker.

Bullard’s comments helped springboard the US dollar Monday. The dollar index soared 0.8% to 95.57 after declining in each of the previous two sessions. The euro declined as a result, with the EUR/USD falling to a session low of 1.1235. It would subsequently consolidate at 1.1249, declining 0.3%.

In economic data, German producer prices declined more than expected last month, as low energy prices continued to weigh on inflation.

Germany’s producer price index fell 0.5% in August, the Federal Statistics Office reported Monday. That was a bigger drop than the 0.3% forecast by economists. In annualized terms, the producer price index dropped 1.7%.

Energy futures rebounded Monday after a late-week selloff. International benchmark Brent crude climbed $1 or 2.1% to $48.47 a barrel on the ICE Futures Exchange in London. US contract West Texas Intermediate (WTI) rebounded $1.16 or 2.6% to $45.84 a barrel.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading