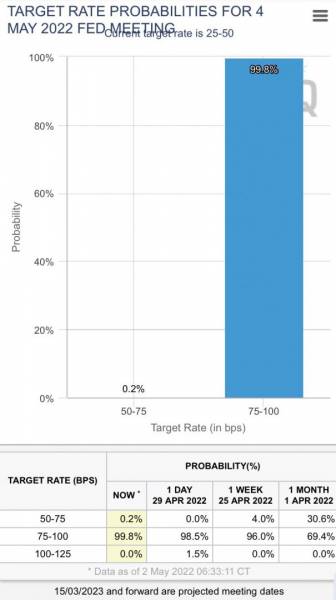

This Wednesday the Fed will be announcing its next rate hike. Reading over some of the commentary from fed speakers we can see that 50BPS looks to be on deck. This has also been priced in by the market as we can see below in the Fed watch tool by the CME. We will also see an announcement regarding QT. Which some speakers equate to an additional rate hike. In the most simple way QT (Quantitative tightening) withdraws liquidity from the system. The market has already started pricing this as you can see with the recent fall of risk assets.

Something I’ve seen recently is market participants already discounting the negative US GDP number that came in last month currently sitting at -1.40%. If this was to continue, we would firmly be in a Stagflationary environment. With negative GDP this will eventually start feeding in Inflation numbers. The real fear should be a growth scare which then leads to a recession. I expect Fed chair Jerome Powell will be asked questions about this at the coming meeting.

My view is that the hiking cycle will be short-lived and as the market has priced in the hawkish cycle If we start to see a decrease in inflationary numbers and GDP causing a recession we will see the first sign in Eurodollars start pricing rate cuts by 2023 we are currently not there yet.

Bonds

Negative yielding debt going positive I think is the real story at the moment. US 10Y tips have gone into positive territory The first time since the pandemic lows (pictured below). German and Swiss nominal 2Y have also gone positive. Begs the question of whether we return to the old regime of the US being at the zero lower bound, and the ECB and SNB sticking with negative interest rates or is this the beginning of a new era?

(Lisa Abramowicz, Bloomberg)

With everything markets can price in possibilities that never come to pass. In saying this I think it’s worth paying attention to December 2023 Eurodollars before and after each Fed meeting. Currently this contract is below the low of the 2018 rate cycle. This if it comes to pass would put interest rates in the US at 3.5%. This is already starting to be reflected in US 5s 10s 30s all sitting around 3%.

FX

DXY

The current risk-off environment has favored the US dollar especially considering they are one of the few central banks. that are looking to raise rates in an aggressive fashion. coupling this with investors unwinding risk positions they look to the safety of the dollar especially when funding is tight. To see the trend reverse we would want to see bond yields going lower.

GBP

The selling off of cable been unrelenting as noted before. I see sterling crosses as a more volatile version of the euro apart from isolated headlines such as Brexit. I would expect some consolidation going forward unless there is some form of dollar funding issue.

EUR

Will they won’t they? The money markets have started pricing rate hikes in the ECB. With some ECB speakers even saying they could hike within the July meeting. Like most participants I find it hard to believe the Uber dovish ECB will hike. If they do, this could be a turning point similar to the Swedish central bank and we could finally see Europe off negative interest rates. Which makes sense considering inflation is over 7%!

JPY

The correlation between the JPY and the US 10-year yield Is through the roof. I can’t see this correlation breaking down any time soon considering Japan is the biggest buyer of the bond market. What could possibly turn JPY Is a growth scare in the world This would lead to people wanting to lock in yields. The signal will be if US GDP continues to be in negative territory.

AUD

With the recent rise of interest rates at the RBA it Has caught the attention of Australian politician. Unsurprisingly as most of the Australian saving is built around housing and this could put a dent in the housing market. This is the first time they’ve raised rates since 2007 and it’s a clear indication that central banks globally are taking inflation seriously. If the RBA has the guts to keep raising rates, I think this is bullish for AUD and its relevant crosses.

The post Macro Research What To Expect from The Fed This Week? appeared first on JP Fund Services.