“Overstock.Com Inc, one of the first of many, publicly listed companies globally to do an Initial Coin Offering (ICO), now via it’s subsidiary tZero – which is a Crypto exchange trading security tokens – has announced a tie up with The Boston Stock Exchange. This will help tokens to comply with some of the SEC regulations and is a very positive move for tokens, as well as a healthy sign that the ICO market is maturing.”

These words come from the blockchain, crypto economics, ICO and funds specialist Jonny Fry, after the recently announced new joint venture between tZERO and BOX Digital Markets to launch the first security Token Exchange in the world.

The statement was made on May 18, 2018, when the two companies entered into a letter of intent to form an exchange to list and publicly tradesecurity tokens for companies that issue, or convert existing stock to, security tokens. As Jonny Fry pointed out, the proposed joint venture would be equally owned by tZERO and BOX Digital, with each having equal representation on the Board of Directors, together with one mutually agreed upon independent director.

tZERO plans to contribute cash and license tZERO’s blockchain technology for operation of the security token market. BOX Digital will contribute expertise and personnel toward obtaining regulatory approval and operation of the security token market. Approval of the U.S. Securities and Exchange Commission will be sought following execution of definitive documentation. Creation of the joint venture is subject to definitive documentation and customary conditions.

For Jonny Fry, however, there are things that have to be put into discussion first in this matter as “after all, many people have believed that in reality a significant majority of Cryptocurrencies are NOT utility tokens but are SECURITY tokens, and need an exchange to be listed on. To date Crypto exchanges have not been keen to list security tokens, as this could have potentially meant the exchange itself would have needed to be regulated. It would also have meant that potentially the firms issuing the Tokens would have to comply with regulation, and so significantly increase the costs of doing an ICO,” said Jonny Fry.

“If you are raising capital using an ICO for a company that it is going to build/create a business and turn it from an idea to something tangible, then it is likely the token you create will be a security, he tipped out. Although it is ironic that, once the ICO has raised capital to build software or some type of organisation, many will need a way to access/power the organisation i.e. a utility token. So, there is a body of evidence to argue that many tokens initially need to be treated, listed and traded as a security token, and then potentially will become a utility token.

In this particular case, tZERO, following the regulator approval of the U.S. Securities and Exchange Commission, decided to start with a security token, for what Jonny Fry praised the risk they are taking. “If you are doing an ICO and create a security token, you immediately need to look at the regulatory hurdles and significant potential costs of promoting or, in some cases, even allowing investors to participate in your token sale. In effect you will need to comply with security regulations from the likes of SEC in the US or FCA in the UK, as you could find yourself carrying out an Initial Public Offering (IPO) and being like Apple, Google, BP or Facebook, a publicly listed security.”

This first step made by tZERO has just opened the door widely for newcomers and it is likely we will see many more exchanges offering to trade security tokens going forward as a regulated exchange.

“This regulation will indeed allow trade with security tokens and at the same time it could act as a possible gate keeper and offer global regulators some comfort – but only if the exchanges allow clients to use the exchange provided they have completed appropriate KYC and AML checks,” he warned.

Looking towards the future of regulated tokens

The next challenge is, how can you make the whole user experience of buying tokens more user friendly, without the need to have private keys and hot and cold wallets? Then the industry needs to address the issues of custody that is, who and how, can a third party hold digital assets which is vital for Crypto funds to be able to evolve. While the technology of blockchain that powers many tokens was designed to decentralise the economy, the ability to have an organisation to look after your tokens that can be trusted is still appealing for many.

Currently it is not possible to offer a regulated mutual fund/OEIC/Unit Trust to the public, as these vehicles need to have the majority of their assets invested in “recognised securities”, Jonny Fry said and he added that these recognised securities need to be traded on recognised, therefore regulated, exchanges which ideally are able to provide fair prices. liquidity and the ability to buy and sell these securities, so the asset managers can value the funds they are managing. While all of these regulations have been created to try and protect investors, in reality there are many securities/equities, particularly quoted smaller companies, that have a listing which have very little daily liquidity and arguably offer little comfort that the price which is quoted, is the price that can be traded at.

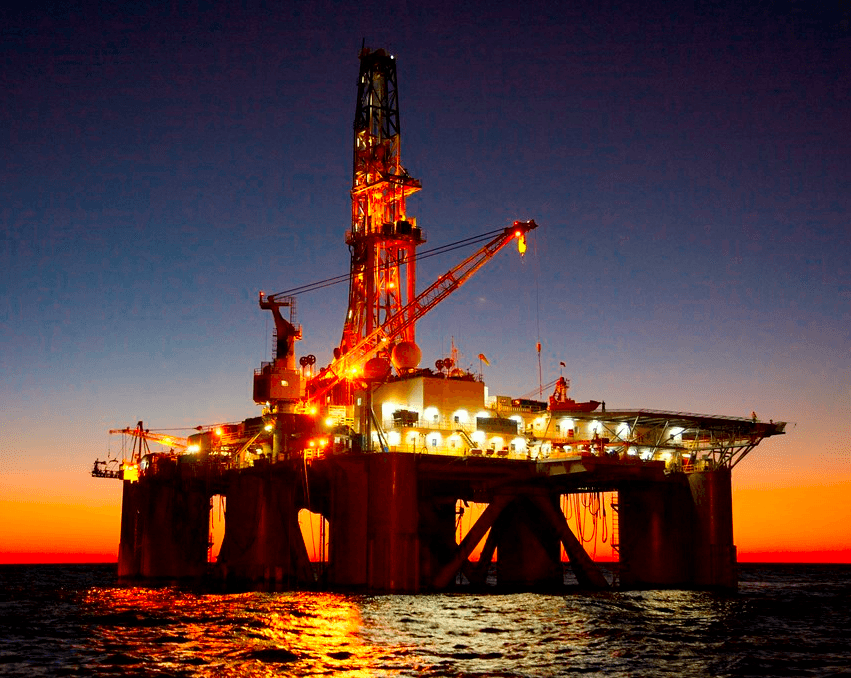

“There are many Cryptocurrencies that have a far more daily turnover i.e. people buying and selling, than many, many publicly listed companies, and furthermore, rather than being listed on one stock exchange which is the norm, Cryptocurrencies are often traded on multiple exchanges GLOBALLY. Even for the most valuable companies, by market capitalisation, in the world such as Amazon, Apple, ExxonMobile, Microsoft, which may be listed in New York, Tokyo and London, every Friday evening in New York the stock exchange closes and one has to wait until it opens again, Monday morning in Tokyo, before you are able to start trading again. If you contrast this with Crypto exchanges, where you have the ability to trade 24/7, and often using several different exchanges that are located across the world,” he pointed out.

Jonny Fry concluded by pointing out a brighter future, as he thought that tZero’s announcement with The Boston Stock Exchange is a significant step forward. “It potentially will allow Cryptocurrencies to be traded on a regulated exchange which in time may be recognised, and so allow institutions who are currently managing over $80 Trillion according to Goldman Sachs and heading to $100 trillion, start moving some of this capital into Cryptocurrencies. ”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading