Shy Datika is the CEO of anyoption, one of the world binary options leaders. He is also behind ILS BROKERS and Etrader. Shy has a Bachelor of Applied Science (B.A.Sc.) from the Tel Aviv University and a Master of Business Administration (M.B.A.), Business Administration and Management, Finance from Ono Academic College. Datika has an excellent track record in building sustainable businesses in the financial market, leading the various firms and managing the daily operations among them ForexManage, a software company providing solutions for the banking industry in foreign exchange risk management. Prior to that, he was a senior dealer in Bank Hapoalim for few years heading the G7 spot desk.

Shy Datika is a strong leader personality in the capital markets, and one of the personalities that was part in the inception of the fast growing binary options trading industry, as the founder and CEO of anyoption. This company operated by Ouroboros Derivatives Trading Ltd out of Nicosia, Cyprus was founded in 2008. anyoption.com is one of the largest websites for binary options trading. anyoption offers mobile and tablet apps, proprietary technology, a trading academy, a copy trading variation and has a licensing from the Cyprus Securities and Exchange Commission (CySEC) since the end of 2012.

tradersdna interviewed Datika to hear his views on the capital markets, his company, the current challenges for traders, the considerations when to trade binary options, the advantages, as well as the future of the industry in general, and his brokerage specifically. He talks about the market challenges, the industry trends, how regulators should best protect traders, the costs and challenges of regulation and other specific developments.

tradersdna: It is well-know that 15 years ago #FX spot was somehow in the dark ages and electronic trading platforms sort of something very new for the public, so let’s begin with an obvious question: What’s Binary Options added value for investors and traders?

Shy Datika: Within the past decade, we have seen major developments in the online trading industry. What was once the domain of the professional and institutional investor, has now opened up to anyone with an internet connection. Forex brokers have flooded the field in the search for the everyman trader and competition between brokers is fierce. They market to the beginners as well as the more advanced traders through enticing marketing campaigns and the promise of training and guidance. While there is no doubt that these developments have made the financial markets more accessible, at the same time the average retail trader tends to underestimate the risk involved in this venture.

We all have heard stories of how the recent Swiss franc crisis wiped out so many investors and brought down Alpari UK. With binary options, such a thing can never happen because a binary option’s investor can’t lose more than what he originally invested. Meanwhile Forex is traded on leverage where your $1 suddenly is worth 400 times as much. This leaves the investor open to risking a negative balance, so not only can his deposit be wiped out but he can also lose more than is in his account.

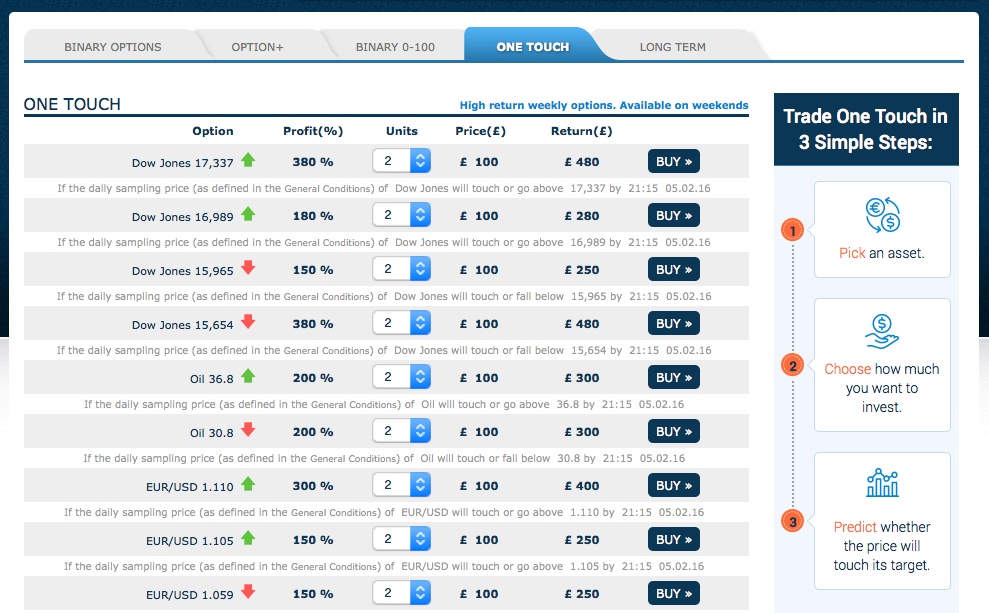

With binary options you know how much you stand to risk or gain before you even place the trade, a comforting notion for many – not least beginner traders as well as institutional traders that have long used binary options as a hedging tool.

tradersdna: In 2015 was an exciting and very demanding year in risk management, especially after CHF (Swiss Franc) shocked not only the markets, but many brokerage, financial institutions and traders. What was your organization risk management adjustment after this Black Swan?

Shy Datika: As a binary options broker we offer trading across many markets including indices, forex pairs, commodities and stocks. Our exposure to the Swissy was generally limited. Additionally because of the way binary options are structured, the traders are unable to lose more than they have invested in a trade – meaning their losses are limited to that investment amount. So while the high volatility experienced during the Swiss franc crisis had severe repercussions on forex brokers and their investors, for brokers like us the losses were limited and sometimes even positive. Many of our astute traders actually benefited from events like the drop in the Swissy which created for them a trading opportunity, as binary options traders can profit on the downside of the move as well as the upside.

It must be remembered that as a regulated broker our traders are covered by the Investor Compensation Scheme, which we know offers a level of assurance to our clients.

tradersdna: Regulation (sometimes excess of it) seems to be not only protecting, but clearly limiting geographically the benefits of leverage products. For example United States and Japan, What’s your current approach to these markets and guidelines that you need to follow from your regulators?

Shy Datika: anyoption has always been pro-regulation. Back in 2008 when regulations where nonexistent in our market, we were already implementing the financial industry best practices voluntarily. As for the U.S market, well we find the U.S regulator is too unpredictable, so we have no plans to expand into that region. For this side of the Atlantic however, we meet with the regulators regularly to give our input because we are well aware that the industry needs regulation. A clean industry is beneficial for a pioneering broker like anyoption.

Having said that, we also need to draw a line between constructive regulation and destructive regulation. While committed to abiding by all regulatory requirements, we need to always bear in mind that the goal of regulation is to protect the client and regulators must fulfill their duties by ensuring that they first weed out all the unregulated firms from the industry. The fact that 90% of all complaints made by traders are against unregulated brokers shows that there is a clear imbalance of focus by the regulators.

tradersdna: If you were to look at your last two years as a company; What would you think is the key value you have that makes anyoption a leader in the Binary Option industry?

Shy Datika: Looking back, it’s clear that there are a variety of factors which set anyoption apart from our competitors. Firstly we are one of the first and foremost brokers in the market. As such we have dictated to some extent the direction of the market. This includes both technologically and with regards to the trading conditions like payouts We are not advocates of the bonus and promotion schemes, which frankly are built on thin air. Instead we put our resources into the customer experience. We have a well-read blog which contains some of the most expert research around, we create courses and we are always innovating new trading types to appeal to a wide range of trader. Furthermore our regulation status is invaluable to us and must be protected. This means jumping over hoops to maintain our transparency and the fact that we comply with all regulatory requirements at all times. We believe it is as a result of all of the above factors that we have become known as a trusted and dependable broker.

tradersdna: As a leverage trading product all investors and traders are fully aware of the risks involved. We used to think that 95% of all the accounts in #FX spot were lost. What is the scenario in Binary options? Can you share some data with the public?

Shy Datika: First of all, let me clarify that binary options are not leveraged products, unlike spot forex. Leverage is one of the key reasons why 95% of spot forex traders lose their funds. Binary options traders on the other hand do not face the same trading risks as those investing in CFDs and forex which is why 51.7% of the time, they win in their trades. In term of overall profitability, we see an average success rate of 25% for binary options traders as opposed to 5% for spot forex traders.

tradersdna: Hedge or Speculative? Let’s take a perspective into the future; How do you see the market developing for Binary Options and your company as key player in this growth?

Shy Datika: Looking ahead, we see the industry moving in the same direction as the gaming industry, in terms of a consolidation of small players into a large group of key players. We have to remember that the binary options industry is still evolving and sometimes faster than anyone can anticipate. Nevertheless, I believe one has to innovate in order to remain relevant in the industry and the way to do this is by moving away from binary options towards FinTech so you get wider product diversification.

tradersdna: The last 15 years defined a massive participation in speculative trading and there are plenty negative stories in the trading industry. However, there are some success ones that serve as inspiration and hope for the retail sector. Can you share with us a few success stories from traders generating either a decent income or explosive returns trading Binary Options and the differences compared with direct forex or stock trading?

Shy Datika: Certainly. Over the years that we have been operational, we have come across a variety of traders that were able to generate a consistent income from trading binary options. I can say now that none of these successful traders will fit the common stereotype you might imagine of a high-flying financial investor. In fact, the majority of our consistently successful traders are either housewives or pensioners. The common denomination between them is the fact that they initially took up binary options as hobby.

For example, we have Magda, a 55 years old housewife. She first started trading as a way to productively use the extra time that she had on her hands. With a $500 initial investment, she managed to build up a steady income stream averaging $1200 per month over the past 2 years. The same goes for Stuart, a 60 year old retired plumber who we speak to often. He started trading with $1000 and after 6 months, he managed to make an average of $1500 to $1800 per month consistently. When we compare binary options to spot forex, we don’t see explosive returns like some spot forex traders earn. In fact we don’t encourage large risks; we prefer to build up long term relationships with our traders. And we know the only way to do that is if they have a majority of wining months. When you know beforehand the risks that you are taking as in the case of binary options, it helps you to plan your investments better.

tradersdna: We have talked about regulation and Binary options’ value, let’s discuss now about technology. As MT4 has a decent market share; can you tell us about anyoption platform, tools and tech software offers?

Shy Datika: anyoption has always been partial to using propriety technologies. When we first started in 2008, there was no such thing as a white label binary options trading platform. So we developed everything in-house with our own development team. This approach helps us to be more flexible with our offering and risk management as well as enabling us to have more control over this offering. In fact, most of the binary options platforms that we see in the industry today including the white label ones are based off our initial platform design in 2008.

tradersdna: Online trading is one of the most competitive industries, where is anyoptions allocating its resources to improve their current market share and keep delivering value to its clients?

Shy Datika: We are constantly striving to improve our customers’ trading experience and recently as part of our move to add more value to our services, we incorporated long stock investments as one of our new product offerings. On top of that, very soon we are going to reinvent the way people trade binary options when we launch our new product called “Bubbles”. Essentially, what we are going to do is to turn numbers based trading into a more visual process. The end result is a more user-friendly trading experience as well as being more entertaining too.

As to our market share, we are always on the lookout for new opportunities which is why we are in the midst of obtaining our license in the Australian market. We have already started off 2016 by getting a license to work with the South African market and for the rest of the year we are looking at expanding further into Asia.

tradersdna: Can you tell us about anyoption trading academy?

Shy Datika: Our trading academy is something that we are extremely proud off. We invest a lot into the academy. I like to think that we have compiled one of the most comprehensive binary options learning centres in the industry today. We cater to everybody, from beginners to the more advanced. Since 2008, we have been adding video courses, educational articles and eBooks to our trading academy because we believe in investing in our traders’ education. It’s another thing which sets us apart from the other brokers. After all, we know successful traders are happy traders and happy traders keep working with us.

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.