The GBP/USD declined more than 100 pips Thursday, as the Bank of England acknowledged renewed downside to inflation while voting to keep interest rates on hold again.

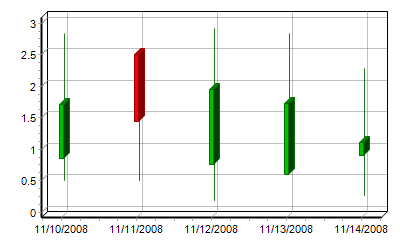

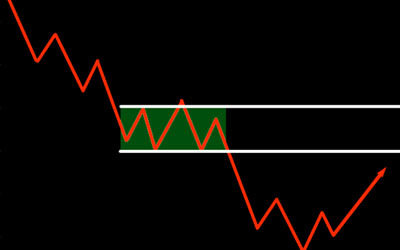

The GBP/USD declined by as much as 118 pips in intraday trade. The pair would subsequently consolidate at 1.5283, declining 0.7% or 105 pips. The GBP/USD is considered oversold according to the Relative Strength Index. It now faces immediate support at 1.5277. On the upside, initial resistance is likely found at 1.5350.

The Bank of England voted 8-1 in keeping interest rates at record lows on Thursday. Ian McCafferty was once again the lone Monetary Policy Committee (MPC) member to vote for a rate increase. With the decision, the BOE has now voted to keep rates at a record low of 0.5% for six-and-a-half years.

The BOE also released its quarterly inflation report following the meetings, where it said “the outlook for global growth has weakened since August.” The BOE put the blame largely on emerging markets, which have shown signs of significant volatility this year.

Although the BOE acknowledged that inflation would rise above the 2% target in two years, it acknowledged that risks “lie slightly to the downside” over that period. This suggests that BOE policy will remain accommodative over that period to account for a choppy rise in consumer inflation.

The GBP/USD has been hit hard by weak inflation expectations. Cable has declined by around 3.7% over the past 12 months and is down 11% since the July 2014 highs of 1.7161.

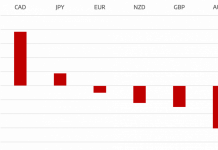

Meanwhile, the US dollar index remained well supported Thursday after climbing to three-month highs in the previous session. The dollar index, a weighted average of the greenback against six global currencies including the British pound, was hovering around 98.00 ahead of the North American stocks.

With the exception of the London Stock Exchange, European stock markets were up across the board Thursday. The German DAX Index rallied 1% in intraday trade. The CAC 40 Index in Paris also climbed 1.1%. London’s FTSE 100 Index was virtually unchanged.

The pan-European STOXX 600 Index was up 0.3%.

Asian markets ended mostly higher on the day, with Tokyo’s Nikkei Index adding around 190 points or 1%. China’s benchmark Shanghai Composite Index closed up 1.8%. Hong Kong’s Hang Seng Index was virtually unchanged.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading