In the previous lesson, we looked at how you can scale out of trades to lock in profits and reduce the risk attached to a trade. Today, we’ll be looking at a counter-intuitive strategy that can actually be pretty profitable if you do it correctly.

Scaling Into a Losing Position

This tactic, which involves increasing the size of a losing position, goes against every common-sense rule in the trader’s handbook. It’s definitely not something you should even attempt without a lot of experience under your belt. That said, if you do it right, it can actually be quite an effective strategy – if you follow the rules.

Basically, if the combined risk of your original position and your new position is within your risk tolerance level, then it is perfectly acceptable to up the stakes on a losing trade. However, in order to do it safely, you have to follow a few important rules:

Use a stop loss – and stick to it

Plan your entry levels before you put on the trade

Calculate your position sizes and the total combined risk of the positions, and make sure it fits within your risk management strategy.

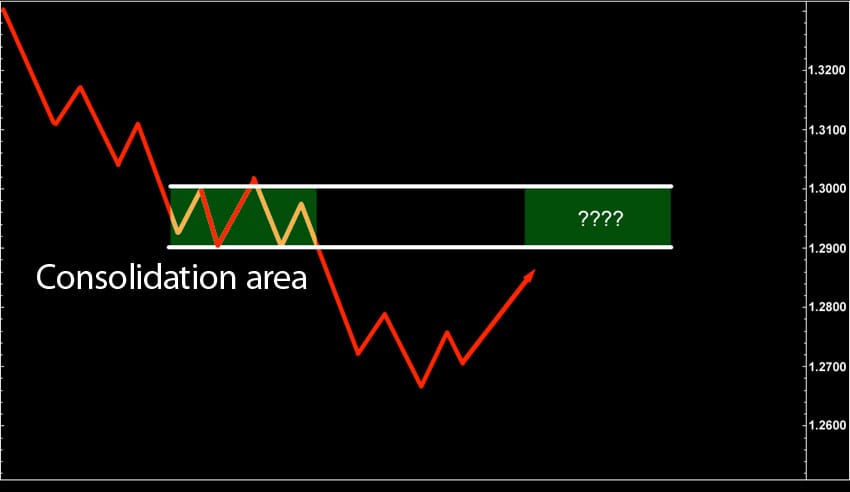

In the above chart, the pair moved down from 1.32000, consolidated between 1.29000 and 1.30000 before heading down once again. Then, having bottomed out between 1.27000 and 1.28000, the price retraced to around the recent consolidation area. You’re fairly confident that the pair will head back down again, but you’re not too sure of the point at which it is likely to do that.

There are a few different ways in which you might wish to enter this trade. You could short at the bottom of the consolidation level at 1.29000, which had served as support until the level was broken and is now a resistance level. The main drawback to this approach is that if the pair moves higher, then you could have got into the trade at a better price.

Instead, you could wait until the pair reaches 1.3000, the top of the consolidation area, and a potential resistance level. However, if you do this, the market might not make it to this level and could drop back down lower, meaning that you’d missed the return to the downtrend.

Another approach would be to wait until the resistance area is tested and the pair moves back below 1.2900 before you enter. This is perhaps the safest option, but then you do risk missing out on a good chunk of the downtrend action.

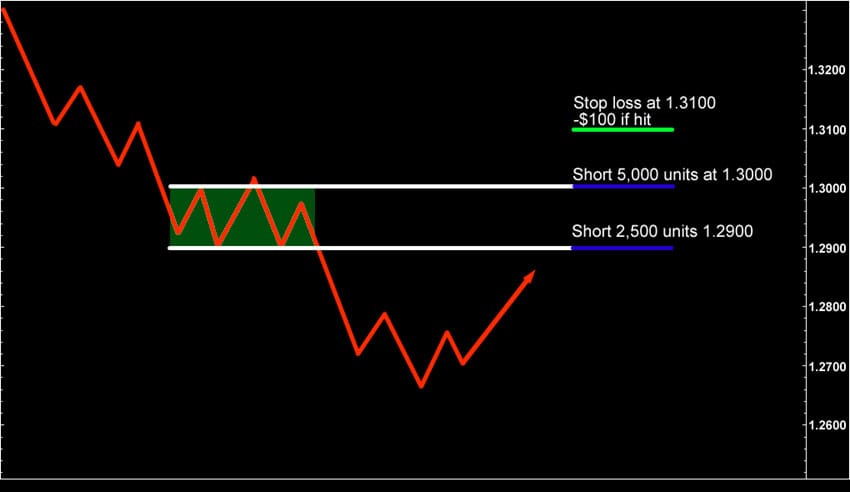

….or, you could enter at 1.2900 AND 1.3000 – as long as you have this planned out beforehand and stick to your plan. The stop loss should be placed at a point that would demonstrate that your prediction was wrong and that the price will keep going up. We’ll place the entry levels at the two points of support and resistance – 1.2900 and 1.3000.

Then, we need to work out what position sizes to use in order to stay within a reasonable risk threshold. So, if you have $5k in your account and you only want to risk a maximum of 2% on a single trade, this means that you are prepared to lose $100 ($5,000 x 0.02 risk) on the trade.

So, you decide to short 2,500 units of EUR/USD at 1.2900. This means that each pip movement is worth $0.25. With the stop being placed at 1.3100, the price can move against you by 200 pips before the trade closes at a $50 loss ($0.25 per pip x 200 pip stop loss).

You also decide to short 5,000 units of EUR/USD at 1.3000, with 5,000 units making your pip value $0.50. Because this is closer to the stop loss at 1.3100, you have a 100 pip stop on this position, and if the trade hits the stop you will lose $50 ($0.50 per pip x 100 pip stop loss).

So, if you hit the stop loss, the combined loss will be $100, or 2% of your account.

The main benefit of this type of trade is that we can enter at one position, and if the market goes against us we can enter another position without going outside your risk management parameters.

In this case, the two trades combined creates a short position of 7,500 units of EUR/USD with an average price of 1.2966 and a 134 pip stop loss spread. If the price fell after both positions had been triggered, you would receive a $100 profit – giving this trade a risk/reward ratio of 1:1. Because most of your position was entered at 1.3000, the price doesn’t have to fall much lower than the resistance area in order for the trade to be profitable.

In the fourth and final part of our series, we shall show you how to scale in to winning positions, which can be a very effective technique for maximising profits.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading