Last week we had the US Payrolls numbers. The strong numbers continued to push the USD higher although the level of volatility was lower than we had seen in previous weeks. The DXY closed 0.5% higher at 112.7.

Euro along with other majors had a more sideways week though still losing ground vs the US Dollar. The PMI data was weaker than expected but failed to move the single currency.

GBP seems to have come out of the pressure cooker for now. The construction PMI easily beat expectations and closed around the 1.11 level. 1.10 is still critical support for the pound.

Commodity currencies also had an uneventful week. NZD and AUD were around 0.5% lower with the Aussie underperforming as the RBA were more dovish than expected. CAD gained 0.7% vs the US Dollar as oil bounced back.

Oil prices showed upward momentum. The OPEC+ 2 million barrels production cut along with Russian rhetoric on supply helped Oil move higher. WTI closed 17% higher around $93 per barrel.

The week ahead looks like we could see risk assets move out of the range we were in this week. The selloff post NFP on Friday could follow through into the beginning of the week.

In terms of data, we have earnings from the UK along with inflation numbers from Norway, the US, Japan and Switzerland.

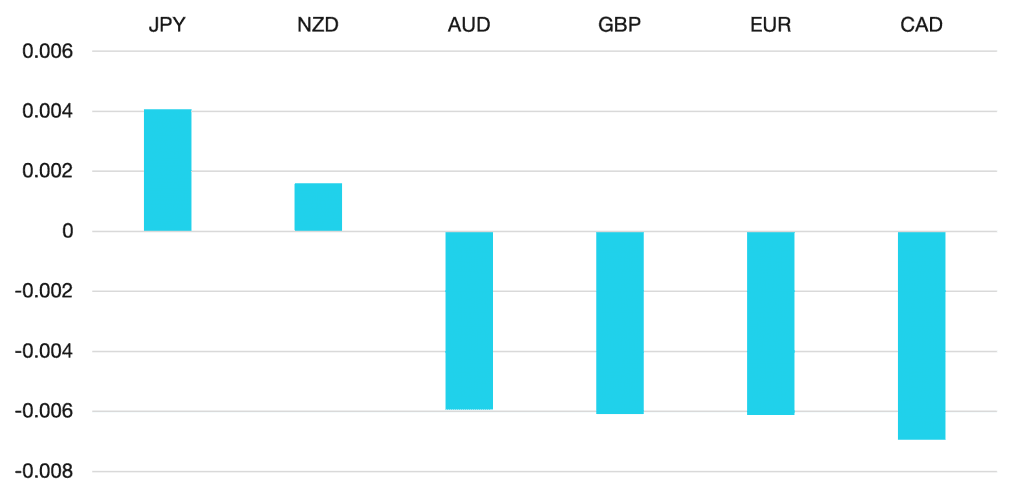

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post

Cromwell FX Market View

Strong Payrolls Spur USD Strength

first appeared on trademakers.

The post Cromwell FX Market View Strong Payrolls Spur USD Strength first appeared on JP Fund Services.

The post Cromwell FX Market View Strong Payrolls Spur USD Strength appeared first on JP Fund Services.

Read More: