The Euro fell last week, firstly weighed by ECB comments who continued to push back the need for policy action but more importantly lockdowns across the eurozone began to become a more likely reality as Austria returned to full lockdown.

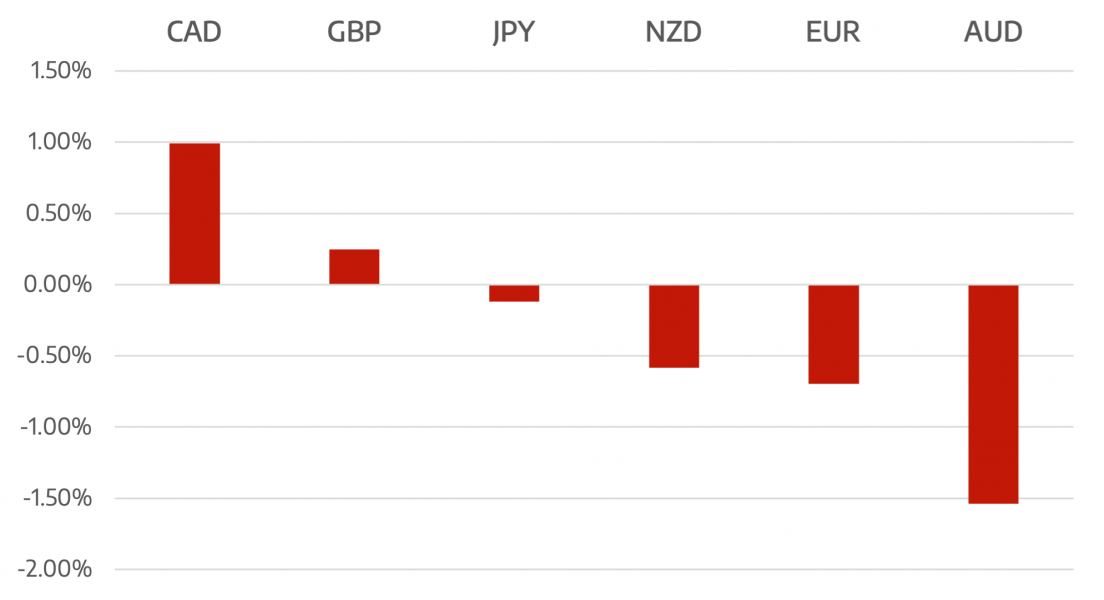

Sterling had some respite being one of the strongest performers as continued expectations of a BoE rate hike

CAD fell to it’s lowest level since early October as a result of WTI oil prices falling 5% along with last weeks CPI announcement. The continued covid restrictions in Europe A QWLL a Mjor drawdown in US strategic reserves contributed to a $4/bbl fall in WTI

The week ahead could focus on risk sensitive currencies as as CAD. The potential of more lockdowns across Europe and a continued fall in the price of oil and other raw materials could see risk sensitive currencies continue to fall.

The RBNZ meets on Wednesday to address rising inflation and how it should be tackled in New Zealand. Expectations are for a 25bps hike. The central bank said at the last meeting that they expect inflation to rise to around 4% in the near term, before falling to 2% in the medium term.

Thursday is a holiday in the US and Friday is a half day, therefore markets will be slower than usual, and US data is front loaded to Wednesday.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Lockdown Fears Resurface</h3> appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading