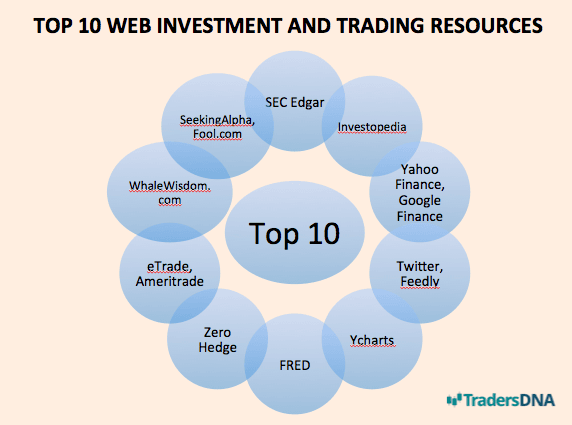

Want to lose money? The internet is full of trading ideas that will help you do just that. What you need is not to be told what to do, but to get advice that will allow you to think for yourself. To meet this end we’ve put together a list of ten resources that you will need to make your own decisions and have a chance of success on the capital markets.

SEC Edgar

We’re sure of one thing. If you don’t spend time on the SEC Edgar platform you’re not doing well in stocks, or you won’t be for much longer. Every single public filing is searchable and downloadable on this database and every company that’s ever gone public is displayed for your analysis. If you don’t read annual reports you’re not investing, you’re gambling.

Investopedia

Billed as a great solution for beginners, Investopedia is so much more than that. Everybody runs into a metric or a strategy they’re not familiar with every now and then even big traders rarely know what’s going on outside of their discipline. Investopedia, augmented by Wikipedia itself, is a great resource for any trader who’s bogged down in jargon and looking for a simple way out.

Yahoo Finance, Google Finance

With a range of simple to use tools and basic charts, the two financial news and information aggregatiors are there to give an all-round look at the way companies are performing. You’re getting the basic package on Google Finance and Yahoo Finance, so don’t expect miracles. Use them to glance at how the markets are doing, but go elsewhere to really get your hands dirty.

Twitter, Feedly

Depending on your tolerance for social interaction you’ll need to choose between these two sites to give you a constant news ticker. Feedly uses RSS feeds from news websites, while Twitter is more adaptable allowing you to add in Carl Icahn’s latest comments, along with those from Justin Bieber.

If you’re trading regularly you’ll need to keep up to date with the latest news, and sticking to a single source just isn’t good enough anymore. Even investors with access to a Bloomberg terminal use a Twitter feed on the side.

Ycharts

Take any two pieces of information and chart them against each other in order to find a relationship. Ycharts is one of the best charting systems out there, and beats many of its rivals by sheer range of indicators and ease of use. It’s a one stop shop for data visualization and comparison, and it’s got a great free trial.

FRED

The Federal Reserve’s collection of financial data is one of the best sources of economic information in the world. We know that the world runs on macroeconomic indicators and you’ll need access to them in order to make good decisions.

Zero Hedge

You won’t want to be basing your decisions off of what you read here, but Zero Hedge is full of challenging contrarian views that will keep you on your toes and test your real knowledge of the financial markets you are betting on.

You may disagree completely with what you read, but if you can’t write an argument to back up your side you’re running on instinct alone, something that will more than likely emaciate your retirement fund.

eTrade, Ameritrade etc.

We’re not going to pick one online broker above all the others here. You know which one is best for you and you should stick to it. There are some interesting options out there, but this isn’t the time or place to list them. Do some research and find out what works for you.

If there’s one piece of advice we could give out: pay attention to the trading costs. You’ll need a suitable online brokerage to drive your investments, so make sure it doesn’t eat your kids college tuition fees.

WhaleWisdom.com

If you’re a hedge fund nut you’re probably aware of the limitations of the 13F filing. The .txt copy published by the SEC is woefully unreadable, and requires manual spreadsheet work to allow comparisons.

Whalewisdom does the work for you on this one and creates an accurate look at how hedge funds have been buying and selling according to their most recent filings. Have a look at the site and see how it can help make hedge fund decisions form a reasonable, readable whole.

SeekingAlpha, Fool.com

For something a little different head to sites like Seeking Alpha and the Motley Fool. While not a thorough learning experience, and certainly not full of information to take at face value, the essays on the platforms will get your creative juices flowing and give you a decent insight into the markets and the way other investors are thinking.

Set yourself up with something from each heading in the above list, and you’ll be able to do most of the basics of analysis and portfolio management by yourself. If we’ve left out anything you love to use, or an up-and-coming darling, be sure to let us know in the comments.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading