Bitwala, Germany’s flagship cryptocurrency company with customers in more than 30 European countries, is building the war chest for its rapid expansion strategy: After the successful introduction of the world’s first fully-regulated gateway for fiat money to cryptocurrencies, Bitwala now has the first-mover advantage to deepen market penetration across Europe and build bridges to other continents. With its Security Token Offering under German law, in the form of profit participation rights running for 15 years, Bitwala is tokenising the future of Blockchain Banking.

Bitwala is first in line to reap the benefits from the tokenised economy

The Bitwala Token (BWL) is reinventing a well-established German security. Profit participation rights (“Genussrechte”) are a widely accepted form of mezzanine capital and a go-to financing solution across all industries. Nowadays, they rarely change hands as trading of participation rights is still costly and cumbersome. Leveraging blockchain technology, the BWL token will embody the same high-standard investor rights, and also enable instant and convenient trading, making this fair form of investments even more attractive.

Bitwala has become the go-to place to trade bitcoin in Europe. It already has plans mapped out for a trading platform of its own dedicated to BWL tokens and those of other companies. As such, Bitwala is also among the first to tap into an additional market beyond banking to generate income from a potential trillion-dollar market worldwide: according to the World Economic Forum (WEF), up to 10 percent of global gross domestic product (ca. $10 trillion) will be tokenised and available for trading on a blockchain by 2025. Millennials, who stand to inherit $30 trillion, typically express a preference for investing in digital assets (Finder 2018).

BWL embodies a time-tested form of investment improved by Blockchain-Technology

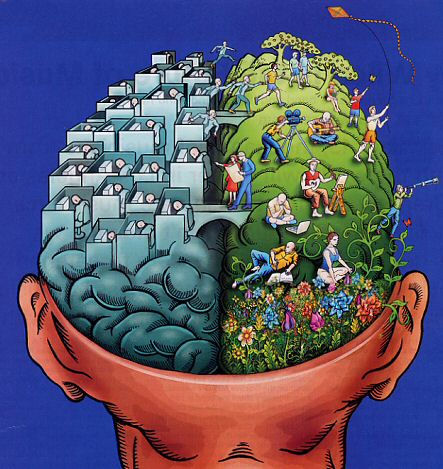

“We have chosen security tokens to finance our plans for rapid expansion as our tokens offer the best of both worlds: rock-solid participation rights on the blockchain, yet allowing the public to invest even with small amounts. Interest in our ongoing private sale is very strong, especially from well known Asian institutional investors who are at the forefront of a global trend towards crypto securities, such as the BWL, and are in the final stages of negotiation”, Christoph Iwaniez, Chief Financial Officer of Bitwala GmbH says, “At present, only selected professional investors, who invest north of € 100,000, are legally allowed to invest in our private placement scheme. But we are planning to open this unique investment opportunity to the public in the summer, by submitting a prospectus and securing the expected approval by the German Federal Financial Supervisory Authority BaFin.”

From an investor’s perspective, BWL will combine the advantages of both debt and equity securities. BWL owners have promising upside potential, they receive 15% of Bitwala’s exit proceeds and any dividends. There is a degree of protection on the downside at the end of the 15-year period, investment capital is returned at a rate of 2 for 1, equal to a 4.73 percent annual yield. As BWL holders legally are creditors, they have legal preference over shareholders. In the case of an Initial Public Offering, token holders can choose between payout or token to share swap.

Bitwala’s founders and its strong set of venture capital investors such as Earlybird (N26), High Tech Gründerfond (Wunderlist), Alstin and coparion are in unison that this security token offering is the ideal strategy to fuel the company’s growth.

Europe is giving the greenlights for crypto assets

“After establishing our pioneering Blockchain banking product, we feel encouraged to take the lead again. The signals are all there: internationally operating German financial institutions recently said, they will be moving into security tokens. The regulatory environment in Germany and Europe as a whole is adapting swiftly and the Merkel administration stands to present its Blockchain strategy for Germany in summer”, says Ben Jones, Co-founder and Chief Technology Officer of Bitwala. “It’s a logical step for us to enter the era of tokenisation by tokenising our own company and establish Bitwala as the crypto first banking provider. Over the past years, we have led by example and built a globally recognised brand along with a strong community.”

The Berlin scale-up has a history of fast growth. Founded in 2015, Bitwala started by offering a fast Bitcoin-based remittance service for 75,000+ customers worldwide and a prepaid card scheme tied to Bitcoin wallets. The company has built an international reputation – enabling customers to outstrip international bank remittances – until it was time for a pivot towards a full-blown banking platform.

At the turn of the year 2019, Bitwala’s launch of crypto-first bank accounts, powered by its trusted partner solarisBank, was met with international attention. Growth rate of new customers and volume traded now stand at a multiple of Bitwala’s former offering.

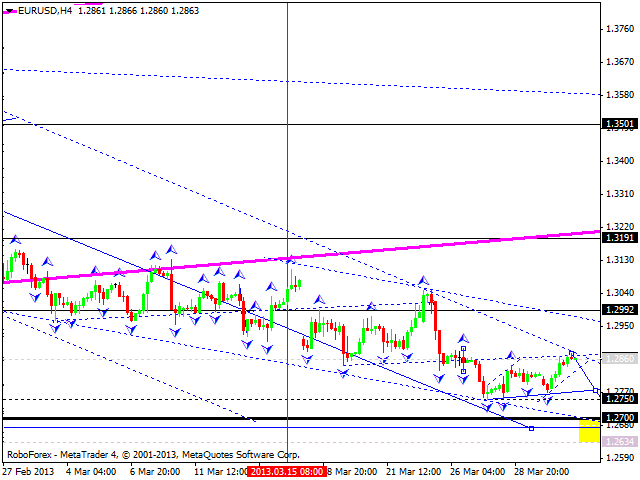

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading