While many traders will spend hours poring over price charts and news feeds in search of an opportunity, comparatively few spend any time analysing the biggest variable in any trade – themselves. Yet, if you ask any successful trader as to the secret of their success, they will almost always expound on the subject of trading psychology. This isn’t always the easiest or most fun thing to pay attention to – not when there are flashy charts and buttons to be pressed – but if you don’t, then your trading success will suffer as a result of irrational urges and false perceptions. To this end, we’ve compiled a few tips to help you get your head straight when you’re trading.

Set Limits

In most cases, extremes of emotion will tend to result in an increase in terms of the number of trades made within a time frame, or the amount that is staked on each trade. Neither of these things is likely to yield a consistently profitable result. If you’re making more trades than usual, you’re analysing each one for a shorter amount of time than you normally would. If you’re staking higher amounts, you’re exposing yourself to bigger risks without a corresponding increase in research time or true conviction about the profit potential.

One highly effective way to counteract your inevitable emotional swings is to set time-related limits to your trading activity. For example, you could limit yourself to two trades per hour, or a certain volume of trade every day. The best way to decide these limits is to monitor your trading activity over a longer period of time and try to identify when you are over-trading. These periods are characterized by high activity accompanied by lower returns or bigger losses than normal.

Analyse Yourself, Not Just the Market

The principles of technical and fundamental analysis are known to any trader that has lasted more than a week or two in the forex market without losing their shirt. The thing about the forex market is that virtually everyone is viewing the same charts, and is using the same analysis techniques. The real variable here is you, and how you react to the information that presents itself.

That’s why it can pay to spend as much time analysing your own performance as you do analysing the market. Look back over your trading record, and try to spot patterns in the profits and losses that you see. For example, you might be doing a lot better with your morning trades than you do with your afternoon ones. In this case, you would try to inspect the differences in your approach with these trades and the differences in the market at these times. You might discover that your normal modus operandi works better in periods of high market activity and worse in quiet periods, or vice versa. This process should give you greater insight into the flaws – and the strengths – in your trading strategy, and help you to generate ideas on how to improve upon it.

Always Have a System, and Evolve it Constantly

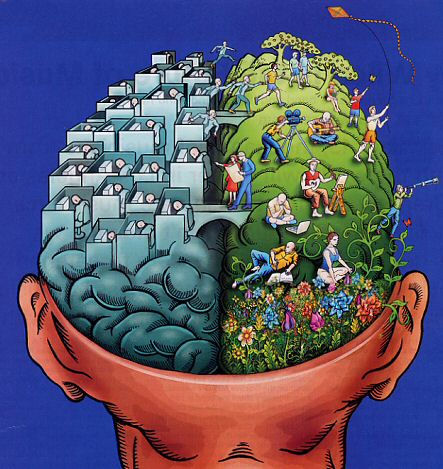

All successful traders have a particular strategy that they abide by, and there is a good reason for this. Strategy is the difference between using the logical, analytical side of your brain and the creative, emotional side to make trading decisions. Needless to say, the former is much more appropriate to making investment decisions. All trading strategies and systems are formulated to give a higher priority to this than might otherwise be the case.

While it’s important to be disciplined when applying a system, it is equally important to continually evolve the system towards a state of maximum effectiveness. That’s why there are no off-the-shelf trading strategies that anyone can use to make a fortune on the forex markets. Even if it worked before, there is no guarantee that it will work now. That’s not to say that you should change strategy on the hoof, because a strategy ceases to be a strategy if it is not applied with a certain level of discipline. The trick is to abide by your strategy as rigidly as possible when you are actually trading, and change it only during regular periods of analysis.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading