The dollar has eased against most of its major peers in the past couple of trading sessions, reversing some of its recent gains and retreating from its strongest position since early January.

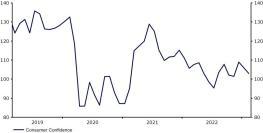

A raft of surprises to the upside in US macroeconomic data have supported the dollar in the past few weeks. The January nonfarm payrolls, inflation and retail sales report all beat economists’ estimates, both raising expectations for the terminal fed funds rate and lowering the possibility of US rate cuts in 2023. Economic news out so far this week has somewhat challenged this view, which can partly explain the modest retracement in the greenback. Durable goods orders, out on Monday, fell more than expected, with sales down 4.5% in January versus the -4% priced in. Housing data has been rather encouraging, notably the sharp increase in pending home sales at the start of the year, though the big miss in yesterday’s consumer confidence index (102.9 vs. 108.5 expected) has offset some of this optimism.

Figure 1: US Consumer Confidence Index (2019 – 2023)

Source: Refinitiv Datastream Date: 28/02/2023

Sterling has managed to capitalise on the broad weakness in the dollar so far this week, surging back through the 1.21 level at one stage on Tuesday. News on Monday that the UK and European Union had agreed on a post-Brexit deal on Northern Ireland has partly helped the pound on its way. This has removed some of the near-term political uncertainty, though we note that PM Sunak may need to get the deal through parliament – it remains unclear whether such a vote will actually take place. Regardless, we think that the focus among investors remains squarely on monetary policy, with investors in feverish speculation as to the extent of additional tightening from the Bank of England this year. BoE governor Bailey will be speaking in London on the cost of living crisis this morning (10:10 GMT), with his remarks likely to be market-moving.

Most other G10 currencies have clawed back some ground on the dollar in the past couple of trading sessions, including the euro, which rose back above the 1.06 level on Tuesday. Inflation data out of both France (6.2%) and Spain (6.1%) beat expectations yesterday, upping the stakes ahead of Thursday’s Euro Area-wide data. Another surprise to the upside here would no doubt further ramp up bets in favour of higher ECB rates, and could support the common currency. As things stand, markets are now pricing in around 60bps of hikes from the ECB through its March meeting, and a terminal rate of approximately 3.8%. We still contest that this is too low, and as markets continue to narrow their expected path of US-Euro Area rate differentials, we believe that the euro should receive some upside support.

In the run-up to Thursday’s key Euro Area CPI report, this afternoon’s German inflation and US PMI data are likely to be closely watched by market participants.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading