We don’t really have a specific trade call or trade suggestion that I want to recommend, but I do want to go through each of the seven major US currency pairs and talk about what we have coming up over the next few days. As everybody should know, coming up on December 16th, we have the FOMC rate decision. The expectation is that they will be raising interest rates in the US, which, in essence, should cause a rally for the #US dollar.

Now, over the past several days, past week or so, we have seen the market slumping. The US dollar slumping. We might say that this could simply be just a correction before we go into that FOMC, and there’s been many times within each of the trends that would go across that we see these pullbacks. We see these corrections, and then eventually the US dollar gains the strength back that we would expect to see with that interest rate news and potentially making new highs or lows in the directions of the trend. So, let’s go through each of the currency pairs and talk about some of the simple aspects of the charts and what we might see over the next four or five days, before we go into FOMC.

#USDCHF fundamentally, we expect that the Swiss Franc is a weaker currency than the #US dollar, but it is interesting that we’ve seen a pretty decent slump. A correction again maybe for the US dollar as it’s pulled all the way back down here into the 0.9900 level. Traders can see interesting things on the chart.

Over here, we see it challenging the 100-daily simple moving average, getting back above it and making the new high. So, today, guess what. Nothing really new here on the #USDCHF. We’re challenging the 100-daily moving average. So, the question is: are we going to see it finally make a support base here on this correction and start working its way back up in anticipation of FOMC, or do we look for the breakdown and a continuation lower? I think today, for the truth, we would expect to see some support here.

We also have Fibonacci here on the chart from the low, the last low that we see there, to the current resistance high placing the .618 fib right at the 0.9800 level. That 0.9800-level – .618 fib – right at the bottom of our green-shaded area right at the 100-period simple moving average. So, all this to say I don’t think you want to go short right now. I know it’s been going down for several days now, but I just don’t think that this is an opportunity to go short here on the USDCHF, as we have a lot of things going against that. We have the correction. We have the Fibonacci. We have the 100-daily moving average. We have historical resistance back here on the left-hand side of the chart that offer a clue to support. That’s the green-shaded area showing us historical resistance along that green zone.

#EURUSD we saw the market falling from the 1.1500s, all the way down here into the 1.0500-level. Over the past several days, starting with the ECB, we saw the move higher. Again, is this simply a correction for the EURUSD, because simply the Euro is still fundamentally a weaker currency pair than the US dollar, so with interest rate news and the raise of interest rates, you would expect that we could see a little bit of a rally for the US dollar against the Euro as we look for it to go back down.

We wouldn’t rule out another rally higher, but again, we could simply be viewing this as a correction before FOMC. We’ll watch for lower highs and lower lows to give us a clue that the market is turning back into a downtrend. But at least right now, a difficult area even to consider going long because we are running into a pretty critical area for price level of resistance for the #EURUSD.

#GBPUSD we’ve also seen that correction higher. We’ve seen the market moving higher. With the news out of the UK this morning, already we’ve seen the market pushing back down. BOE sending this back down towards the 1.5120-level. So, is the correction over? We’ve reached the top of our channel, the top of our range that we’ve been talking about between the red and the black line here. We’ve reached the top there. We talked about this during the Trade Room yesterday. The 1.5180 to 1.5200 level as a potential resistance zone. If you happened to take into a sell, there into the resistance zone and into the red trend line, you’re now into profit. You should be protecting that profit.

Now, of course, today, with that fall, we’ve now challenged down into these supports. So, we’ll be watching the 1.5100, 1.5125-level as a potential support for the day today. That becomes a potential support for anybody that’s in a sell and a target. If you’re not in a sell, this does present an opportunity to go long, but just remember we are at the top of our range, the top of our channel, the red trend line, and we are running into that barrier of resistance. Unless it breaks through there, we can’t really expect a continuation of the trend.

#USDCAD we’ve seen actually the #US dollar taking a pretty good run over the past few days. For the past two days, just a little hesitation up here, just underneath the 1.3600-level. I still think that this is a long currency pair. Definitely would prefer to go long. The preference actually though is for it to fall, first, before we go long, all the way down to 1.3400. I don’t know if we’re going to even see that 1.3500 holding as our barrier of support. That’s that little orange-shaded area you see right there.

So, as long as it stays above 1.3500, we could be looking for just the continued rally. And of course with the FOMC next week, we could see the breakout above 1.3600 and the continuation of the rise here. The only thing that changes this picture for short-term would be a breakdown of 1.3500, heading back down to 1.3400 for the #USDCAD.

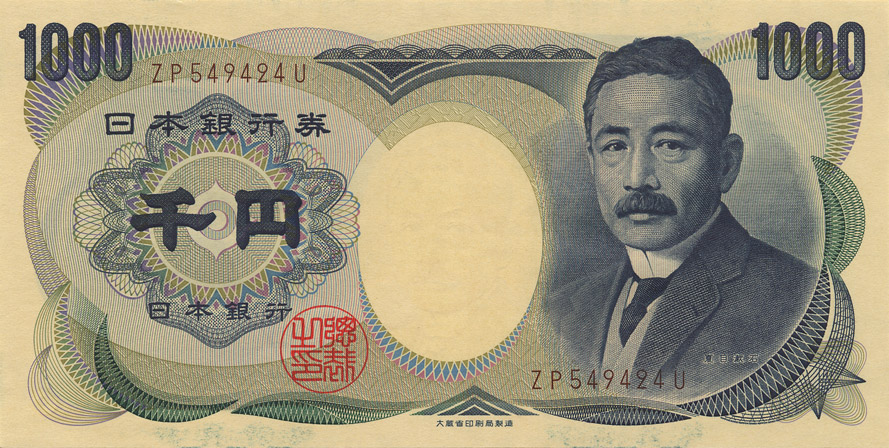

#USDJPY significant fall, we finally broke out of our range. We were stuck in this range for about four weeks. Finally broke out of it. Unfortunately, we took another buy into the bottom of the range, just in time for it to break out. It was very small risk on that trade. It has pushed lower, by the way, back down to the 100-period moving average. A couple of times ago, when we touched on top of that moving average, you could see the rally all the way on the left-hand side of the chart. It rally higher. Then we saw this time right here break through it and continue down. Here, we broke above it and went back up.

So, we’re right around that 100-daily moving average here, so definitely watching for clues to support and reversal. Again, correction a possibility here for the USDJPY, waiting for FOMC coming up next week. One last thing. Let’s take Fibonacci from this low right here in the middle of the chart to the current resistance high. 50 percent retracement level of that run sits right here just underneath our orange-shaded area. So, I’m expecting at least for now, expecting this as correction, looking for the reversal. I’m looking at this area right around 121 as our support today. Not a great place to go short to begin with. Not a great place to go short. It would need to likely rally higher into the 122-level before I would consider this an opportunity to go short.

#AUDUSD we’ve been talking about the triangle pattern the downtrend as you can see black trend line. Red trend line is at the very bottom of the chart, is the triangle pattern we’ve been discussing. Back to the daily. There it is right there. The two red triangles. We saw the rally over the past several hours. A push from the 100-daily moving average, by the way, here at the 0.7190-level, the orange-shaded area. We’ve seen the rally on news yesterday.

Again, FOMC next week. Would expect maybe this to take another slump all the way back down to 0.7100, which is the bottom of our triangle pattern. I would think today the failure of that purple-shaded area becomes the main focus here for the #AUDUSD. Failure of that purple zone becomes resistance and a selling opportunity back closer towards the 0.7340-level, as close as possible to 0.7340. The risk is that it breaks above that purple zone. I’m not looking to go long here. Even though we’ve seen a little bit of a rally, I think this is more likely a selling opportunity into the top of the triangle pattern.

#NZDUSD we had interest rate news. We saw a spike lower and then a rapid reversal as it went back up into the resistance highs, close to 0.6700. Quite volatile. As we were expecting, quite a lot of volatility. I don’t think that we could classify this now as an uptrend, but I definitely know that we have some volatility and the possibility of even challenging the longer-term trend line up here towards 0.6800.

Back to the daily timeframe. I’m looking up closer to 0.6800 as the resistance. That becomes the potential reversal point. Remember interest rate cut yesterday out of New Zealand and the interest rate raise out of the US dollar, out of FOMC next week would definitely have a bearish expectation with that fundamental analysis. Watching though potentially 0.6800 as the resistance for the NZDUSD over the next several days.

Prodigy TradersDNA is a weekly and daily publication in association with Forex Traders Daily all rights reserved. We encourage traders/investors to review the original update just click the following link:

http://bit.ly/USDPullback

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.