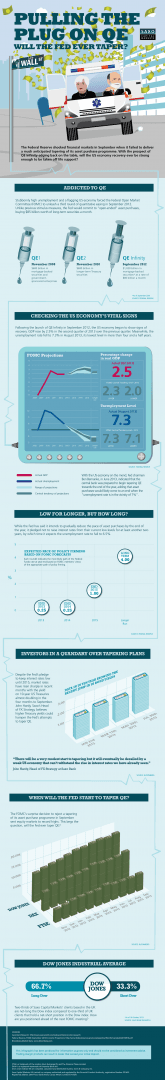

For the past few months, much of the buzz in the currency trading world has centred around the question of if and when the US Federal Reserve will begin to cut back on its bond-buying programme. This programme of quantitative easing, intended to lubricate the US economy and boost employment, is the third round undertaken by the Fed since the financial crisis, hence the nickname ‘QE3’.

This flow of cash into the economy has had some benefits, but it has not been without its drawbacks, and many fear that it could be encouraging the formation of dangerous asset price bubbles. Furthermore, there is evidence that the benefits of this monetary stimulus have started to become increasingly negligible – but it is widely accepted that a sudden stop to the $85 billion a month programme could send shockwaves around the US economy, and the wider global economy. Hence the Fed’s decision to phase it out, or ‘taper’ it, graduallly.

Unlike previous efforts, it has no fixed timescale. This has led to it being dubbed ‘QE Forever’ and ‘QE Infinity’ by some of the more pessimistic pundits. And while the Fed has indicated that it plans to ‘taper’ QE when the employment market recovers, it has yet to set a definite date for when this process will begin. It was widely expected to commence in September 2013 – known speculatively as ‘Septaper’ – but this never materialized due to a range of factors, and now many analysts are at a loss as to when it might actually begin.

The infographic below, from Saxo Capital Markets, looks at the factors weighing on the minds of Fed officials such as current President Ben Bernanke and his likely successor, Janet Yellen as they look to cut back on what has been a problematic stimulus programme.

Read More:

how to avoid revenge trading forex factory?

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading