By Felipe Dormachi, Markets Analyst Scandinavian Capital Markets.

The bull run in the EURUSD which was initiated by Mario Draghi’s “whatever it takes” verbal intervention has been driving the pair to new highs and making significant gains every month. The ECB’s OMT (Outright Monetary Transactions) bailout mechanism which was intended to eliminate the tail risk in the Euro seems thus far to have worked and the Eurozone seems to have been stabilizing since summer 2012.

However, last week’s comments made by Mr. Draghi on the current strength of the Euro has already started to have an impact on the single currency and the ECB is closely monitoring the exchange rate in relation to the inflation target. The recent appreciation of the Euro could weigh on the inflation target below 2% over the medium term. A lower inflation may imply a rate cut at some point from the ECB. The Market has reacted with force and the retreat from the heights of the rally may indicate that the rally from last July could be over.

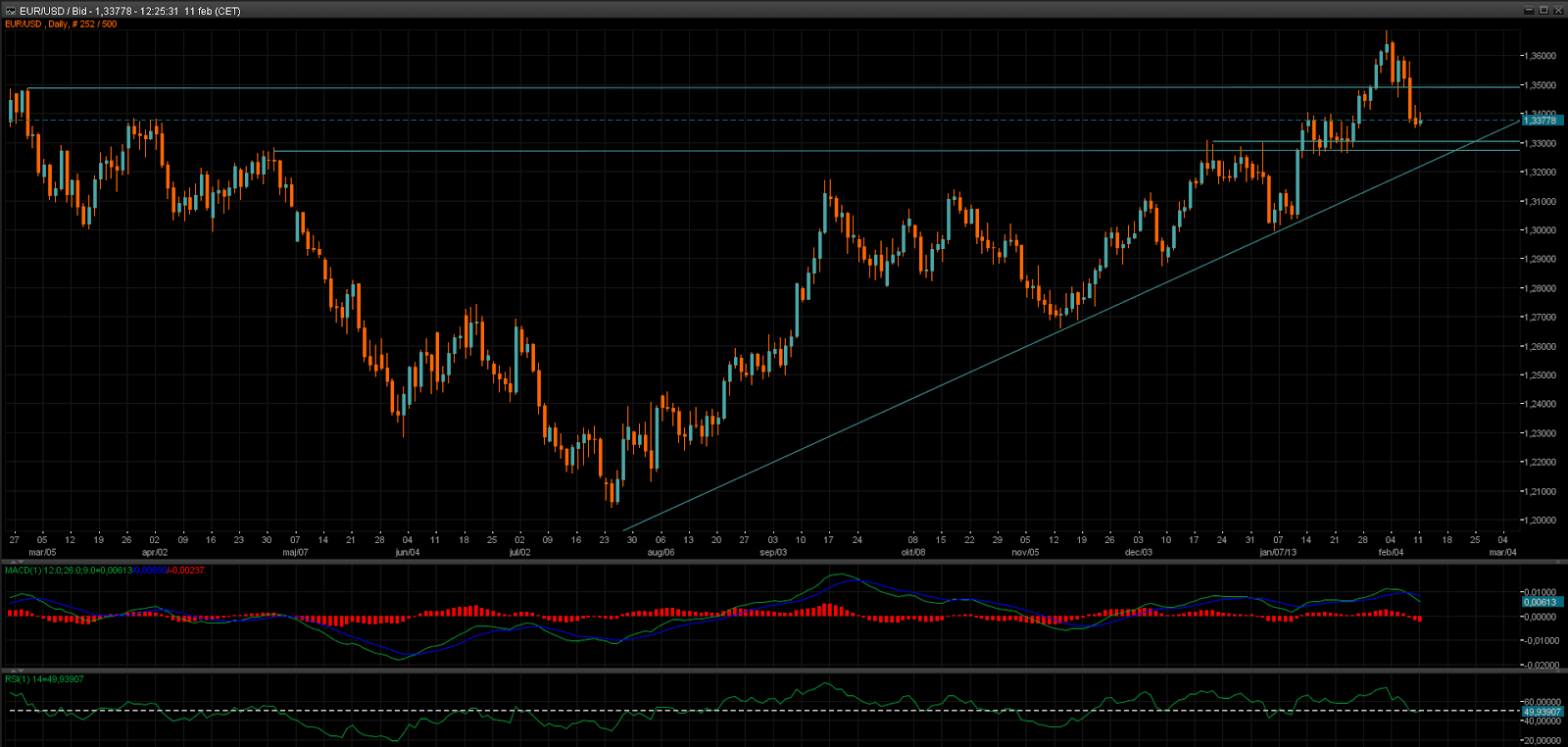

As the chart illustrate, the EURUSD still has an uptrend channel like support in place. Before any further losses in the pair, we could expect the area between 1.3300/1.3270 to be taken out. Although the the bullish pattern is still valid, it would however be broken if the market takes out 1.3300/1.3270. A break of the 1.3300/1.3270 would open a fall down to 1.3000.

In the EUR/USD weekly chart, there is a AB=CD pattern in place that could take us to 1.3850 if the market continues to push to the upside. However, we also have a huge bearish engulfing candle which could add more certainty to a bearish continuation of the current move.

For now, the most rational is to watch the 1.3485 and 1.3300/1.3270 levels. If we reach 1.3485 again, one could anticipate a break to the 1.3850 level. If the scenario comes true, traders ought to watch for an extension of the bearish trend down to 1.3300 as this is the neckline of the inverted H&S in place on the weekly chart.

Follow Scandinavian Capital Markets on Twitter at: https://twitter.com/scmfx and on Facebook https://www.facebook.com/

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading