- 47% of Brits are heading into 2024 feeling worried about money.

- 30% of Brits avoid checking their bank account due to their bank balance.

- Credit management Lowell company to share 5 essential tips on how to become recession proof.

With the UK falling into a recession after soaring interest rates and rising living costs, 47% of Brits admitted they are heading into 2024 feeling worried about money.

Following a new nationwide survey revealing that nearly a third of UK adults are avoiding checking their bank account due to their financial situation, credit management company Lowell are encouraging Brits to face their finances head on and set themselves up for positive habits in the new year.

Encouragingly, there are now 85.3 million views under the TikTok hashtag #recessionproof, with Brits trying to find ways of getting on top of the current economy.

How do Brits feel when talking about money?

Talking about money can bring up varying emotions. With there still being a stigma around discussing finance 17% of people surveyed said that they felt uncomfortable talking about money, with a quarter of Brits (25%) sharing talking about money makes them feel anxious, stressed or ashamed.

However, when overcoming the stigma talking about money can help people take control of their situation with one in five (20%) feeling empowered or in control when talking about their financial situation. Interestingly, men (31%) are more likely to feel comfortable talking about their financial situation than women (19%) overall.

As 22% of Brits said that they avoided seeking financial advice from a professional, beginning the conversation with yourself can be a great launch point for getting to grips with your finances. With this in mind, financial experts at Lowell have shared five things to ask yourself to in order to start becoming recession proof:

1. What are my long-term financial goals?

Rather than starting with number crunching, the first point of action should be to determine your long-term financial goals. This might be clearing your debt or saving for your retirement. Having something to focus on, will make it easier to save each month, as you know what you’re working towards.

2. What is stopping me from achieving my long-term financial goals?

When determining your financial goals, it’s important to predict any potential hurdles to achieving your goals. This could be everything from outlying debt, to concerns your money issues could be affecting your mental health. From there, you can identify ways to overcome these barriers.

3. How can I set up a budget that works for me?

Once you know where you stand and what you hope to accomplish, pick a budgeting system that works for you. For example, for a more flexible strategy the 50/30/20 system, which splits your after-tax income across three major categories: 50% goes to necessities, 30% to wants, and 20% to savings and debt repayment.

4. How can I further educate myself on financial wellness?

As one in five (20%) do not feel confident in their knowledge of financial products, services and terms, education is a key part of financial health. From Reddit threads to financial blogs, there are several free online resources for financial education. Make sure to also read up on key financial calendar dates from energy cap rises, to tax deadlines.

5. Am I prioritising my spending?

Start by allocating enough money for fixed expenses to ensure you have food, a roof over your head, utilities are paid, and transport is covered. If you have any debts make sure you are selecting priority debts to pay off such as council tax and rent.

About Lowell

Lowell is one of Europe’s largest credit management companies with a mission to make credit work better for all. It operates in the UK, Germany, Austria, Switzerland, Denmark, Norway, Finland and Sweden. Lowell’s unparalleled combination of data analytics insight and robust risk management provides clients with expert solutions in debt purchasing, third party collections and business process outsourcing. With its ethical approach to debt management, Lowell always looks for the most appropriate, sustainable and fair outcome for each customer’s specific circumstances. Lowell was formed in 2015 following the merger of the UK and German market leaders: the Lowell Group and the GFKL Group. In 2018, Lowell completed the acquisition of the Carve-out Business from Intrum, which has market leading positions in the Nordic region. It is backed by global private equity firm Permira and Ontario Teachers’ Pension Plan.

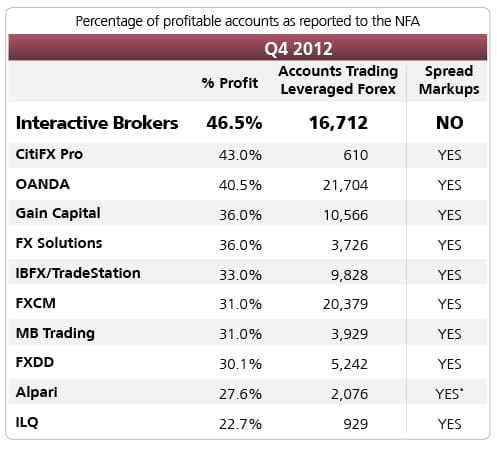

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading