The currency markets were little changed on Friday, as Greece and its international creditors sought common ground for reaching a new debt agreement just days before the current bailout extension expires.

A cash-for-reform deal between Greece and the troika now appears to be on the table, according to reports. Most of the issues related to pensions and the VAT appear to be resolved and are awaiting final confirmation. Creditors are reportedly planning a five-month bailout extension that would provide Greece with €15.5 billion in bailout money through the end of November – €8.7 billion from the Eurozone bailout fund, €3.3 billion the Securities Markets Program (SMP) and €3.5 billion from the International Monetary Fund (IMF).

Greece owes the IMF €1.6 billion by Tuesday when the current bailout extension ends.

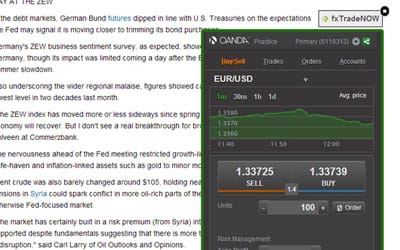

The forex market was relatively steady on Friday as investors continued to monitor back-and-forth talks between Greece and the troika. The US dollar advanced against a basket of world currencies, but moved within a narrow range of 95.08 and 95.42. The dollar index was consolidating at 95.42 in the early New York session, up 0.2%.

The dollar strengthened against the Japanese yen, although investors are awaiting confirmation of an overbought scenario for the USD/JPY. The pair climbed 0.2% to 123.91. Initial support is likely found at 123.31 and resistance at 124.29.

The EUR/USD was trading at daily lows, falling 0.4% to 1.1162. The pair had traded relatively steadily for much of the European session, climbing to a session high of 1.1220. The EUR/USD faces immediate support at 1.1152, Wednesday’s low, followed by 1.1134, the low from Tuesday. On the upside, the 1.1250 level is likely to provide the first resistance, followed by 1.1281.

The euro edged lower against the British pound, as the EUR/GBP tumbled 0.2% to 0.7101. The pair faces immediate support at 0.7092 and resistance at 0.7143.

Greece debt negotiations will continue to make headlines over the weekend. However, as we’ve seen repeatedly over the past four months, talks can break down at any moment. Ongoing reports make no mention of a final resolution, but of an extension that would avert a bigger financial disaster in the immediate term. The five-month extension would ensure that Greece has enough money to repay maturing debts. According to Reuters, the deal is contingent on Greek parliament implementing the first set of reforms.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading