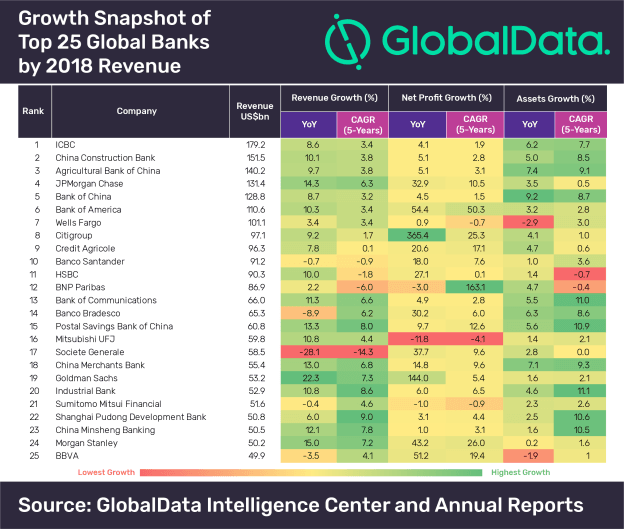

We finally have a President of the European Central Bank, Christine Lagarde, who has raised controversy among detractors and supporters. However, central banks are only a small portion within the vastness of the financial system. In fact, big banks, specially those publicly-traded, are the ones that must be check upon to see how healthy the financial sector is. For that reason, GlobalData analyzed the year-on-year (YoY) change and compound annual growth rate (CAGR) of the publicly-traded global banks over the past five years in revenue (interest income + non-interest income), net profit and total assets, and ranked them based on their latest revenue. Spoiler alert, some of the banks’ results analysed here are as troubled as Ms Lagarde’s appointment.

Of the top 25 global banks, only Goldman Sachs and Morgan Stanley reported over 15% growth. Goldman Sachs reported improvement in performance of all its business units, including investment banking, investment management and market making; whereas record revenues in investment banking and wealth management businesses, and robust fees from asset management and positive long-term net flows benefited Morgan Stanley.

Among the banks, which reported YoY decline in revenue, Societe Generale was the major loser as there was a decline in its interest and similar income, and income from other activities.

Parth Vala, Company Profiles Analyst at GlobalData, comments: “On the profitability front, the top gainers, which reported over 50% growth were Citigroup, Bank of America, Goldman Sachs and BBVA. Citigroup was back to profitability after it incurred one-time impact of tax reform in the previous year. Bank of America and Goldman Sachs benefited from the tax reform, which significantly brought down their effective tax rates. Cost reduction initiatives, robust revenue stream and the sale of its Chilean franchise were the main drivers of profit growth for BBVA.”

BNP Paribas, Mitsubishi UFJ and Sumitomo Mitsui Financial reported YoY decline in their profitability. Revaluation of the remaining stake in First Hawaiian Bank mainly led to the drop in net profits of BNP Paribas.

Mitsubishi UFJ and Sumitomo Mitsui Financial were the only two banks from the top 25, which reported YoY decline and negative CAGR in their profits over the past five years.

Vala adds: “Large Japanese banks have been suffering from aging and shrinking population and prolonged ultra-low interest rate environment in the country. Mitsubishi UFJ’s profitability suffered on the account of lower net fees and commission income, and net trading and other operating profits; and increased general and administrative expenses. Sumitomo Mitsui Financial reported marginal decline of 1% due to contracted lending margin.”

Except Wells Fargo and BBVA, all the banks in the list reported moderate YoY increase in their total assets. In the recent past, Wells Fargo was found to be involved in sales malpractices. As a result, until the bank puts its house in order and resolves all internal governance issues, the Federal Reserve passed an order to cap its balance sheet at US$1.95 trillion. The bank expects to operate under the cap until the end of FY2019.

BBVA has been witnessing decline in its total assets for the past three years. During FY2018, its total assets reduced due to decline in assets of South American business owing to the sale of BBVA Chile, fall in assets in Turkey due to the adverse effects of about 25% depreciation of Turkish Lira against euro, and decrease in non-core real estate assets.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.