Last week we saw a continued pattern of the previous week. Risk assets pushed higher with yields moving lower.

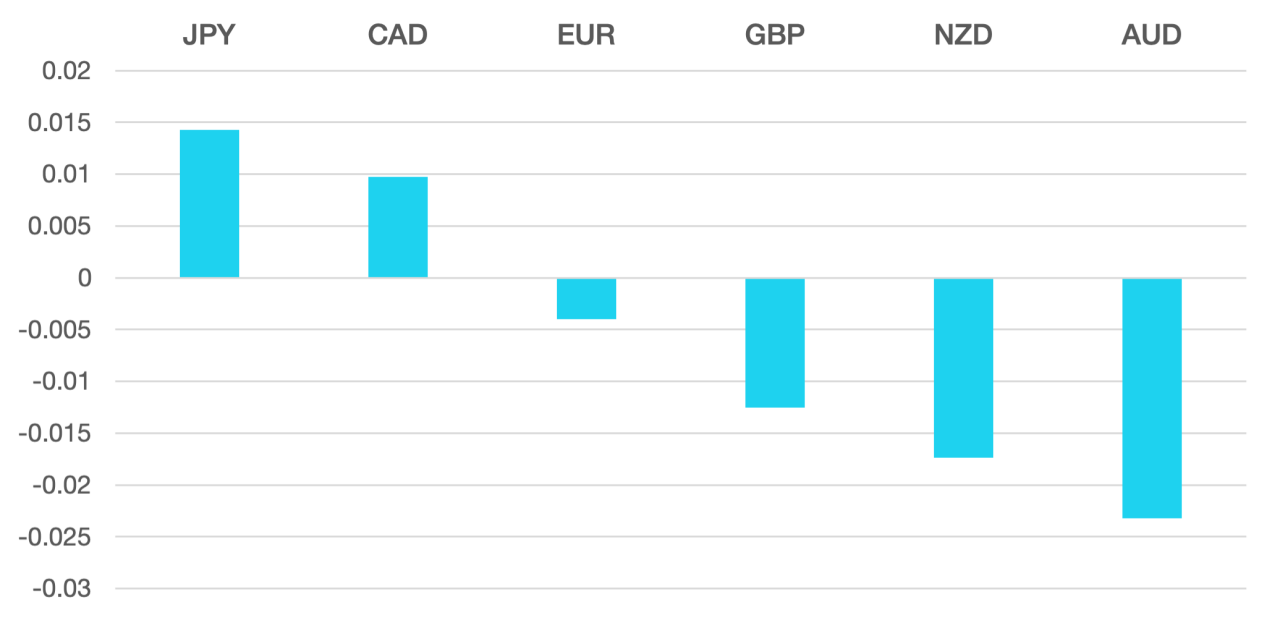

The Dollar reversed some of the previous week losses. The FED hawkish statement supported the greenback and the DXY closed the week 0.7% better just below 106.

The Euro had a relatively good week when faced with the continued backdrop of weak economic data. The single currency ended the week just 0.4% lower but gained almost 1% vs the GBP.

The Pound continues to struggle as weak economic data weighs in. GBP lost just over 1% vs the greenback and upcoming earnings and employment data could dictate the GBP next move.

Commodity currencies despite a continued risk on market had a difficult week. AUD and NZD both lost around 2%. With Oil having a difficult week it was not surprising to see these currencies move lower.

Oil had a second poor week with WTI losing another 4% to close at $77.

The week ahead we have US CPI which will most likely set the precedent for the week and how risk assets are going to trade. We also have GDP and CPI numbers from Europe and UK unemployment.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Risk Assets Rally Continue first appeared on trademakers.

The post Risk Assets Rally Continue first appeared on JP Fund Services.

The post Risk Assets Rally Continue appeared first on JP Fund Services.