Based on the work of sociologists William Thomas and Robert K Merton, and later the work of philosopher Karl Popper, the theory of reflexivity is based upon circular relationships between cause and effect, and it’s been used by many of the top forex traders of all time to inform their trades – including the great George Soros.

As it happens, Karl Popper taught Soros at the London School of Economics, and it is this influence that has led to its adoption by the wider forex community, which is itself heavily influenced by the work of the ‘Man Who Broke the Bank of England’ George Soros, who attributes much of his success to this theory.

How does it apply to forex?

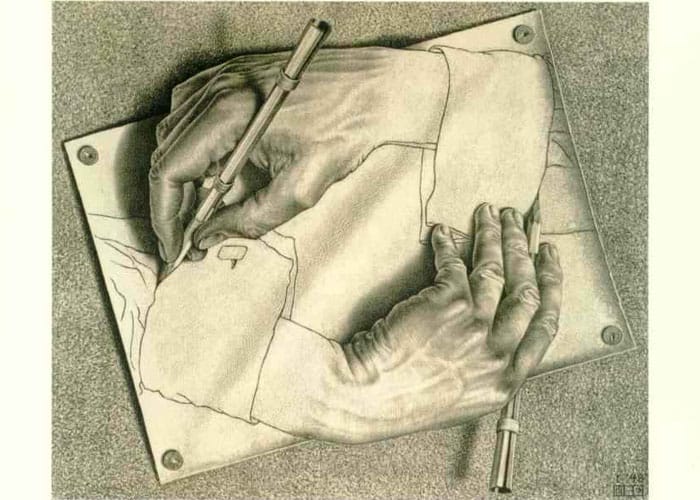

Basically, reflexivity describes a circular relationship between cause and effect, describing how the occurrence of an event can directly influence future events. These events are bidirectional, in that they are able to ‘bend back’ on each other, and can be self-perpetuating.

In the case of economics, or forex, this translates as the effect that a significant market event can have in causing new trends to develop or driving future events. For example, in the case of an asset bubble, rising prices attract more and more buyers into the market, driving prices higher and higher in a self-perpetuating motion until the market becomes unsustainable.

The converse is true during a market crash, which causes more and more sellers to come to the market, and people begin to liquidate their positions out of fear – making the drop much more significant than the fundamentals would suggest. You can see this theory at work in macroeconomics as well, when consumers become pessimistic and that pessimism leads to a cycle of reduced spending, causing a spiralling downturn.

A flexible approach

Since the theory describes markets as having a circular relationship between cause and effect, it is important to maintain a very flexible approach to the markets. The theory of reflexivity states that markets are completely dynamic, that new trends can influence policies and economics and vice versa.

That’s why it’s essential to keep a completely open mind when trading, and to not get too caught up in any single trade and instead move with the flow of the markets. Because one big trend can be self-perpetuating, it therefore makes sense to follow the familiar rationale of cutting loses quickly and letting winners run.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading