The week saw some level of stabilisation after the previous 2 weeks of roller coaster markets. Ukraine continued to dominate the headlines but with no further escalation the markets sought to remain calmer than previous weeks.

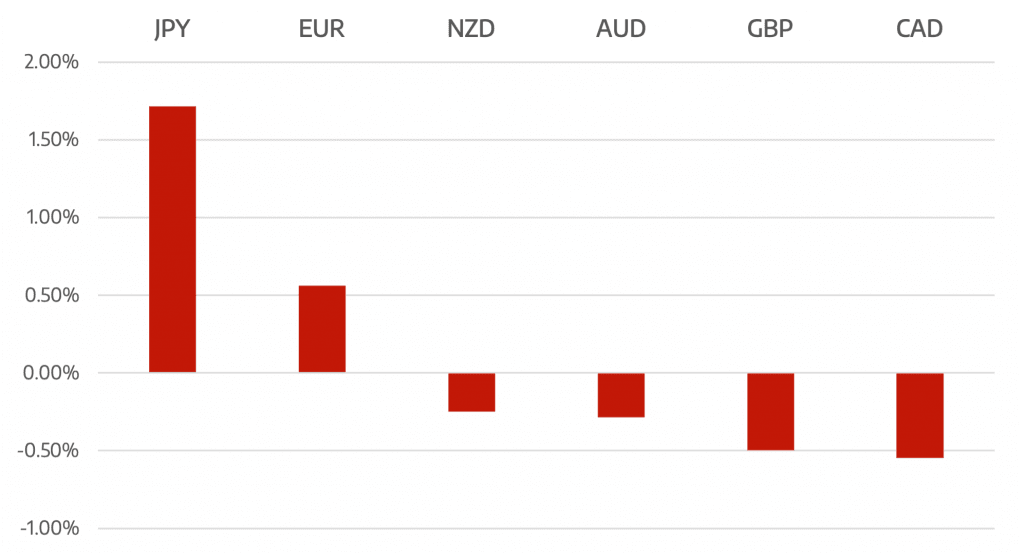

The USD which had seen safe haven status over the last 2 weeks gave up some ground to those worst hit since the Russian invasion.

The Euro looked to bounce back from it’s lows but failed to break out of the mid 1.10 range as the market seemed to be capped.

The move in USDJPY higher seemed to point to a more prolonged USD rally and sell of in Yen ahead. Oil finally saw some selling pressure as talks between Ukraine and Russia pointed towards some progress. Oil closed at $109 a fall of 5%.

The week ahead sees the much anticipated FOMC policy announcement on Wednesday. The market still expects a 25bp rise and a continued tightening stance. We also see BoJ and BoE policy announcements but all of this could be overshadowed by events in Ukraine.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Markets Remain Stable Ahead of Fed

appeared first on JP Fund Services.

The post Cromwell FX Market View Markets Remain Stable Ahead of Fed first appeared on trademakers.

The post Cromwell FX Market View Markets Remain Stable Ahead of Fed first appeared on JP Fund Services.

The post Cromwell FX Market View Markets Remain Stable Ahead of Fed appeared first on JP Fund Services.