Last week saw the central banks look to tighten further as inflationary pressures continue to loom. The Fed was particularly hawkish raising by 75bps but the week also had the SNB delivering a surprise 50bps while the BoE’s 25bps had an underlying hawkish note with 3 members looking to raise by more.

The Euro had an opportunity to shine but the ECB sadly put the brakes on any upside. With the interest rate decision but a few days old the ECB is already looking at ways to mitigate the negative market action we are seeing.

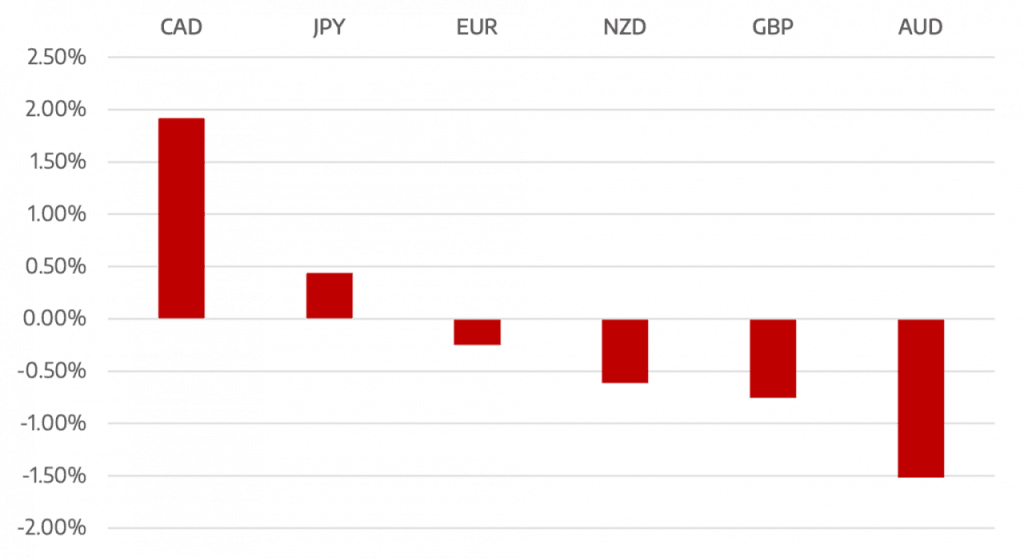

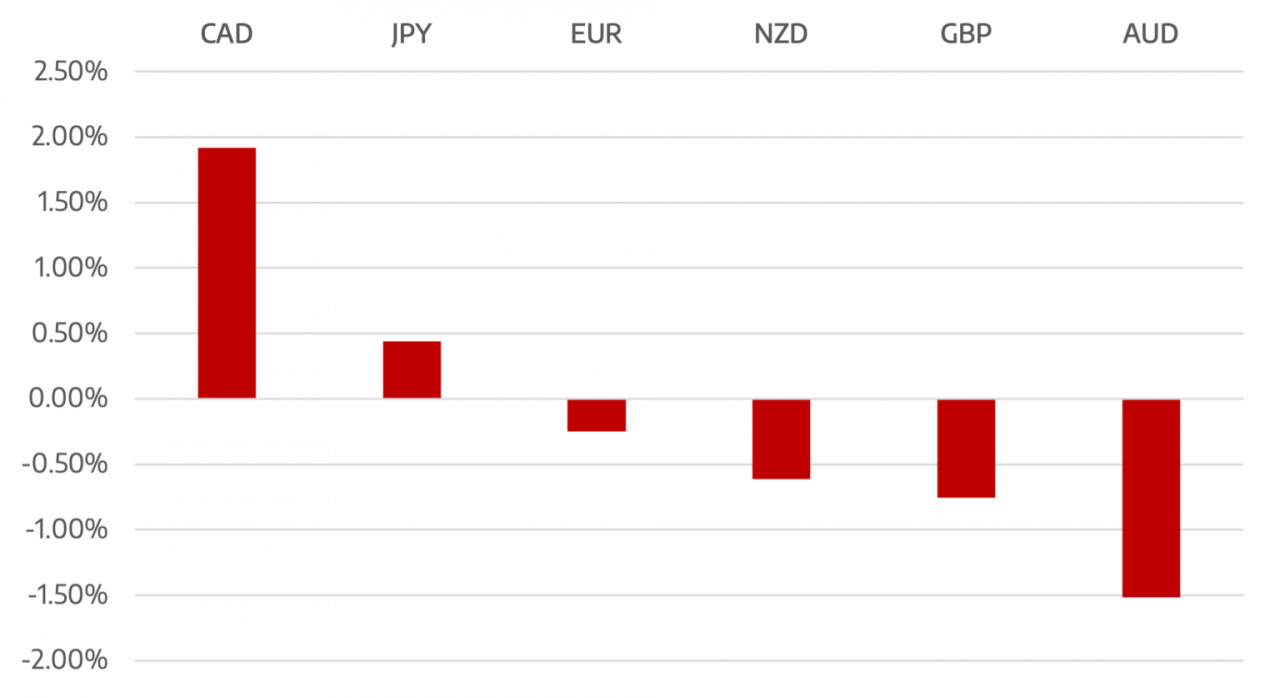

GBP struggled as the weeks economic data continued to disappoint. The BoE did raise rates by 25bps but the market was hoping for a larger increase. The projections are that UK inflation will peak around 11% and if true a more aggressive hike cycle will be required.

Continued risk aversion weighted heavy on commodity based currencies. AUD was one of the weeks worst performers along with NZD as further general market risk aversion filtered through into these pairs.

CAD was one for the worst performers vs the USD as a failing oil price moved the commodity currency lower by almost 2%. WTI lost almost 8% last week to close at $110 level

The week ahead is lighter on economic data but could remain volatile as markets digest the previous weeks Interest rate rises.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Central Banks Make Their Move</h3> appeared first on JP Fund Services.