The trajectory of the money transfer and remittance industry is an interestingly polarising one of late, with many variables leaving the sector on a proverbial tipping point. A new report from MoneyTransfers finds the industry’s direction very much weighs in the balance.

In April this year, The World Bank predicted the sharpest decline of remittances in recent history. They projected that global remittances were to decline by almost 20% in 2020 due to the economic crisis induced by the COVID-19 pandemic and lockdown measures emplaced by countries around the world.

We’ve seen the biggest drop in activity since the great depression, which is why such a prediction from the World Bank should not come as a surprise.

However, MoneyTransfer.com have found that for some companies within the industry, notably online companies such as PaySend, TorFX, Currency Direct and CurrencyFair – who all target different customer segments in the money transfer market – all posted record-breaking activity in March 2020 as lockdowns descended across the world. At Paysend, for instance, March and early April saw an increase in both users and transfer activity by more than 15%. TorFX Managing Director Nigel Fox said that March was the “busiest month since the company was founded in 2004,”. Moreover, CurrencyFair CEO, Paul Byrne, also remarked on his company’s “record-breaking March’ as ‘transaction volumes were up 30% compared to original forecasts,”. Elsewhere, Marc Morley-Freer, Global Head of Private Clients at Currencies Direct said that of the Currencies Direct customers surveyed, 84% said their money transfer needs “were the same as before the crisis,” with the virus not seemingly not impacting the company.

“It’s hard to ascribe just one cause to the downward trend in global remittance payments, and MoneyTransfers.com believes another contributing factor has been individuals being unable to leave their homes while under lockdown, meaning they have been unable to make it to physical stores to transfer funds. This effect has been noted in a variety of publications, and there appears as a result to have been a large change of user behaviour in favour of using digital channels to transfer money. Many of our partners operating in the money transfer and remittance space have noted this change, and it has interesting implications as to how the business of money transfers may be adapting to the current crisis,” said Jonathan Merry, CEO of MoneyTransfers.com.

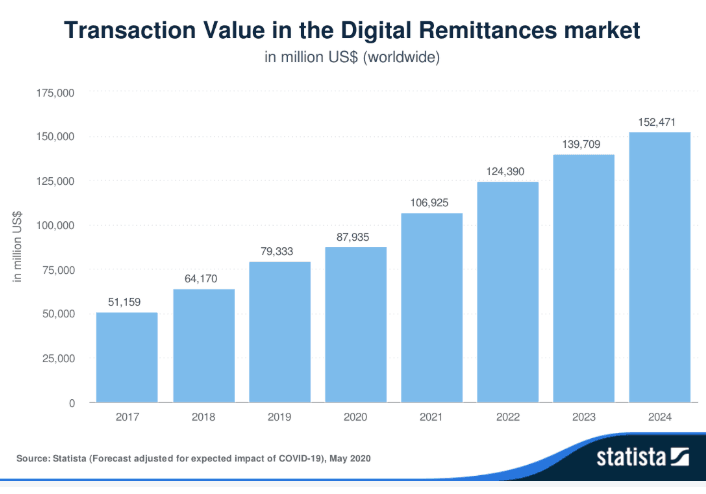

Moreover, data released by Statista appears to further supports this initial trend, with projections adjusted with COVID-19 in mind, found that remittance transaction value will rise to $89 billion this year, compared to $79 billion in 2019. It’s projected to continue to rise to $107 billion in 2021.

The full report covers the remittance and money transfers industry from the start of the pandemic to now, quotes on the performances of some the biggest players in the field, the multiple variables at play, the role of digital and future projections.

According to the report, it’s impossible to know how the world will look after people come out of lockdown to survey the damage done by COVID-19, but there is reason to hope that we could be on the verge of one of the great periods of technological innovation. While it is undeniable and worrying that remittance payments are going to take a hit as a result of this pandemic, the exact size of the reduction in payments is hard to predict. There is reason to hope that increasing access to digital payment methods could hold the key to mitigating the hardship that will be faced by people around the world.

Beyond the increasing focus on digital ways of sending money, the currency crisis has seen renewed interest in purely electronic transfer methods such as digital dollars/euros and cryptocurrencies, which many have long touted as beneficial for sending money across borders securely and with limited fees. As the conversation around money transfers and remittances moves increasingly down these digital avenues, it’s likely that the industry could end up looking very different after the coronavirus has passed.

“If more users are forced to adopt digital transfers due to COVID-19 related lockdown measures, it’s not unreasonable to believe that this change in behaviour could well stay after restrictions are eased. Conversations like these are only going to get louder as societies try to figure out how to keep functioning while limiting physical interactions. The world is changing fast, and it doesn’t look likely to stop any time soon,” the CEO concluded.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading