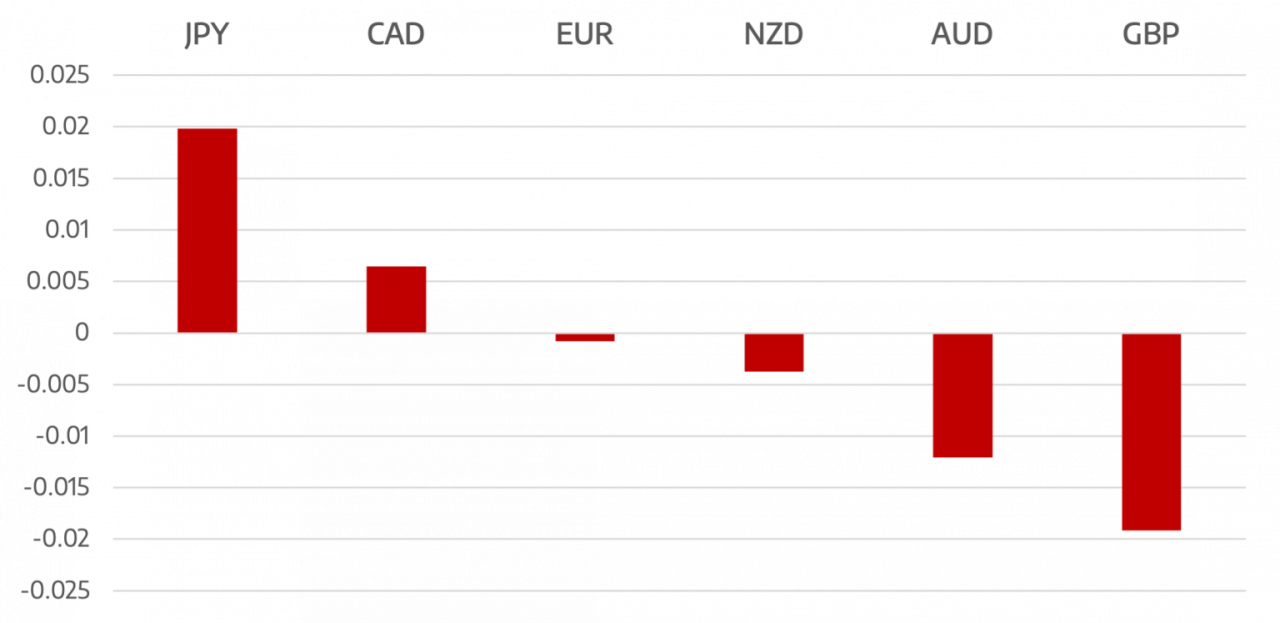

Last week the USD continued its role as the markets favourite currency as it posted another positive week. The US economy continues to show strong economic signs with the market continuing to look for further Fed tightening in the coming months.

Euro ended the week flat as despite USD strength the single currency held its own. The Eurozone CPI was higher, and the markets looked at an increase chance of a 75bps rate rise at the next ECB meeting. The energy situation remains tense in the eurozone which could see the ECB disappoint.

GBP has simply failed to find any upward momentum. The next UK Prime Minister is set to be announced but the market is not reacting to any of the candidates. The GBP was the worst performing market falling nearly 2% against the USD with the currency closing at 1.15 for the first time since the 2020 Covid crash.

Commodity currencies resumed their move lower as risk assets continue to feel pressure. The NZF and CAD both dropped around 0.5% and AUD was 1.2% lower.

Oil prices were under pressure as the general commodity market sold off. The WTI fell 6% lower closing around the $83 level.

The week ahead is slightly shortened with the US labour day holiday on Monday. Data releases sees several PMI and interest rate decisions from the RBA, BoC and ECB.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Fed Keeps the Pressure on Risk

appeared first on JP Fund Services.