Decentralized Finance (DeFi) aims to recreate the traditional financial system with fewer frictions. It is mainly composed by open source platforms, accessible by anyone and driven mainly by automated computer programs and less and less by centralized entities and humans.

What is DeFi?

DeFi, short for Decentralized Finance, is a decentralized open-source system that allows for code smart contract driven stratagems to use in traditional financial – society activities such as banking, lending, borrowing, supply chain, structuring derivative products. By its nature, it encourages the purchase and sale of securities to be carried out through digital networks of blockchain nodes without the need for intermediaries.

The 4 Primary Features of DeFi

1. Permissionless:

A DeFi system’s foundation blockchain is permissionless, hence allowing anyone to access the applications on a DeFi protocol and trade over the network without requiring anybody to sanction it.

2. Open Source and Transparent:

The code is visible to every user, allowing everyone on the network to audit it and verify its security + functions.

This transparency of the network doesn’t tamper with the users’ privacy either, since all users are identified by their digital signatures (like a social media username).

Open-source coding ensures DeFi’s credibility.

3. Interoperability:

DeFi is very easily compatible with the integration of other applications, so DeFi always has the scope to expand further, offer new financial services, or develop new financial marketplaces. It is a good idea to find a reliable defi dapp development company to work with if you’d like to optimize and develop your dapp.

4. Accessibility:

Anyone with a computer/smartphone and a decent internet connection from any corner of the world can join a DeFi network.

DeFi are based on Synthetics

Synthetics are a financial instrument or product that is meant to simulate other financial instruments while altering their key characteristics. The functionality of a financial instrument can be achieved through a blend of different financial instruments, as well.

Synthetic tools include tools for Asset Management, Analytics, Crypto Lending & Borrowing, Margin Trading, Decentralized Exchanges, DeFi Infrastructure & Dev Tooling, Insurance, Marketplaces, Derivatives, Staking, Tokenization of Assets, Payments, stablecoins..

The vast majority of DeFi systems are currently created using blockchain platforms with smart contract capabilities such as Ethereum, but other platforms could also serve as base.

Centralized vs Decentralized Finance

Centralized vs Decentralized Finance

In centralized organizations, primary decisions are made by the person or persons at the top of the organization.

Decentralized organizations delegate decision-making authority throughout code & the organization.

Advantages of decentralized organizations include increased expertise at each division, quicker decisions, better use of time at top management levels, and increased motivation of the community.

DeFi solutions will have an increasing significant impact on the financial industry & society.

Challenges of decentralized Finance

Some of the most prominent risks present in the DeFi field come from issues regarding tech smart contracts, cybersecurity, governance, user error, market volatility, lack of insurance on loans & potential failure of the price mechanism.

But maybe, the biggest challenge to date is the lack of structured governance and accountability.

That is why DeFi needs strong governance entities, as otherwise it can become unclear who should be held accountable for potential wrongdoings or failures.

When problems arise, DeFi needs certified governance parties that can take actions to freeze transactions, fix problems and restore normal operations.

Opportunities of decentralized Finance

Decentralized platforms facilitate combinatorial innovation.

In a DeFi ecosystem, technologies are building blocks for solutions, promoting new combinations + products for communities.

Combinatorial DeFi platforms innovation is made possible by permissionless innovation and open sourcing smart contracts AI driven platforms.

DeFi applications and platforms—such as Bitcoin, Ethereum, and — share their core technologies through permissive open-source licensing, allowing anybody to make use of their core technologies as well as to build new applications on top of them

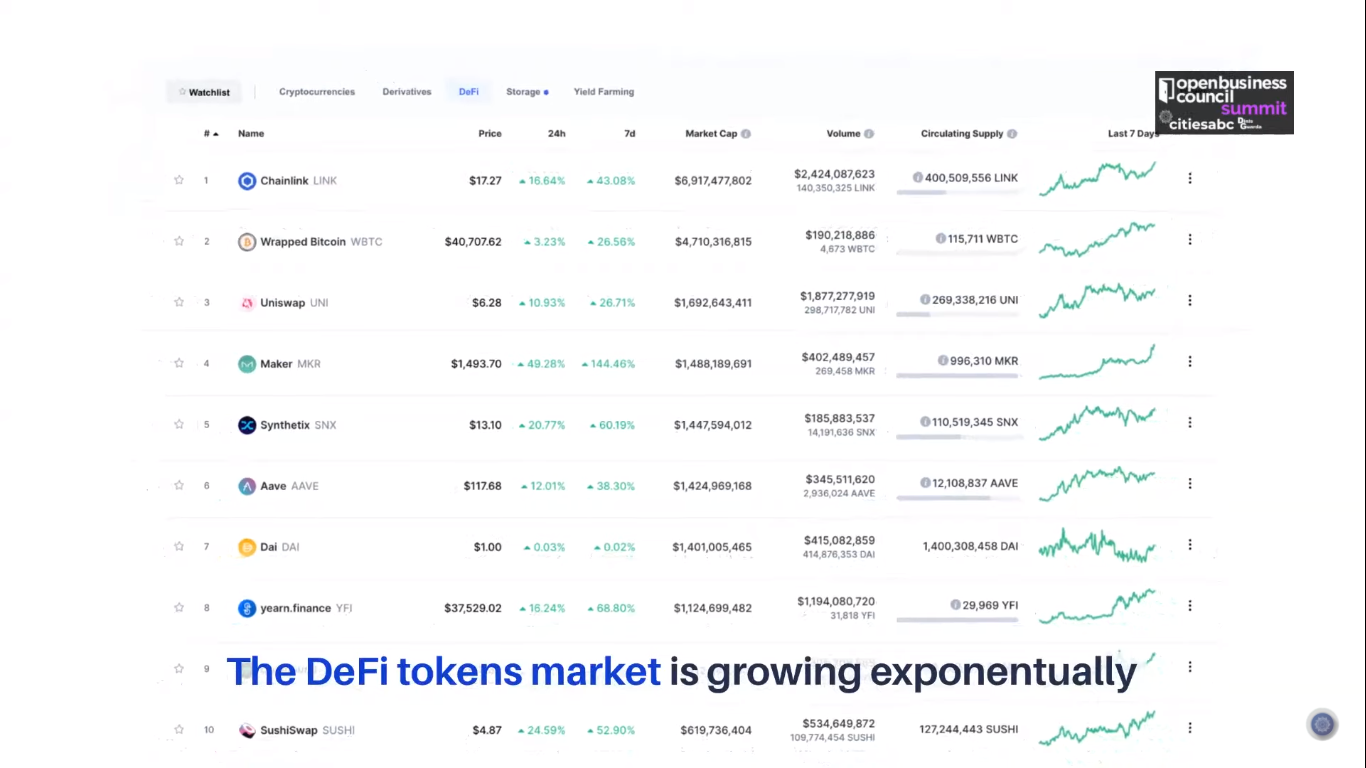

The DeFi Market Size and Growth Forecast

2020 Was the Year of DeFi. The dollar value of assets locked in DeFi protocols closed out the year above $13 billion, demonstrating 2,000% growth since January. This goes hand-in-hand with the massive growth of the DeFi tokens market, which soared to $29.394B in total Market Capitalization.

DeFi biggest sectors so far:

1. Trading and Marketplaces

2. DEXes/ Decentralized Exchanges

3. DeFi derivatives

4. Tokenization

5. Stablecoins

6. Synthetic Assets

7. Lending and Borrowing:

8. Asset Management

9. Insurance

10. DAOs/ Decentralized Autonomous Organizations

11. Payments

12. Decentralized Marketplaces

13. Identity

14. Gaming

Top DeFi Platforms & Tokens

As for the blockchain used, Ethereum and EOS dominate the DeFi lending marketplace.

While most DeFi lending apps are built on ethereum, EOS commands a big amount locked by a blockchain.

Non-custodial type platforms and protocols are Dharma, Compound, Maker, Nuo Network, dYdX, Fulcrum, ETHLend…

BlockFi and Nexo are examples of the custodial type platforms.

MakerDAO, Dharma, and Compound represent nearly 80% of the total ETH locked in DeFi platforms.

Compound is an Ethereum-based money market protocol for various tokens. It supports BAT, DAI, ETH, USDC, REP, ZRX tokens.

Every asset market is connected to the cToken (cBAT), which acts as an intermediary token for all transactions and lenders earn interest through the cTokens. This is a liquidity pool type P2p platform.

Maker’s Dai stablecoin is probably the most well-known and widely used synthetics in DeFi.

Supporting DAI and ETH tokens, the Ethereum-based platform allows a user to borrow DAI, which maintains a soft peg in USD, by placing ETH token in reserve in Collateralized Debt Position (CDP).

The top 5 DeFi tokens by market cap are:

Aave – AAVE (Total Supply: 16,000,000 AAVE)

Aave is a leading lending protocol that leverages a native token AAVE to secure the protocol and participate in governance. Aave is currently undergoing its migration from LEND to AAVE at a rate of 100:1, which you can do through the Migration Portal. AAVE can be staked via the Safety Module for AAVE rewards.

Synthetix – SNX (Total Supply: 190,075,446)

Synthetix is a leading derivatives protocol backed by a native token SNX. In order to mint new derivatives – called Synths – users must stake at least 750% of the Synths value in SNX. Maintaining this ratio – referred to as a cRatio – allows users to earn native inflation along with a pro-rata portion of trading fees from the Synthetix Exchange.

yEarn – YFI (Total Supply: 30,000 YFI)

yEarn is an automated liquidity aggregator offering a number of different yield farming opportunities. The protocol is governed by a native token – YFI – which was launched with no premine and did not hold an Initial DEX Offering. Users can stake YFI to participate in governance and claim a pro-rata share of protocol fees.

Uniswap – UNI (Total Supply: 1,000,000,000 UNI)

Uniswap is the leading decentralized exchange in DeFi. In mid-September, Uniswap airdropped 15% of its supply to past users through a program marked ‘UNIversal Basic Income‘. Today, UNI can be earned by providing liquidity to select pools and will eventually be used for governance as a larger portion of the supply is issued.

Sushiswap – SUSHI (Total Supply: 250,000,000 SUSHI)

SUSHI is the governance token of the Sushiswap AMM and lending protocol. It is earned by LPs by providing liquidity to select pairs on Sushiswap, and can be staked via the Omaske bar to earn protocol fees and issuance. SUSHI is also used to vote on new Onsen launch partners, or projects that receive added SUSHI rewards for conducing an Initial DEX Offering through Sushiswap.

Decentralized finance (DeFi) has witnessed staggering growth in 2020. And it has just started as 2021 will be much bigger. There are now more than $26.7+ billion locked in Ethereum DeFi platforms while DeFi platforms have more than 500,000 users.

DeFi – The Future of Finance and Crypto

DeFi – The Future of Finance and Crypto

DeFi blockchain technology will reduce involvement of centralized institutions, encourage experimentation, and broaden access to financial services, decentralized currencies, contracting and payments, funding…

DeFi decentralized business models will reshape all the existing industries, starting by finance and will create a new radical decentralized landscape for businesses governments where entrepreneurship + innovation will share community empowered new business reward models.

Conclusion

DeFi is starting to change all the financial industries but will have major impact in governments, businesses and society.

But not all society can be objectively codified or publicly recorded on blockchains, DeFi will need inputs to a global tech financial , business + governance systems of distributed trust.

“We are a stone’s throw away from the global financial industry running on a common software infrastructure.” Lex Sokolin, Global Fintech Co-Head of ConsenSys

Whether you are looking for insurance, exchanges, staking solutions, or most other financial tools and services, odds are you will be able to find a DeFi platform that has it covered.

But bear in mind not all DeFi platforms have been rigorously tested or have been audited by third parties, and many are still considered experimental.

Although we are still in the early days of DeFi, the potential it holds to disrupt finance – society is unmatched.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading

Centralized vs Decentralized Finance

Centralized vs Decentralized Finance DeFi – The Future of Finance and Crypto

DeFi – The Future of Finance and Crypto