Investing your capital to secure your financial future is one of the most important decisions you’ll ever make. As a novice investor, should you go it alone, or does it make more sense to work with the best investment management firms? Here are some considerations to think about before making any commitment.

Starting with a reality check

One of the main benefits of working with a company that has a team of investment managers, financial planners, and tax experts at their disposal is that they can provide an objective view of your situation. Most will start with a detailed audit of your current situation, and explore what you are aiming to achieve in the long term. They’ll then create an investment plan based on helping you to achieve your objectives.

Depending on how much experience you have as a financial analyst, you can always do this exercise yourself. However, it’s unlikely that you’ll have the range of skills and experience to consider every aspect of your current situation and how best to achieve the financial future you want.

Balancing risk and growth

One of the traps novice investors fall into is to seek short-term gains. This can lead to risks being taken, with resulting losses. If you can sustain these, no problem. However, if you’re working with a limited amount of capital and have a limited appetite for risk, you’re likely to be over-cautious and miss valuable opportunities.

An experienced fund manager is more likely to spread the risk and create an evenly balanced portfolio. This is more likely to produce the returns you want, over the long-term. He or she will also keep to the strategy aimed at achieving your long-term goals.

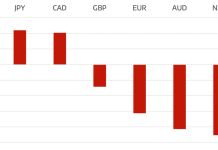

Monitoring the markets

Becoming an investment expert takes time, study, and experience. Understanding economic cycles and timing your moves correctly is the key to long-term success. If you’re ready to commit to learning how the markets work and tracking them closely, then DIY investing can be a rewarding activity for you.

On the other hand, an investment company will do this research for you and will most likely have people with deeper expertise in several fields. There’s no point in making money on the markets if you don’t optimize the tax you’ll pay. A tax-planning specialist can protect your investment income.

If you’re attracted to independent investing, a practical compromise would be to use a financial planning firm to handle the majority of your portfolio, and consult them when you want a second opinion on an investment you’d like to make.

A cost or an investment?

One reason novice investors prefer to go-it-alone is concern over the cost of an investment management service. Online trading platforms can have a low entry point and seemingly only charge small commissions. However, these can soon mount up, and without expert advice, losses can soon eat into your capital.

The costs of portfolio management/financial planning services vary depending on the sums involved and the services you use. As long as you’re informed of these before committing yourself, and consider the opportunities they’ll find for you as they follow the agreed strategy towards your goals, it could be the best investment you’ll make.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading