The first signs of the economic disruption caused by the coronavirus crisis have been felt across capital markets, where many stocks have entered full “bear market”. With this increased volatility on the market, there is an amplified focus on trading from home using the latest trading technology.

Chris Jenkins, managing director at trading execution platform Tora has some interesting insights on the different models being used by firms as traders are being forced to work from home and still cope with unprecedented activity:

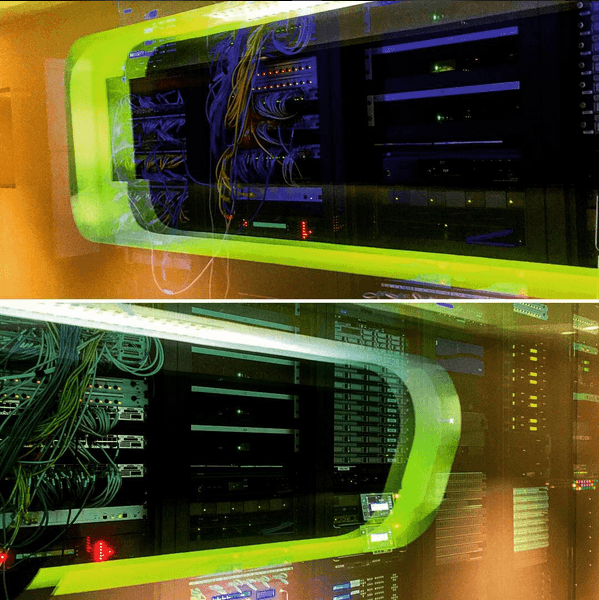

“The Covid-19 pandemic is, unfortunately, the first real world example for much of the global financial industry to test infrastructure improvements made over the last decade. Banks, hedge funds and asset managers have spent billions on new and more powerful systems, hoping to weather large spikes in trading volatility and/or volume.

However, not all firms followed the same approach to infrastructure updates. Those which opted exclusively for a cloud-based infrastructure have the upper hand as employees should have the same user experience whether they are in the office or in an apartment. All that is required is a computer and a reasonably fast broadband connection.

That said, it will be interesting to see how local broadband companies and conference call providers such as Zoom will handle the increased volume of users and constant high levels of activity.

Employees connecting to their company systems via virtual private networks or applications such as Citrix, are however crucially adding potential latency into functions that can be latency sensitive. This is job role dependent, so while the a few seconds won’t mean much to someone in the back office, it can be critical for traders dependent on live market data.

I was in Hong Kong in 2003 during the SARS epidemic at the time many firms didn’t really have a plan for dealing with a crisis of this nature. That’s not the case now.

Learning from lessons past, when the SARS epidemic hit Hong Kong in 2003, the city started to send people home from Chinese New Year and many people haven’t moved. There are thousands of people working remotely and working efficiently, showing a way forward even if governments expand restrictions. In the West, those firms with detailed plans should also see an easier transition to what could be the new normal for weeks or months to come.”

Global Stock Markets face their worst weeks since the financial crisis of 2008

In fact, amidst the Covid-19 pandemic, global stocks markets are facing their worst weeks since the financial crisis of 2008, and most economists around the world fear an upcoming global recession. The worst day to date was Monday 16, March. Stock markets all over Europe and the US slumped, with the Dow Jones losing close to 13% and the S&P 500 falling almost 12%, marking the biggest one-day falls for both indexes since “Black Monday” in 1987. In fact, in the last month, the Dow Jones Industrial Average has racked up the five biggest one-day points falls in its 135-year history.

European markets entered bear market territory in March, In the case of major European markets, these events have wiped 20% off their recent peaks. We’ve not seen such a severe loss since the aftermath of Lehman Brothers’ collapse a decade ago and things don’t seem to get any better in the foreseeable future.

The apparently unstoppable spread of the coronavirus crisis has triggered a massive wave of selling, which has plunged stock markets worldwide into a full-blown bear-market. And at least one benchmark stock market index in all G7 countries and 14 of the G20 countries have been declared to be in bear markets.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading