The acceleration lower in the Pound comes amid the increased risk of a disorderly exit from the European Union and a heightened possibility of a “hard exit” which signals a loss of access to the single market. One of the primary benefits of the relationship with European Union for the United Kingdom was the trade incentives and lack of tariffs. Furthermore, the “passporting” nature of the relationship gave way to London becoming one of the biggest financial centers globally as they benefited from hosting multinational banks looking to provide services across Europe from one centralized location. That could all change, with speculation rising that the long-hoped for “soft exit” will be increasing impossible. The result has been investors voting with their feet, selling Sterling and looking for brighter investment opportunities elsewhere.

Exit Risks Growing By the Day

After plunging to the lowest levels since 1985 , more pain may be in store for the GBPUSD pair as traders increasingly see the potential for a number of setbacks for the UK economy after the Government triggers Article 50 to exit the European Union. Although the “Bremain” camp had largely hoped for a “soft exit” that would allow the UK to maintain trade ties with the European Union to take advantage of lower trade restrictions, rhetoric from the European Union does not seem to support this course. Key policymakers have already come out against the idea of UK benefiting from certain rules while deciding others on its own. Internally, Prime Minster Theresa May has indicated that the “hard Brexit” is likely due to the fact that the UK wants to retake control of its borders, reflecting the will of the “Brexit” voters.

In general, the financial repercussions of a hard exit are thought to be significant. Already, investors are choosing to shun UK assets with the Bank of England reporting weaker flows to stocks and commercial real estate. Additionally, due to a current account deficit and a broader trade deficit, the UK requires foreign financing of its debt with the drop in the Pound like reflects this reality. While the economy has performed admirably despite the uncertainty, the outlook remains significantly more uncertain. Furthermore, London’s status as a global financial center will likely be significantly reduced under these conditions, forcing multinationals to move their offices south into France to take advantage of the EU services passport. As a result, with months to go until Article 50 is triggered, the Pound has significant room to fall as questions about the exit strategy go unanswered.

Pound Breakdown

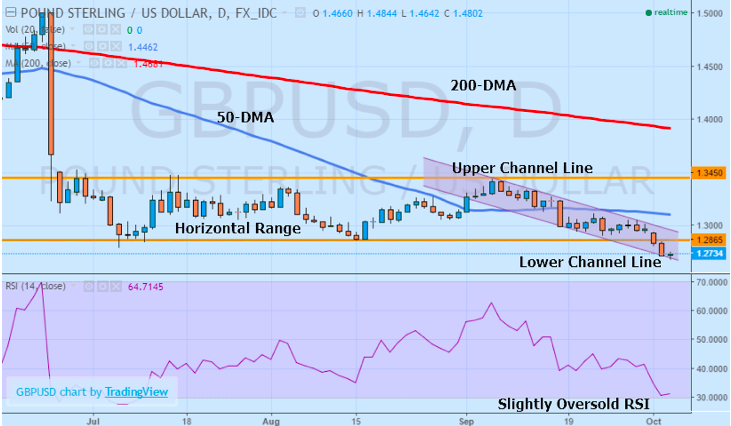

After trending relatively sideways for several straight months after the votes were tallied back in June, the GBPUSD has broken lower from its horizontal range as the momentum to the downside accelerates. Although the move that has transpired over the last few sessions might seem slightly oversold as evidenced by the relative strength index nearly falling to the 30.00 level, a rebound might not be imminent or prolonged. In the event of a technical correction, the main level to watch is the lower bound of the former range at 1.2865. However, with a candlestick close below this level, a move to the tune of 60.00-75.00% of the former range would be considered relatively normal for this type of breakout activity. Based on a range of 1.2865 to 1.3450, that implies a potential move lower of 350-440 pips lower.

Adding to the bearish case for GBPUSD are both the 50 and 200-day moving averages which continue to trend lower above the price action, acting as resistance. The 50-day moving average will likely coincide with the key psychological level at 1.3000 in a matter of days, preventing any sustained rebound to the upside. However, with GBPUSD currently trending near the bottom of an emerging equidistant channel, the timing may be ripe for a quick upward correction towards the lower bound of the former range before a resumption of the prevailing downward trend in the pair. Trading against the trend in a channel is slightly dangerous, with more ideal bearish positions initiated closer to the upper channel line. However, a candlestick close below the lower channel line could suggest another downside breakout, accelerating the momentum lower once more.

Looking Ahead

A lot hangs in the balance for the UK as the outcome of negotiations with the European Union. No matter what, sovereignty over borders has become an issue that will not be compromised by the UK Conservatives. The result is that the nation will likely also lose access to the single market mechanism that currently allows for the free flow of people, goods, and services across national borders without additional taxes. For UK businesses and the economy at large, this may present a significant risk over the medium-term, with investors indicating their dismay with the latest selloff of the Pound. Should the outlook clear and the exit possibilities become clearer, uncertainty will continue to weigh on the Pound, with the most recent price action only the beginning of what will likely be a longer-term downward trend for GBPUSD.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading