Sometimes referred to by traders as the ‘Aussie’, the Australian dollar is the official currency of the Commonwealth of Australia and also some independent Pacific Island states. It is currently the fifth most traded currency in the world, with 7.6% of the world’s daily share as of 2011 behind the US dollar, the euro, the yen and the pound sterling.

There are several reasons for the Australian dollar’s popularity with currency traders. Firstly, the relatively high interest rates in Australia make it useful from a carry trade point of view, as traders can borrow one currency with a low interest rate (such as the JPY) to buy another (such as the AUD) with a high interest rate. Secondly, the Australian government doesn’t tend to intervene in the currency markets, unlike for example the Japanese government, and this creates more tradable volatility. Thirdly, the economy and political system of Australia are considered to be very stable indeed, which means that traders don’t have to worry about sudden huge valuation changes as a result of snap policy decisions. Fourthly, it gives traders some exposure to fast-growing emerging market economies in the Asia Pacific region and the commodities cycle, which makes it a good choice for diversifying a portfolio containing other major currencies.

Australian Currencies in the 20th Century

Up until 1910, the British pound sterling was the legal currency in Australia. An Australian version of the pound was introduced in that year, and remained on parity with the British pound until devaluation in 1931. The pound was replaced by the dollar on 14th February 1966, at a conversion rate of two dollars to the Australian pound, or ten Australian shillings per dollar. At this point, the exchange rate with the British pound was pegged at AUD 2.50 = GBP 1. This ended the following year when the British pound was devalued against the US dollar, while the Australian dollar stayed pegged to the USD under the Bretton Woods system at a rate of AUD1 = USD 1.12.

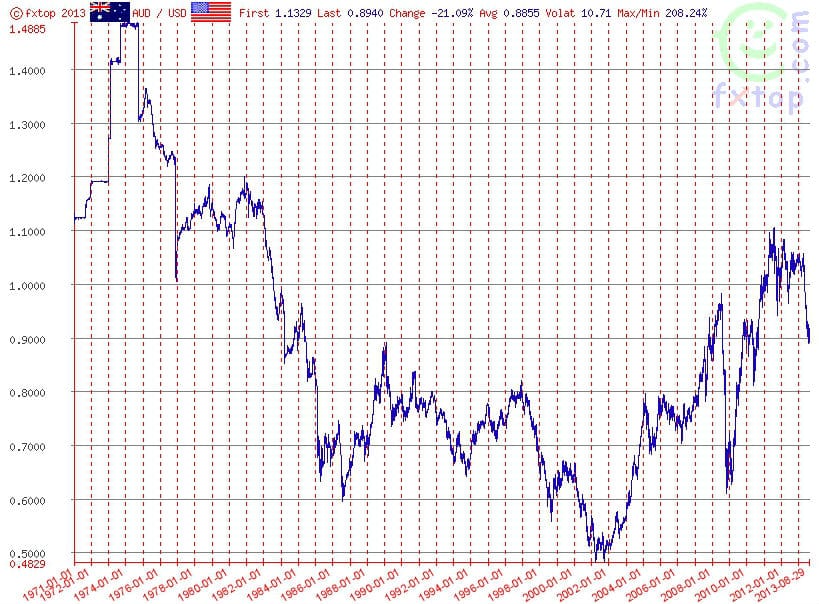

Source: FXTop.com

The Australian dollar was at its peak value in comparison with the US dollar during the period after the Nixon shock of 1971, which ended the Bretton Woods system. In December of 1973, the peg was adjusted to USD 1.4875, with fluctuation limits being adjusted to USD 1.485 – 1.490, with the highest point of 1.485 being reached twice that month.

The AUD floats

The Australian dollar became a free-floating currency on 12th December 1983, which meant that its value became wholly dependent on supply and demand in the international currency markets. In the ensuing 20 years, the highest value it reached relative to the USD was $0.881 in December 1988, and the lowest value since flotation was 47.75 US cents in April 2001. By June 2008, it had climbed back up to 96 US cents, and reached a high of 98.49 later that year before falling significantly, although it recovered the following year to 94 cents.

The AUD briefly reached parity with the USD for the first time since becoming a free-floating currency in October 2010, briefly going above US$1 and sustained this for a longer period in November. It reached a record post-float high of $1.1080 against the USD on 27 July 2011, and some have suggested that it could go as high as 1.70 USD by 2014.

The Long AUD Rally

The debt crisis in Europe, coupled with Australia’s strong ties with material importers in China and other Asian countries, have been major factors in driving up the value of the AUD since the turn of the century. The Australian dollar often moves in the opposite direction to other major currencies, mainly due to the fact that commodity prices have a huge impact on its relative strength. It tends to rally during periods of global boom, with demand for Australia’s raw materials going up, and fall during periods when mineral prices fall or domestic spending outweighs export earnings. This is the opposite of leading reserve currencies such as the USD, which tend to rally during slumps as traders gravitate away from falling securities into cash.

The AUD as a Reserve Currency

Although it is one of the most traded currencies in the world, it was not until recently considered a major reserve currency. However, this all changed with the 2011 announcement that the Central Bank of Russia would start building up reserves of Australian dollars.

Other Articles in this Series:

Major Currencies: The US Dollar (USD)

Major Currencies: The Euro (EUR)

Major Currencies: The British Pound (GBP)

Major Currencies: The Swiss Franc (CHF)

Major Currencies: The Japanese Yen (JPY)

Major Currencies: The Canadian Dollar (CAD)

Major Currencies: The New Zealand Dollar (NZD)

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading