The Canadian dollar ($ or CAD) is the currency of Canada, and is the 7th most traded currency in the world, accounting for 5.3% of the global forex trading volume.

From Wampum to Dollars

Back in the early 16th century, the indigenous First Nations people of Canada traded using a barter system, although valuable items such as Wampum (sacred shell beads of the Eastern Woodlands Tribes of North America), furs, and metals such as copper and silver were occasionally used as a type of pseudo-currency. Due to a lack of hard currency, early French colonists also made use of the barter system, and silver coins from France were mainly used by merchants to import European goods and pay taxes. #

At one stage, the coin shortage had become so severe that the colonial authorities were reduced to paying soldiers with playing cards marked with the amount on the back. This practice continued on and off between the years of 1685 and 1709, when playing cards were banned as a form of currency, although the coin shortage continued to be a serious problem. The problem was finally addressed in 1729 with the official issuing of a new type of card money, as well as other forms of paper money such as treasury bills and letters of exchange. Eventually, these eclipsed card money in their usage.

The arrival of British colonists in the 19th century did not do anything to address the coin shortages. However, the widespread circulation of army bills during the War of 1812, which the British government redeemed at full value in 1815, helped to restore people’s faith in paper money, which had been badly tarnished during the era of card money. This also paved the way for the emergence of banks from 1821 onwards, and banks started to issue their own paper money backed by gold and silver reserves. At this stage, several coins were used as currency, including the British pound sterling and the Spanish dollar. In 1841, the Province of Canada created the Canadian pound, which was equivalent to 16 shillings and 5.3 pence sterling, four US dollars, or 92.88 grains of gold.

While the imperial authorities had a clear preference for a fractional system based on the British pound sterling, locals were keen to adopt a decimal currency similar to the US dollars used by their neighbour and main trading partner. In 1853, as a compromise, the gold standard was introduced, which made the gold sovereign legal tender, and decimal dollar-based coinage was introduced in 1858. Most other forms of currency were outlawed in 1871 in order to establish the dollar and tie up loose ends, but the gold sovereign remained legal tender right up until 1990.

The 20th century and beyond

Like most other countries tied to the gold standard, Canada suspended convertibility to gold during the First World War, and abandoned the gold standard completely at the height of the Great Depression in 1933. Under the Bretton Woods Accord, which determined post-war exchange rates, the Canadian dollar was initially fixed at a rate of CAD $1.10 = USD $1.00, and this was changed to parity in 1945, although the peg was returned to its original value in 1949 after the devaluation of sterling against the dollar.

Ahead of its Time – The Free Floating CAD

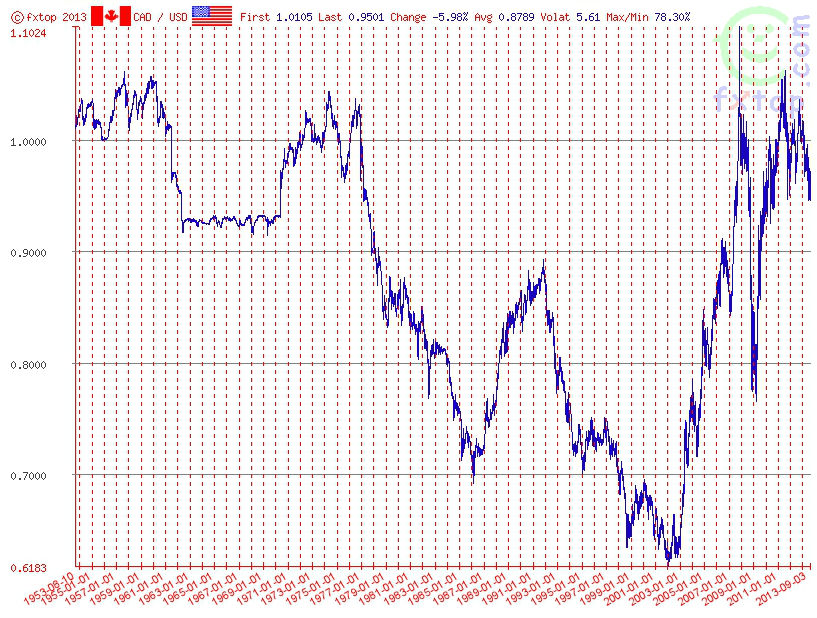

Canada decided to let its currency float between 1950 and 1962, an unusual step for the time, and the CAD traded at a slight premium over the US dollar during these years, reaching a high of USD 1.0614 in August 1957. A dramatic fall in the value of the Canadian dollar after 1960 led to the adoption of a fixed exchange rate once again, and it remained fixed between 1962 and 1970. In an effort to combat inflation, the CAD was allowed to float once again in 1970, and has remained a floating currency ever since.

During much of the 1970s, the Canadian dollar appreciated against the US dollar, reaching a high of USD $1.0443 in April 1974. However, the technological boom of the 1990s, which was mainly centred around the United States, saw the value of the Canadian dollar depreciate dramatically against that of the US dollar, reaching an all-time low of USD $0.6197 in January 2002. Since then, it has recovered due to the high price of commodities – and oil in particular – that Canada exports. This trend reached its zenith in 2007, when the CAD soared 23% in value and reached parity with the US dollar for the first time since 1976, mainly due to the strength of the Canadian economy at the time and the weakness of the USD on the currency markets. So dramatic was this rise that the Canadian dollar was named the Canadian Newsmaker of the Year for 2007 by the Canadian edition of Time magazine.

The Canadian Dollar on Global Markets

Because Canada’s main trading partner remains the US, the fluctuations in the USD/CAD currency pair are the most keenly watched by traders and economists in Canada. If the Canadian dollar appreciates too quickly, it can cause problems for exporters, although it does make it cheaper for Canadian industries to purchase materials.

The Bank of Canada, which is the central bank for Canada, does not have a target value for the Canadian dollar, and claims that it has not intervened in the currency markets since 1998. Yet, while the BoC’s official stance is that the Canadian dollar’s value should be determined by market conditions alone, it is known to have made some minor attempts to influence its value on the world markets.

Before the rally of the 2000s, the value of the Canadian dollar tended to move roughly in tandem with the US dollar in comparison with other global currencies. Since 2002, though, it has diverged significantly from the US dollar, and has been fluctuating wildly in recent years. This high volatility is a product of the Canadian dollar’s new-found status as a petrocurrency, with Canada’s significant oil exports leading the CAD to move in correlation with changes in the oil price.

Other Articles in this Series:

Major Currencies: The US Dollar (USD)

Major Currencies: The Euro (EUR)

Major Currencies: The British Pound (GBP)

Major Currencies: The Swiss Franc (CHF)

Major Currencies: The Japanese Yen (JPY)

Major Currencies: The Australian Dollar (AUD)

Major Currencies: The New Zealand Dollar (NZD)

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading