The global forex market has expanded massively over the past three years, and the City of London remains the world’s leading forex trading centre, according to the latest Triennal Bank Survey conducted by the Bank for International Settlements (BIS).

Perhaps the most striking statistic from the report is that the average daily forex trading volume has grown by a colossal $1.3 trillion in just three years. The pace of this growth has also accelerated markedly. Between 2007 and 2010, the daily volume grew from $3.3 trillion to $4 trillion – an increase of 21%. Between 2010 and 2013, the volume grew by 39% to $5.3 trillion, the fastest rate of growth in recent history.

London Extends its Dominance

The increase in London’s share of the FX market has been an ongoing trend for several years. In 2001, the UK accounted for 31.8% of the global trading volume. By 2007, this figure had risen to 34.6%, and by 2010 it had gained further to hit 36.8%. This is part of a wider trend of forex trading being increasingly concentrated in the biggest financial centres. In April 2010, sales desks in the UK, the US, Singapore, Japan, and Hong Kong handled 71% of all foreign exchange transactions. By April 2013, this had risen to 75%, an increase of 4%.

Yen and Aussie Increase Their Share at Expense of European Currencies

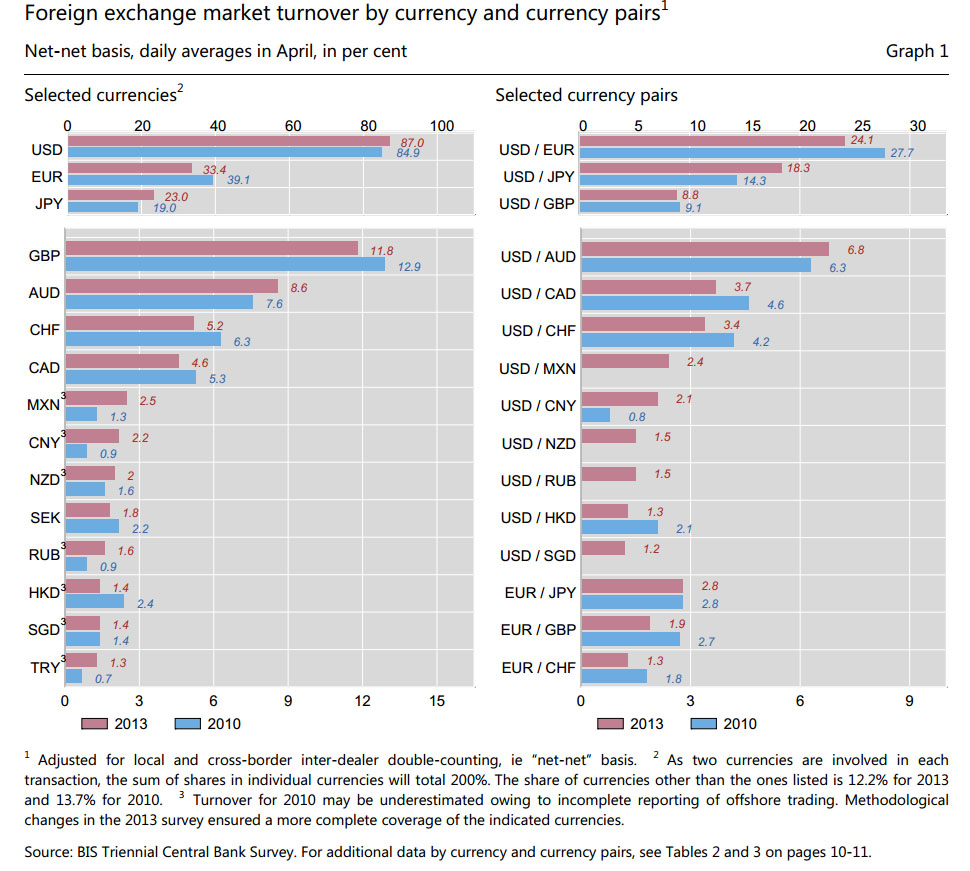

The US dollar remains the dominant foreign exchange currency, accounting for one side of 87% of all trades in April 2013, up from 84.9% in 2010. The euro remains in second place with 33.4%, falling from 39.1% in 2010, while the yen has made the biggest percentage gain, moving up from 19% in 2010 to 23% in 2013. Like the euro, the pound sterling has lost market share, slipping from 12.9% to 11.8%, while the Swiss franc has also dropped off – probably as a result of central bank intervention in 2011 – from 6.3% to 5.1%.

Of the major currency pairs, the USD/EUR remains the most traded, although its share has fallen from 27.7% to 24.1% between 2010 and 2013. Meanwhile the USD/JPY has made substantial gains, growing from 14.3% to 18.3%. The USD/GBP remains in third place, dropping from 9.1% to 8.8%, while the USD/AUD is slowly gaining ground on it in fourth place, edging up from 6.3% to 6.8%. Other big movers were the USD/CAD and the USD/CHF, which fell by 0.9% and 0.8% respectively.

Derivatives Trading Shows Increased Growth

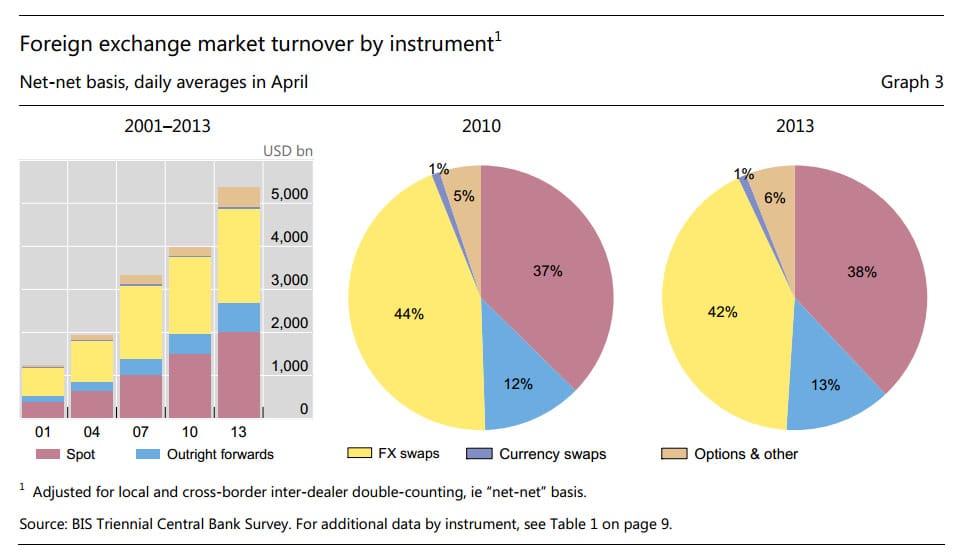

FX swaps remain the most actively traded forex instrument, with a daily volume of $2.2 trillion. This represents 42% of the global market, and while the raw figures have grown by 27%, the percentage of daily volume has shrunk by 2 percentage points from 44% in 2010. Meanwhile, Spot market trading grew to $2 trillion per day, an increase of 38%, and this contributed around 40% to the rise in the global forex trading volume between 2010 and 2013. However, the rate of this growth was down on the previous figure of 48% between 2007 and 2010.

The turnover of currency swaps also grew at a rate of 26% with a daily turnover of $54 billion, but they continue to represent a small share of the overall FX market.

Stronger growth was seen in other areas of the Forex OTC derivatives market, particularly in the case of FX options and forwards. The volume of outright forwards surged 43% from $475 billion in 2010 to $680 billion in 2013, and their share of the total trading volume edged up 1% to 13%, the highest proportion to date. The biggest increase was seen in the trading of FX options, which increased by more than 60%. Together, the rise in turnover of FX forwards and options accounted for nearly a quarter of the growth in global Forex turnover between 2010 and 2013.

On the whole, the maturities of FX swaps and outright forwards are getting slighly longer, with 56% of outright forwards having a contractual maturity of between 7 days and a year as compared with 52% in 2010. There was also a strong expansion in the turnover of FX swaps and forwards with a maturity of over one year, although these long maturities still account for a small percentage of the overall market.

Most of the trading in FX instruments, including spot transactions, is still conducted over the counter, with OTC turnover dwarfing that of standardised Forex instruments on organised exchanges.

Counterparty Market Continues to Diversify

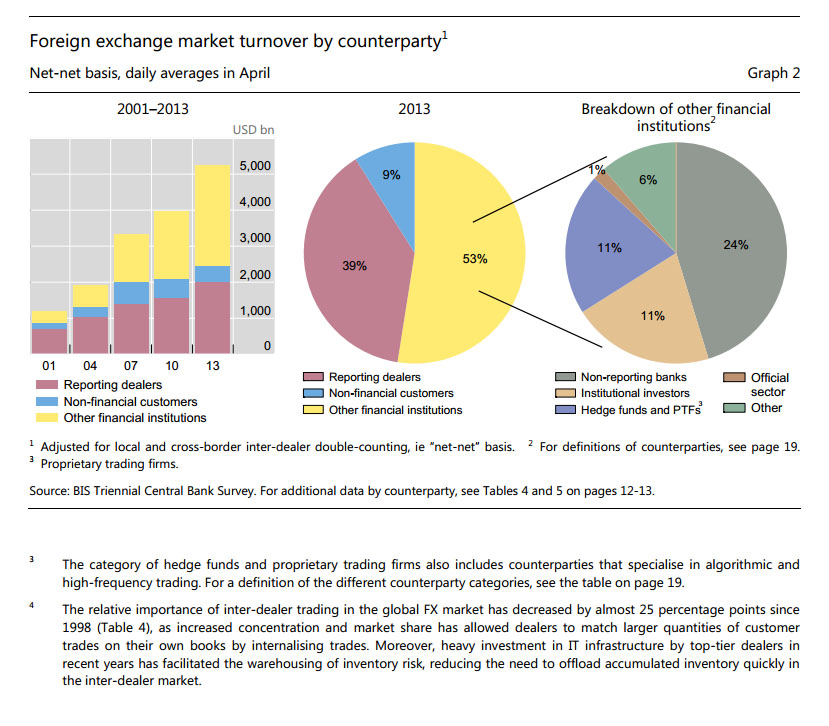

In terms of counterparties, the biggest contributors to growth in the global Forex turnover between 2010 and 2013 fell into the category of ‘other financial institutions’, including smaller banks that do not act as FX dealers, hedge funds, institutional investors, and proprietary trading firms.

This is a continuation of a trend that saw ‘other financial institutions’ overtake ‘other reporting dealers’ (trading in the inter-dealer market) as the main counterparty in the 2010 survey. Transactions of Forex dealers within this group grew from $1.9 trillion in 2010 to $2.8 trillion in 2013, an increase of 48%, with the biggest increases in activity being seen in FX options (82%), outright forwards (58%) and spot transactions (57%).

Trading with ‘other reporting dealers’ grew in step with the FX market as a whole, while market share of transactions with non-financial customers has shrunk significantly in the past three years. Inter-dealer trading was up to $2.1 trillion in 2013, an increase of 34%, although their overall share of the market has remained steady at 39%.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading