· Manufacturing and construction businesses appear to have benefited from restrictions easing, while other sectors still struggle. This is the first sign of the economic recovery of the UK economy.

· However, full economic recovery remains a long way off, as more than half a million businesses say they are at high risk of insolvency – an increase from two weeks ago.

· Anticipated recovery time also rises to 31 weeks.

The number of businesses with a positive outlook for the next 12 months exceeds the number with a negative outlook for the first time, in the clearest sign yet that parts of the UK economy are slowly springing to life, according to the latest wave of the Opinium-Cebr Business Distress Tracker.

However, despite the marginal improvements the UK is still not out of the woods. The latest Tracker suggests that more than half a million (544,000) businesses are at a high risk of entering insolvency as a result of coronavirus-related disruption – up from 510,000 two weeks ago.

These are some of the signs of recovery in the UK economy

Business insolvency risks

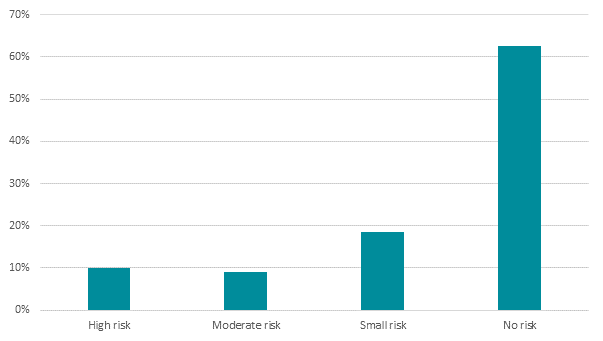

Although the share of businesses that feel they are safe from insolvency has risen from 58% to 63%, there has also been a small increase in the share that say there is a high risk of them entering insolvency as a result of coronavirus related disruption. These results suggest that while many businesses have been able to transition from a state of emergency to a state of heightened caution, more than half a million (544,000) remain in a perilous position.

2% of firms surveyed indicated that they could not survive another month if trading conditions remain as they are currently. This marks an improvement on the situation in the previous edition of the Tracker, when 5% of firms faced imminent collapse within a month if trading conditions remained as they were.

Employment impacts

The number of businesses making workplace adjustments has remained largely stable since the second wave of the Distress Tracker. Here, 84% of UK senior decision makers state that their company has made changes to their operations because of the pandemic, compared to 83% two weeks ago. More encouragingly, there has been a sizeable reduction in the average number of employees on furlough (26% down from 32%), and there is positive news in terms of working hours – businesses say that an average of 29% of employees have had their hours reduced, compared to 32% in the second wave. Finally, wages and salaries have also seen improvements, with the average number of employees facing pay cuts down to 27% from 34%.

Business activity rates

The latest business survey was conducted between May 21st and May 27th. The results therefore provide one of the first glimpses into how the partial easing of restrictions introduced at the beginning of the month have affected different parts of the economy. On 10th May, the government updated its guidance, urging those who could not work from home to go to work. This appears to have had a significant impact on the manufacturing and construction sectors. Although profits over the past 30 days remain 28% below what would have been expected during more normal times, this is an improvement compared to the 35% shortfall in profits recorded two weeks prior to the latest survey.

Economic recovery

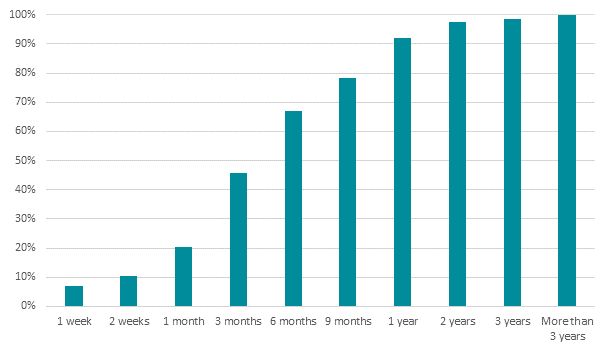

The results of the latest Tracker reinforce the message that the longer the lockdown lasts, the longer it will take for most businesses to rebuild once restrictions are eventually lifted. On average, businesses anticipate needing 31 weeks to return to their pre-crisis levels of production – up from 25 weeks four weeks ago. For the first time, the Tracker also examines the specific factors that will be driving this delay in the economic recovery. 56% of those expecting their recovery to take longer than a month cite concerns about demand for their products or services once restrictions are lifted, while 51% state that difficulties obtaining inputs from suppliers will limit their ability to bounce back. 52% indicate that a weakening of customer relationships will slow down their recovery, while more than two-fifths (43%) are concerned about deteriorating skills and productivity among furloughed workers.

James Endersby, CEO at Opinium said “Although the situation remains extremely challenging for many businesses, the easing of lockdown in recent weeks have led some to anticipate the end of prohibitive restrictions on their operations. We are far from being out of the woods yet, but the direction of travel has injected greater positivity into the business community. The number of us going back to work is accelerating and many are seeing the prospects for their business improve.

“The challenge facing us is the disjointed return to normal. Large numbers are facing disruption to demand from their customers and combined with issues further up the supply chain. Even once lockdown measures are removed business leaders still expect months of hard work until levels of production return to normal.

Pablo Shah, Senior Economist at Cebr said “The gradual easing of restrictions in May has helped some businesses to come out of hibernation – particularly in the manufacturing and construction sectors – while providing a more general boost to sentiment throughout the economy. Workforce measures to weather the storm – such as pay cuts and reduced hours – are being reigned in, while less than a third (29%) of businesses have a negative outlook for the next 12 months.

“The survey results suggest that many businesses have transitioned from a state of emergency to a state of heightened caution. However, the longer the lockdown lasts, the longer it will take for businesses to rebound. Among firms that anticipate needing more than a month to recover, the majority (56%) fear that financial or operational difficulties among clients or customers will affect demand for their products or services, while 51% are concerned about reduced access to necessary inputs.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading