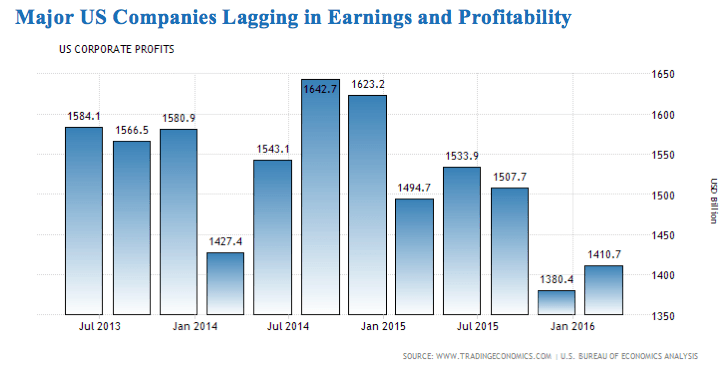

Major US Companies Lagging in Earnings and Profitability

Corporate profitability is already down 2.6% year-on-year and this marks the fourth successive quarter of declining profits in the US. This trend is part of a much broader economic downturn which has now permeated the US economy. The largest companies across America have reported another quarter of lukewarm sales and declining profitability. This is fuelled in part by lower levels of overall business investment in the US economy, weakness in the energy sector and geopolitical concerns vis-a-vis a Brexit, a potential Grexit and the upcoming US presidential election.

Major US industrial companies readying to cut costs

While the earnings reports trickling in since July have shown an improvement in Q2 2016 over Q1, prospects do not look good for the rest of the year. The political climate in the US, Europe and beyond is but one component that is causing a degree of concern for investors. The more important issue is declining industrial production. This is evidenced by reports from Caterpillar that its yearly profitability forecast has been slashed. The US construction machinery company is now cautioning that slow worldwide growth will invariably lead to layoffs. Additionally, another industrial giant, Praxair Incorporated is also looking to slash costs owing to the US manufacturing slowdown. Typically, when companies make announcements of cost-cutting, they are referring to job losses, closures of business units, or scaling down of operations.

Businesses across America, and globally, are cutting their capital expenditure and investment across the board. There is dramatically reduced demand from the oil industry, and this means that there is an excess supply of available equipment on the market. In the industrial sector, this is a problem for the US economy. An estimated 67% of companies listed on the S&P 500 index will be reporting their financial results. Earnings are expected to fall for the fourth successive quarter in a row, retreating 2.6% year-on-year. This data was provided by Thomson Reuters. In the revenue department, consensus estimates indicate that a quarterly decline of 0.4% will likely be recorded.

Weakness in Energy Markets Plaguing the Industry

Profitability is expected to grow by approximately 5% in utilities, healthcare and consumer discretionary sectors. While energy companies will see declines of up to 87%, Telecom will see 1.4% shaved off and financial firms are likely to see 3.6% lower revenues. The pain is widespread with energy companies. These corporations have been languishing with weak earnings for the better part of a year. When oil prices tanked in the middle of 2014 from well over $115 per barrel to just $27 per barrel in 2016, this devastated the industry. Declines in profitability may have slowed somewhat as oil gradually clawed its way up to the $40-$45 per barrel range (Brent crude oil in WTI crude oil), but an oversupply is now in effect. Regardless, commodities brokers are expecting Q3 and Q4 earnings reports for energy companies to improve as evidence of stabilisation in oil markets takes root. Q2 earnings will likely increase by 1.8%, while revenues will increase by 2.6%.

The profit crunch is going to affect the following sectors adversely (year-on-year) in Q2:

- Energy – -86.6%

- Materials – -6.4%

- Financials – -3.6%

- S&P 500 Index – -2.6%

- Telecommunications – -1.4%

- Consumer Staples – -0.1%

The following sectors are going to see increases in profitability in Q2 (year-on-year):

- Consumer Discretionary Spending – +11.7%

- Healthcare – +7.1%

- Utilities – +5.5%

- Industrials – +2.8%

- Technology – +0.2%

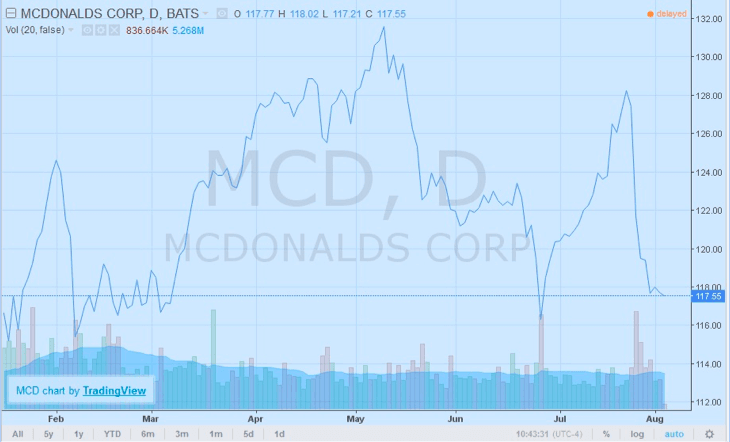

For example, McDonald’s Corporation (NYSE: MCD) attributed much of the weakness in quarterly earnings to the economic uncertainty that abounds. The CEO also commented on the costs gap between grocery shopping and eating at restaurants, while the company’s sales increased by 1.8%, beneath the consensus forecast of 3.2%. With caution the order of the day, discretionary spending is being severely tested at this time.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading