Do you want to know why long-term investors are not panicking despite the high volatility of digital currencies? Expert analysis and predictions helps you to trade responsibly, minimising the risk and maximizing the gains.

BITCOIN (BTC)

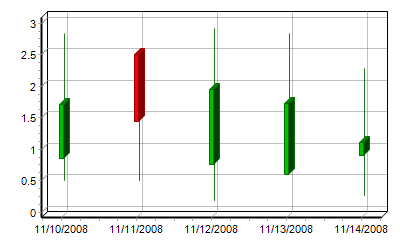

Bitcoin price showed a resurgence of buying pressure as the eastern markets opened at the beginning of last week. It faced rejection at the four-hour supply zone, extending from $23,932 to $24,722. It closed on Tuesday by retesting the midpoint of the 42% crash at $24,655. Investors expected Bitcoin price to sweep the $24,655 level again, triggering a sell signal.

On Wednesday, August 19, Bitcoin price tried to undo the gains it witnessed over the last 7 days. This sell-off has caused Ethereum and Ripple prices to follow suit, pausing the rallies that altcoins were experiencing. Moreover, bitcoin price crashed 7.5% over the last 24 hours as it retested the 200-week Simple Moving Average (SMA) at $22,877. A breakdown of this level and the 30-day Exponential Moving Average (EMA) at $22,737 signaled the start of the second leg down.

On Thursday, August 11, 2022, Bitcoin price auctioned at 23,905. There was a clear bearish divergence on the daily chart, prompting the sellers to aim for lower targets consistently. Still, the liquidity levels at $24,800 and $26,950 were not breached.

As of Friday, BTC price traded at $24,182 as the intraday traders took advantage of the profit-taking consolidation near the $24,600 level. Despite the sudden decline in prices, the peer-to-peer cryptocurrency still looked very bullish.

At the start of the weekend, Bitcoin price auctioned at $24,051. Bulls should consider moving forward with caution as the BTC price action trades near the edge of an ascending wedge. The peer-to-peer digital currency has consistently performed in staggered upward motion in recent weeks. Although profits have been made and intended targets have been reached, the uptrend has not been easily accomplished.

ETHEREUM (ETH)

At the start of the week, Ethereum price tried a comeback as it retested the $1,730 resistance level, which coincided with the 100-day EMA. Ethereum price displayed applause-worthy strength in the last few weeks. Ethereum price validated the early bullish claims as it made its furs contact with the $1800 barrier on Monday August 8, 2022. Ethereum price exchanged hands at $1712 as profit taking near the anticipated target zone unfolds.

Ethereum price took a cue from Bitcoin price and crashed 9.4% within 24 hours on Wednesday. This development paused as BTC hovered above the 30-day EMA and the 200-week SMA. Ethereum price rallies as intended

Ethereum price showed its first smart money fake-out during August. Previous forecasts have continuously mentioned the likeliness of such a move as magnet-like liquidity levels lie within the $1,850 and $1,900 zone. Ethereum price breached through the $1,700 zone overnight, causing bears to advance with optimism. On August 8, 2022, the bears’ hopes were fully invalidated as a strong candle vengefully pierced through $1,700 and has since ascended the Ethereum price to $1,853.

Ethereum price traded at $1,835 on Wednesday, August 10, 2022. Ethereum showed strong confluence at the $1,900 level and continued to display strength towards the $2,200 zone. Ethereum price continued to ascend on Friday. Ethereum price consolidated at $1,900.

RIPPLE (XRP)

At the beginning of the week, XRP price showed potential to rally toward the 100-day EMA at $0.421 as investors prepared for an explosive 12% move. XRP price was grappling with a significant resistance barrier after months of trying to flip it. XRP price used the $0.381 level as a foothold between May 13 and June 10. After a breakdown on June 11, the altcoin has been trying to reclaim it but the four attempts so far have failed to yield any results on August 8, 2022.

XRP price was trying to patch its leaks after the fourth rejection at the $0.381 resistance level on Wednesday, August 10, 2022. This move was to push XRP price to the $0.340 support level. Ripple’s XRP price breached an ascending parallel channel for the fourth time.

XRP price traded at $0.37 on Wednesday. Ripple has witnessed a 25% rally since the July 27 sell-off. The digital remittance token has been the underperformer in comparison to its Bitcoin and Ethereum counterparts. Still, the technicals suggest a second 25% rally could occur as a bullish engulfing candle has successfully pierced and closed above a descending trend channel.

Ripple price should remain on traders’ watchlist as the remittance token could become very volatile in the coming days. A second attempt at $0.41 should be the catalyst to induce a 25% rally targeting $0.47. Invalidation of the uptrend thesis is dependent on $0.325 holding as support.

XRP price auctioned at $0.37 on Friday as the technicals were on their way to establishing a classical sellers’ pattern on the daily chart. XRP price was two hours from printing a bearish evening star at the close of the day.

At the end of the week, Ripple (XRP) price was not enjoying their reclaiming of the $0.36 hurdle for long. With pressures mounting, more bearish signals were emerging, firstly pointing to the end of the summer rally and secondly possibly seeing a breakout soon that could fall in favor of the bears. With these elements, XRP price stands to lose 52% and erase the whole incurred gains from this summer.

Ripple price has been struggling since last week as it had to cut short its winning streak of consecutive weekly gains. XRP price could be at risk of losing interest from bulls, for example, Ethereum price action has a much clearer and supported rally to trade on. XPR price will probably see bulls being pushed against and below the 55-day Simple Moving Average next week and the pivotal support at $0.36. Certainly, should the dollar strength return from its summer recess, expect to see even a falling knife towards $0.1730 as the low of 2022 will be tested as thin liquidity in the summer months magnifies certain moves.

CARDANO (ADA)

Cardano price auctioned at $0.53 as the coiling price action continues to subside last week. Cardano price had a setback after briefly touching $0.55 on Monday when it faded following disappointing Coinbase earnings. Although this looked like a cold shower, it held a golden opportunity to buy into ADA price action as it was underpinned by a double technical belt. There was a chance price action would bounce off one of these levels and skyrocket towards $0.70, returning a 30% increase to portfolios.

Cardano price got caught in the crosshairs of disappointing Coinbase earnings that were the result of the crypto winter hanging over the asset class for most of 2022 thus far. Cardano price attempted and failed to overcome a crucial resistance level thrice over the last month.

Cardano price formed a range, extending from $0.380 to $0.609, between May 12 and 13. Since then, ADA has spent a lot of time in the lower half region of the said range. Although the recent recovery above the midpoint at $0.494 showed promise, the bulls have been unable to move through the $0.550 hurdle even after multiple attempts in the last three weeks.

At the end of the week, Cardano (ADA) price looked heavy and could drop like a stone this new week as a few indicators signal warning lights. To make matters worse, the global sentiment is shifting back towards the same rhetoric it had at the beginning of the summer. The summer rally looks to end with several elements and tail risks coming back from a break.

ADA price could devalue by 80% in a worst-case scenario. ADA price is at risk of a collapse as it could set back its price action to square one for 2022 or even at new lows. ADA price, first of all, has been underpinned these past two weeks at $0.485, right below the monthly pivot held for a second week in a row for August. Thus far, the good news begins when the bad news begins, as no real bullish signals can be perceived from the weekly chart. Bulls were unable to make a convincing new high for August, while for two months, July still holds the record as the small trading range between highs and lows points to a breakout soon, which could fall in favor of the bears and see a drop towards $0.415 in a first phase, followed by a falling knife towards $0.075.

SOLANA (SOL)

Solana price has been producing higher lows since its bottom at $25.71 on June 15. Since this local bottom, SOL has produced four higher highs as it rallied 84% at one point. SOL traded at $39 on Monday, August 8, 2022. There were liquidity pools of uncollected stop-loss present below $31.66, and the swing lows formed around $26 during the bottom formation in June 2022.

On Wednesday, Solana price showed a slow takeover of the bears after bulls managed to move the asset higher. Due to Bitcoin’s sudden sell-off, altcoins, including SOL, took a major hit. Solana price produced higher lows and lower highs, indicating a massive squeeze for SOL. However, the recent attempt to move higher set a lower high at $43.77 on August 8. On Wednesday, August 10, 2022, the altcoin traded between the $44.37 and $38.22 barriers.

Solana (SOL) price action closed out the week with a mere 7% gain. Overall it has been a good trading week from a fundamental perspective and technicals in a supporting role, after the orange ascending trend line saved the day again, and showed that price action is satisfactorily underpinned.

Solana’s (SOL) price, from a first glance at the sheet, looked bullish and set forth to continue its rally and winning streak this week. However, a closer look under the hood reveals that on a weekly chart, price action is going nowhere and could soon collapse once a tail risk gets inflated again. With the end of the summer at hand, the volume starts to pick up again, and this rally could as easily start to fade out as it did in July.

Although looking bullish, SOL price could give a false sense of security and be caught by a bearish surprise. Keep a close eye on that 55-day SMA, as that is key from now on. Once that level gives, expect to see first the monthly S1 supporting around $33.63 before turning into a falling knife towards $19 and standing to lose 55%.

An upside surprise would come from some more positive catalysts next week with a few economic data points that could revamp the drop in US inflation and continue to confirm that households are starting to have more disposable income. A quick lift in price action would happen towards $50, just above the monthly R1 for next week, and then by the end of August, $61.44 should be tested or even broken to the upside.

TETHER (USDT)

The price of Tether has risen by 0.00% in the past 7 days. The price declined by 0.02% in the last 24 hours. In just the past hour, the price shrunk by 0.00%. The current price is $1.00023 per USDT. Tether is 18.01% below the all-time high of $1.22.

BINANCE USD (BUSD)

Binance USD’s price has risen by 0.05% over the last 7 days. In the last 24 hours, the price declined by 0.15%. Just one hour ago, the price declined by 0.05%. Currently, the price of BUSD is $0.9995. $1.11 is the all-time high for Binance USD, but the price is 9.95% below it.

USD COIN (USDC)

Since the beginning of the week, the USD Coin price has risen by 0.00%. Within the last 24 hours, the price increased by 0.01%. In the past hour, the price has gone up by 0.01%. USDC is currently priced at $1.00. It is at its highest price ever.

DOGECOIN (DOGE)

Over the past 7 days, Dogecoin has gained 6.86% in price. During the last 24 hours, the price of the cryptocurrency has dropped by 4.51%. The price increased by 0.26% just in the past hour. As of right now, the price of DOGE is $0.07593. 89.74% of Dogecoin’s all-time high has been reached.

Digital Asset Insights

Digital Asset Insights #79

appeared first on JP Fund Services.