As 2020 dawned, things weren’t looking great for the AUD. Yes, the housing downturn appeared to have run its course. However, China’s ongoing slowdown appeared to be making any potential recovery a modest one.

Those were quaint times, weren’t they?

In March, these concerns became secondary as Coronavirus, or COVID-19 spread to every corner of the planet. With travel and non-essential work shut down worldwide and with trade slowing to a standstill, a severe recession or depression appears likely.

What does this mean for the Australian dollar in 2020? We’ll address the factors influencing its trajectory (pre and post-COVID-19) in the months ahead.

Housing Is No Longer The Major Concern

At this time last year, investors were wringing their hands over the fall of the Australian housing market. After decades of uninterrupted gains, the property bubble had finally popped.

As of June 2019, housing prices had fallen by 8.2% peak-to-trough – the steepest descent in Australian history. It was the aftermath of years of lending to borrowers who could barely afford the loans they were taking on. Read more here about investing in index funds in Australia.

What was the catalyst for the drop? Analysts believe reports coming out of the 2017 Royal Commission led the Australian government to implement a stress test for mortgages. During proceedings, the Australian Prudential Regulation Authority, or ARPA, took the Big Four to task over their lax lending practices.

This revelation led to increases in lending rates, even as the Reserve Bank of Australia’s rate remained at record lows. In late 2017, reports stated that a million Australian households could experience mortgage stress with even a 0.15% increase. When the banks jacked their rates, the Australian property bubble finally popped.

Untold thousands of Australians, who were already struggling with rising unemployment and stagnant wages, were forced to sell. Others defaulted on their loans, leading to foreclosure. Two years on, both have led to the price decline mentioned above.

At the end of 2019, though, pundits were predicting an end to the slide. 2020 would see the start of a gradual recovery, they said. As 2020 dawned, that seemed less likely, as the entire country burned. And then, COVID-19 hit.

Australia’s and China’s Fates Are Inextricably Linked

Before we talk about the Coronavirus, though, it’s essential to understand the root causes of Australia’s pre-COVID-19 problems.

In a word, they stem from this country’s overwhelming dependence on a single export market – China. Ever since Deng Xiaoping opened up China to the outside world in the 1980s, it has craved raw materials. Iron ore was a particular need – and, conveniently enough, Australia had ample supplies of this mineral.

According to the government of Western Australia, 82% of iron ore exports went to China in 2016-2017. LNG, or liquefied natural gas, is another area of interdependence. 40% of Australian LNG production went to China last year, whilst 40% of Chinese LNG imports came from Australia.

This profitable relationship is a big reason why Australia has managed to avoid recessions over the past 30 years. Even during the Global Financial Crisis, Australia eked out several years of modest growth, fuelled by Chinese stimulus programs.

That’s why the slowing of Chinese growth over the past decade has been cause for concern. At the peak of Chinese stimulus spending in 2010, the economy advanced more than 12% YoY. By 2019, after years of steady decline, China only logged GDP growth of 6%.

That number would be prodigious by Western standards. However, in China’s case, it’s the latest sign they are transitioning to a mature, service-based economy. Less growth means less need for raw materials. And, when you base colossal chunks of your economy on the fortunes of a single nation, that spells trouble.

The Impact Of Coronavirus On The AUD

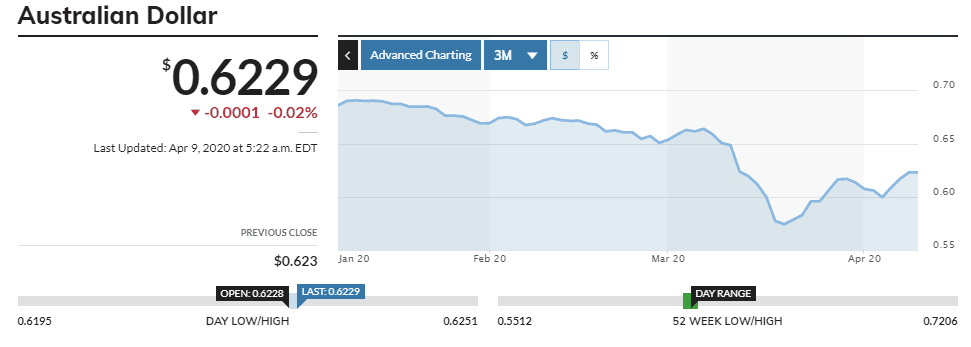

A floundering housing market and steadily-reducing sales from your biggest customer are, at best, a recipe for economic stagnation. In 2011, AUD/USD was worth 1.10317. In 2015, it had declined to 0.78772. And, by January 2020, the rate sunk to a low of 0.69835.

And then, COVID-19 strode onto the scene. Within days, global recession fears and investor flight to the “safety” of USD caused AUD/USD to plunge to 0.55303. Although this rate has recovered in recent days, foreign exchange in Australia continues to suffer significant volatility.

Upcoming economic reports and government stimulus efforts will do much to influence the direction of the AUD in the coming months. However, no factor will have as much influence than what China decides to do to manage the COVID-19 fallout.

China’s Recovery Will Impact The AUD’s Performance

Even as it emerges from the first wave of Coronavirus, Western governments are attacking China for their response, which was, at first, slow. It is likely this infection emerged from a wet market in Wuhan, which were supposedly illegal under Chinese law.

And, whilst, at first, the central government appeared to be more concerned with saving face, they eventually contained the outbreak in their country. As of April 2020, new case growth is now in the dozens, not in the thousands, with most new cases arriving from abroad.

Already, authorities are relaxing transport restrictions. Workers are heading back to their factories. Whilst a second wave is inevitable, it’s impossible to deny a fundamental truth – the worst appears to be over there.

The ability of China to manage its infection curve will be critical to the AUD’s fortunes in 2H 2020. If they can keep it flat by tracking new infections and isolating the exposed, they may be able to avoid a second round of mass lockdowns. However, if they fail to apply lessons learned, a second plunge in the AUD could occur later this year.

Apart from that, improvements in the AUD also hinge on how the Australian government responds to COVID-19. At first, Prime Minister Scott Morrison downplayed the virus. As late as the end of February, he said that Australians could still go to football and cricket matches without fear.

Of course, the events of the past month have awoken most politicians to the reality of this pandemic. As of the writing of this blog, state governments have passed social distancing laws, and they have sealed internal borders.

They’ve yet to go for a full lockdown as their Kiwi neighbours have. If it stems the rise of cases, though, it may be a measure worth considering. Flouting authority has long been an aspect of Australian culture. Knowing this, an iron-fisted approach may be the medicine that gets the country back to normal sooner rather than later.

Buckle Up – It’s Going To Be A Bumpy Ride

The world – never mind Australia – has not seen a crisis like this in over a century. After a vicious World War, the Spanish Flu brought the planet to its knees. At the moment, the AUD is in a weak spot, as are many other resource currencies. The next year will see a continuation of economic weakness, uncertainty, and fear.

But sometime within the next 12-18 months, researchers will find a vaccine. When they do, we expect the AUD to find a path towards sustained growth.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading