- Palantir is witnessing massive success with its new AI software platform, which has helped fuel revenue and profits.

- For five consecutive quarters, the company has recorded profits, and its balance sheet closed 2023 showing $3.7 billion in cash and equivalents, with no outstanding debt.

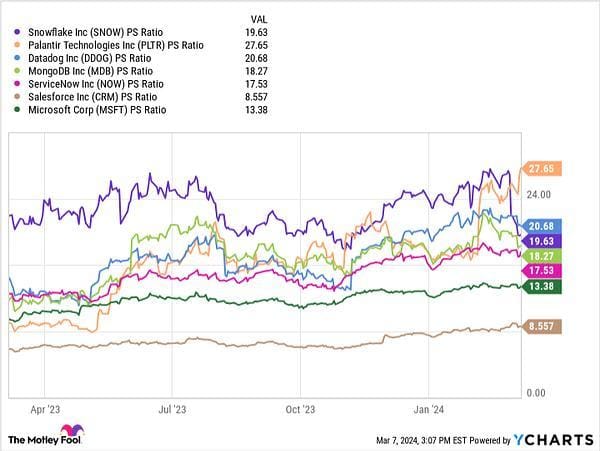

- At a price-to-sales of around 28, Palantir is the highest-valued company in this cohort based on this metric.

As the global market for artificial intelligence (AI) continues to evolve, savvy investors are closely monitoring the competitive dynamics within the sector to pinpoint where it is best to invest. In a recent analysis of the AI landscape one clear winner is emerging, Palantir Technologies (NYSE: PLTR), outpacing competitors with its innovative approach and impressive financial performance.

While well-known tech companies such as Microsoft, Alphabet, Amazon, and Nvidia have been investing billions in AI technologies, Palantir has differentiated itself with its strategic focus and rapid expansion in the data analytics space.

Palantir’s success can be attributed in part to its product, the Palantir Artificial Intelligence Platform (AIP). Since its commercial launch in April 2023, AIP continues to gain significant traction, with nearly 850 demo pilots conducted within a year. Additionally, Palantir’s customer base saw a remarkable 35% year-over-year growth, signalling strong market demand for its AI solutions.

Chelsea Alves, a consultant with UNMiss, states, “In the SaaS business realm, Palantir Technologies’ keeps hitting the mark on key metrics that determine success, such as its net revenue retention and price-to-sales ratio. Its consistent profitability and robust financial position underscore its resilience and strategic foresight in navigating the dynamic landscape of artificial intelligence. With a solid balance sheet and a clear focus on innovation, Palantir is positioned to capitalize on emerging opportunities in the AI market, solidifying its position as a leader in the industry.”

In contrast, Snowflake Inc. (NYSE: SNOW), once regarded as a trailblazer in data warehousing services, faces continual challenges in maintaining its growth momentum. Despite its impressive initial public offering and renowned investor backing, Snowflake’s revenue growth has decelerated, coupled with declining net revenue retention (NRR) over eight consecutive quarters.

Snowflake’s recent acquisition of Neeva, a startup specialising in generative AI applications, has also failed to instil confidence in its AI strategy. The departure of its CEO adds fuel to the fire as to the declining projected future of Snowflake, raising concerns about its competitive positioning in the AI landscape.

As investors evaluate opportunities in the AI space, Palantir Technologies is quickly becoming a strong frontrunner, backed by its robust financial performance, innovative product offerings, and strategic vision. With Palantir’s stock valuation reflecting its premium status in the market, investors should consider building or augmenting their positions in Palantir Technologies, leveraging dollar-cost averaging to capitalize on its long-term growth potential.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading