US stocks plunged on Wednesday, while oil prices crashed to new 11-year lows as disappointing Chinese economic data unleashed waves of volatility in the global financial markets.

The Dow Jones Industrial Average fell around 250 points after the opening bell on Wednesday. The benchmark gauge was trading below 17,000, with 29 of its 30 blue-chips reporting losses.

The S&P 500 Index also fell 0.9%, as all ten of its major sectors reported declines. Energy stocks led the markets lower, plunging more than 3%. Materials stocks were also down more than 2%.

The technology-heavy Nasdaq Composite Index was also down 0.9% after the opening bell.

US stocks have experienced sharp volatility so far this year. The VIX Volatility Index, also known as the “investor fear gauge,” has spiked more than 14% over the past three days and is trending near the historical average.

Markets were already lower in Asia and Europe on Wednesday after a fresh batch of Chinese PMI data pointed to further weakness in the world’s second-largest economy. The Caixin China services PMI – a closely followed indicator of service activity – fell to 50.2 in December, a new 17-month low. Earlier in the week Caixin said China’s manufacturing sector contracted in December for the tenth consecutive month. Weak manufacturing data prompted Beijing to guide its national currency lower, which triggered a rout in global stocks. This rout included a nearly 7% drop in the Shanghai Composite Index.

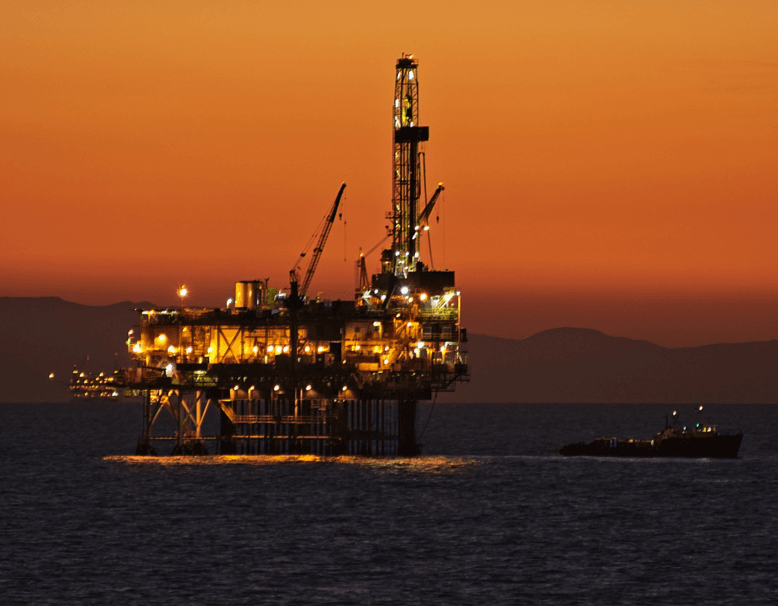

Weak Chinese data also guided oil prices to fresh 11-year lows on Wednesday. North Sea Brent crude fell $1.06 or nearly 3% to $35.36 a barrel on ICE Futures Europe. The West Texas Intermediate (WTI) benchmark for US crude also fell 84 cents or 2.3% to $35.13 a barrel.

Global volatility pushed investors into the safety of gold on Wednesday. The yellow metal climbed $9.80 or 0.9% to $1,088.20 an ounce, its highest level since early November. The gain also marked the fourth consecutive advance for gold.

Firmer gold prices kept the US dollar subdued after seven consecutive daily advances. The dollar index, a weighted average of the US currency against a basket of six rivals, was little changed at 99.34. The index moved higher earlier in the session after payrolls processor ADP said US private employers added 257,000 jobs last month, the strongest gain since December 2014. The report comes just two days before the Labor Department releases official nonfarm payrolls data for December.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading