The interesting thing about the cryptocurrency market? The top 5 most effective trading strategies in the forex and stock market also applies to the cryptocurrency world.

This makes the cryptocurrency trading market better for trading, since it is open 24/7, whereas the traditional stock market is only open for a window of time. The future of cryptocurrency, and for trading in general, is all about simplicity, and the best trading strategies encapsulate that.

Find the right Broker

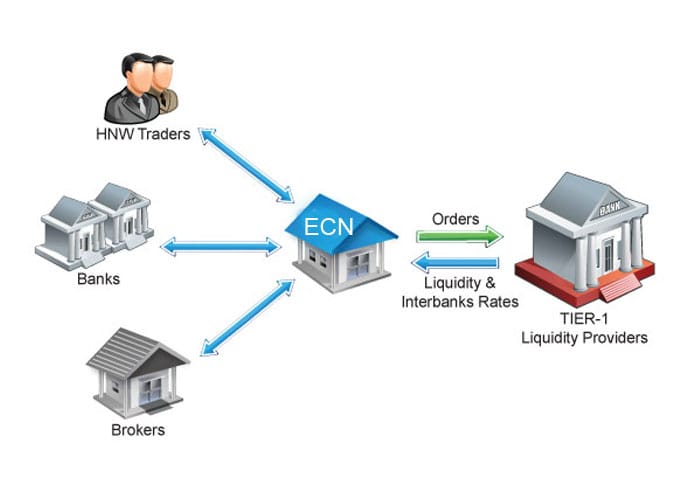

Before you can begin trading cryptocurrrencies, you have to make sure that you have the right broker. These can be few and far between as a number of brokers are less than reputable.

You have to find a broker that is fully regulated, has the assets that you want to trade and had an effective platform. One broker that you can try is IQ Option. You can read more about them in this IQ options cryptocurrency review.

You can test out the platform without having to fund. This will allow you to make sure that it is indeed the right product for you and whether you want to actually trade on it. You can avail safe trading bots for KuCoin which is designed to automate cryptocurrency trading. Once you are complete then you create a live account and start trading.

A Caveat First: Safety, Emotion and Risk:Reward Ratio.

The first thing to query about when looking for the top cryptocurrency broker is how safe the websites and the servers are. No matter how good your strategy is, without a reliable broker, you will still lose.

Emotional strength is also needed. Trading strategies ensure consistent results over time by preventing financial biases caused by behavior of the trader. The last thing one needs is a trade made based on their emotional behavior, which will mess up some and sometimes all of the account, be it profit or capital.

Range Strategy

For the breakout strategy, a 1:2 risk to reward ratio is an excellent framework for beginners. The strategy follows as such:

- Find a cryptocurrency that is in a range (meaning the cryptocurrency does not go lower than then short-term lows and not higher than short-term high)

- Set 1% of a stop below the short-term low, preferably with the price hitting the short-term low. This is the stop loss.

- Set 2% of buying price above the entry, for the take profit level.

- Buy the position when it hits the short-term low.

Works well when the market is ranging.

Though when the market is showing strong trends, this strategy mostly tends not to work too well, and can even incur a lot of losses.

Break strategy

For this strategy, you can just have a moving stop loss, which means you let your winners run and you just cut losess.

- Find a cryptocurrency that has a small range.

- Place a stop buy a few pips or satoshis above the short-term high.

- Place a stop loss at a few pips or satoshis below the short-term low.

- Enter a trade.

Pullback strategy

This works well with a set ratio like 1:2. Trending cryptocurrencies will give you profits but ranging ones may incur losses for you.

- Find a cryptocurrency that is trending up.

- Enter a trade if the price hits or touches the short-term low.

- Put a 1% stop loss from the nearest low.

- Put a 2% take profit above the nearest high.

Moving momentum strategy

This strategy is like the previous one where it works extremely well if the cryptocurrency is trending up or down. The difference is that you don’t put a take profit price or level, and just let the trade run if it is profitable.

- Find a cryptocurrency that is trending up.

- Enter a trade if the price hits or touches the short-term low.

- Put a 1% stop loss from the nearest low.

- Once you are profitable, move the stop loss from a 1% loss to break even to 1% profit for every 2% increase in price.

Bollinger band strategy

This requires the Bollinger band technical tool at default settings. This tool gives you visual representation of what may be the place where a price may bounce. This works in a ranging cryptocurrency.

- Use the Bollinger band.

- Buy if the cryptocurrency hits the lowest Bollinger band or sell if it hits the highest Bollinger band.

- Place a 1% stop profit and 2% take profit.

Always set a clear goal each time before sitting down to trade and walk away once the goal is clear. Same goes for the losses. Walk away and come back tomorrow. There can always be opportunities in the future once again.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading