1.6 Million Salvadorans Now Using Bitcoin Chivo Wallet

The president of El Salvador, Nayib Bukele, tweeted that the adoption of the nation’s recently launched Bitcoin app, Chivo Wallet, has come to over 1.6 million Salvadorans, who now are using the app and have access to BTC. This is quite a feat considering Bitcoin only became legal tender in the country on September 7, 2021. Prior to adopting a Bitcoin standard, seventy percent of the population in El Salvador was unbanked — but now Bitcoin is banking the unbanked and those who have installed the app now have access to a savings account via Bitcoin. Since the population of the small country is about six and a half million, this means that almost twenty-five percent of the population in El Salvador now has savings. Despite the FUD which the mainstream media has thrown at both Bitcoin and El Salvador this past month, the country is poised to take advantage of all the benefits of operating on a Bitcoin standard. President Bukele has stood his ground against the IMF and the World Bank in his decision to make Bitcoin legal tender, and in doing so, El Salvador is setting a great example for other countries to follow in adopting Bitcoin. Surely, its citizens are going to benefit both in the short and long term.

Coinbase cancels lending product due to SEC threat

It seems that, unfortunately, Coinbase has wilted under SEC pressure. The Brian Armstrong-led crypto exchange, Coinbase, has now abandoned its proposed plans to launch a crypto lending product, since the United Securities and Exchange Commission (SEC) has argued it would be a violation of its securities law. Early last week, Coinbase announced in an updated blog post that it would no longer launch the USDC APY program, and it has discontinued the waitlist. The post read: “As we continue our work to seek regulatory clarity for the crypto industry as a whole, we’ve made the difficult decision not to launch the USDC APY program.” It went on to read, “We have also discontinued the waitlist for this program as we turn our work to what comes next. We had hundreds of thousands of customers from across the country sign up and we want to thank you all for your interest. We will not stop looking for ways to bring innovative, trusted programs and products to our customers.”

Back in June, Coinbase had proposed the Lend product which would have seen its users earn up to four percent interest on selected crypto assets. However, the exchange then revealed that it had received threats of a lawsuit from financial regulators if it continued with its plan. Armstrong had earlier highlighted how the Gary Gensler-led commission had acted quite “shady” and had refused to provide responses to why it considered the product to be a security. According to Armstrong, “They refuse to tell us why they think it’s a security, and instead subpoena a bunch of records from us (we comply), demand testimony from our employees (we comply), and then tell us they will be suing us if we proceed to launch, with zero explanation as to why.” As of early last week, the SEC had yet to release an official statement defending itself against the allegations levied by Coinbase.

SEC chair Gary Gensler says stablecoins are like ‘casino chips’

On Tuesday of last week, in his latest remarks about cryptocurrencies, the United States Securities and Exchange Commission chairman, Gary Gensler, went ahead and compared Stablecoins to instruments used for gambling purposes at casinos. Interviewed by David Ignatius, a columnist with Washington Post, Gensler said several cryptocurrency projects fall under securities that SEC oversees, while the rest are better suited for enforcement by the Commodity Futures Trading Commission. He described the authority of both agencies as robust, but noted that their coverage was inadequate, especially for Stablecoins, which could have the traits of investment contracts. Gensler actually said, “Stablecoins are almost acting like poker chips at the casino right now. We’ve got a lot of casinos here in the Wild West, and the poker chip is these Stablecoins at the casino gaming tables.”

Perhaps wanting more power than ever before, according to Gensler, both the SEC and the CFTC would benefit from the U.S. Congress in terms of regulation and enforcement for Stablecoins. He noted that current laws are seemingly too broad to handle a modern financial instrument like crypto. “I do really fear that we’ll keep bringing these enforcement cases, but there’s going to be a problem. There’s going to be a problem on lending platforms, on trading platforms. Frankly, when that happens, I think a lot of people are going to get hurt.” Gensler had hoped to introduce crypto-related policy changes that would cover token offerings, decentralized finance, Stablecoins, custody, exchange-traded funds, and lending platforms back in August.

Burger King Launches ‘Keep It Real Meals’ NFT Campaign With Digital Collectibles Market Sweet

On Tuesday of last week, the fast-food restaurant chain Burger King announced that they have launched a non-fungible token (NFT) campaign called the “Keep It Real Meals” initiative. The NFT marketplace Sweet revealed a partnership with the burger giant, and the new campaign is quite different from other NFT concepts. This initiative will showcase QR codes tethered to close to six million meal boxes and scanning the QR codes will unlock a digital collectible. Burger King’s announcement stated, “collecting them can lead to unlocking bonus NFTs.” The campaign will feature three celebrities including the Brazilian singer Anitta, American social media personality LILHUDDY, and the American rapper, singer-songwriter, and entrepreneur, Nelly. Some of the unlockable bonuses will include such rewards as having a phone call with one of the campaign celebrities. The BK announcement read, “Guests can choose from three Keep It Real Meal boxes curated by Nelly, Anitta, and LILHUDDY, available at participating U.S. Burger King restaurants, while supplies last. When guests scan an artist’s Real Meal box QR code, they are awarded one of three variations on one of three collectible NFT game pieces. Guests complete the artist’s set when they’ve collected the same variation of each collectible NFT game piece.”

Burger King is one of many well-known brand names that has delved into the non-fungible token (NFT) industry and cryptocurrency products in general, joining brands like Oscar Mayer, Snickers, Arizona Iced Tea, Milky Way, and Axe Body Spray. Other big names have been dipping their feet into the blockchain conversation, experimenting with different ideas. The BK promotional announcement went on to say, “Once a set is complete, guests will be programmatically granted a 4th reward-based NFT, which awards prizes ranging from 3d BK digital collectibles, whopper sandwiches for a year, autographed swag, or even the aforementioned call with one of the artists.

Robinhood Is Testing Bitcoin and Crypto Withdrawal Feature And New Digital Wallet

Last Wednesday, Robinhood announced on its blog that it will finally begin testing crypto withdrawals, as well as a new digital hot wallet. They also opened a waitlist where users can sign-up to test out the upcoming wallets. These updates come after a year of broad criticism of Robinhood due to, among other things, their platform not allowing users to control their own Bitcoin private keys. The firm had repeatedly hinted at enabling such features, without ever delivering any evidence that such products were being developed. It remained unclear whether Bitcoin will be one of the “supported cryptocurrencies” the platform will begin to enable for deposits and withdrawals. Dogecoin would be a more likely bet, since according to Barron’s, the dog-based coin recently generated $144 million for the company. Robinhood’s announcement for their new hot wallet, along with crypto transfer features, comes after a mounting demand by customers. Bloomberg reported that evidence of such features has recently appeared in a beta version of the trading platform’s iPhone app. Although they did not provide photos or other evidence of such features, Bloomberg stated that “the software includes a hidden image portraying a waitlist page” meant for users to sign-up. The business outlet attributed the discovery of said features to software developer Steve Moser, and the waitlist page became immediately active.

Currently Robinhood only offers Bitcoin strike price exposure through their platform, with no ability to withdraw, and customers often think they hold Bitcoin, when in fact they are holding a security. This is a second layer of Bitcoin which marks its price but lacks the underlying asset. Notably, Robinhood shares jumped over two percent after the Bloomberg report. The stock has gone up over seven percent since its IPO in July. According to Bloomberg, the in-house trading of cryptocurrency made up forty-one percent of Robinhood’s net revenue during the 2nd quarter of this year. Robinhood Chief Executive Officer Vlad Tenev had previously commented on the hot wallet development. “It’s something that our teams are working on. The ability to deposit and withdraw cryptocurrencies is tricky to do with scale, and we want to make sure it’s done correctly and properly.” It remains unclear whether or not, and then to what extent, the company will be buying Bitcoin.

NFT Artist pplpleasr and Fortune donate 214 ETH for new Ethereum-powered philanthropic fund

FORTUNE magazine and digital artist pplpleasr have announced the FORTUNE Journalism PleasrFund, which is to be a decentralized donor-advised fund run entirely on the Ethereum blockchain through Endaoment. The PleasrFund will be dedicated to advancing independent investigative journalism together with programs that foster interest in proven reporting and journalistic integrity. This new fund was initially seeded by a contribution of 214.55 ETH, approximately $165,000 when the contribution was made, which represented half of the proceeds from FORTUNE and pplpleasr’s series of non-fungible tokens (NFTs). It is meant to serve the public interest by requiring further accountability and transparency through journalism, while contributing to critical thinking and appropriate debate. In an auction which ended on August 9, FORTUNE and pplpleasr sold a limited series of NFTs which were based on pplpleasr’s artwork used in FORTUNE’s digital “Crypto at a Turning Point” package, along with their print magazine cover for the August/September 2021 issue, “Crypto vs. Wall Street.” A series of 256 minted NFTs of the cover were sold for a fixed price of 1 ETH each. Also, three special-edition NFTs based on the cover were auctioned off for 23.1, 45, and 105 ETH respectively.

FORTUNE CEO Alan Murray released a statement saying, “The FORTUNE Journalism PleasrFund is a natural next step for us as one of the first mainstream outlets to cover decentralized finance and cryptocurrency, and a media company is driven by the purpose of making business better for stakeholders.” Endaoment is the first fully on-chain 501(c)(3) nonprofit organization providing more than a million and a half organizations with the infrastructure to process over one-hundred-fifty different cryptocurrencies as donations. The scope of Endaoment’s reach has helped introduce the nonprofit community to the world of crypto. The FORTUNE Journalism PleasrFund will require that all recipient organizations adhere to Endaoment’s funding policy and be U.S.-based 501(c)(3) organizations. The organizations will receive an initial disbursement of $165,000 from FORTUNE and pplpleasr, and individuals are invited to contribute to the FORTUNE Journalism PleasrFund either through cryptocurrencies or via PayPal.

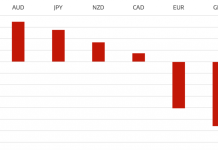

Bitcoin, Ethereum, Solana And Other Crypto Prices Further Plunge Following China’s Fresh Crypto Ban

At the end of last week, prices of all cryptocurrencies plummeted like an anchor amid China’s Central Bank’s announcement that all crypto-related transactions are illegal and must be banned in the country. Just before China’s announcement, most cryptocurrencies were in recovery mode after last’s Monday’s setback, which had wiped almost $200 million from the cryptocurrency market. On Friday morning, most cryptocurrencies had stabilized, and Bitcoin was trading at $44,985, up by two percentage points from the prior twenty-four-hour period. Ether, the second-largest cryptocurrency by market cap, surged to $3,102, and was up one and a quarter percent. Other altcoins were averaging almost two percent gains. Then on Friday afternoon, the People’s Bank of China (PBOC) released a statement saying that all private virtual currencies like Bitcoin, Ethereum, and other altcoins do not enjoy the same legal status as legal tender, and that were not legally repayable, therefore should not be traded. This FUD triggered further crypto market downturn which saw Bitcoin dropping over four percent (to about $42,560) within a two-hour period. Ether plunged seven and a half percent to $2,881, Cardano was down three percent to $2.16, and Dogecoin dropped seven percent to stand at 20 cents.

Experts stated that China’s property market helped to cause further “FUD” due to concerns over Chinese bans – and that this is a common and classic source of crypto price pressure. The popular crypto analyst Michaël van de Poppe said, “Markets are always reacting so heavily to FUD. Impressive.” Executive director of the crypto/digital assets hedge fund ARK36, Ulrik Lykke, said that China has been going through a rough economic patch recently and he agreed with other experts who expect the crypto market to witness some pullback in the coming days.

Lykke said, “While each time China’s crackdown on crypto happens, the markets react with a price drop, each time the effect is smaller and more short-lived.” He went on to further explain that Bitcoin and other cryptocurrencies are increasingly being recognized and actively used as a hedge against uncertainty as well as fiat currency debasement. He stated that the Chinese authorities are willing to use Bitcoin as a hedge, in spite of the governmental ban, and this informs just how much long-term confidence investors already have in the asset. In conclusion, Lykke was of the strong opinion that investors should be careful not to make emotional decisions based on trending news (FUD) stories – on-chain fundamentals still indicate that bull market continuation in Q4 is likely.

The post Digital Asset Insights #34 appeared first on JP Fund Services.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading