Financial institutions are responsible for enforcing anti-money laundering (AML) policies and procedures to prevent suspicious individuals from moving illegally obtained funds into the financial system. As part of the financial system, banks are at the forefront of ensuring that suspicious or unlawful financial activities are reported to authorities. As such, they and other major financial institutions invest in advanced transaction monitoring system solutions to identify potentially malicious financial activity. For their part, governments strictly impose anti-money laundering regulations around the world to stop criminal transactions and counter-terrorism financing.

However, as more countries participate in free trade agreements to bolster employment and economic growth, governments face the challenge of guarding free trade zones (FTZ) against illicit financial activities. Because free trade zones have reduced customs supervision and duty-free arrangements, these areas are susceptible to money laundering and other financial schemes.

To further understand why free trade zones are more vulnerable to unlawful financial activities, read on to find out more.

What is a Free Trade Zone?

Free trade zones (FTZ) are special economic hubs that enforce tax and duty exemptions together with less stringent customs supervision on participating trade parties. It generally enables faster processing of manufactured goods, including repackaging and re-exporting without inspections from customs authorities. When a business headquarters its operations within an FTZ, they can delay their tax payments until their goods have been shipped to another location. Products coming from an FTZ are only subject to prevailing tax duties once they are moved to consumers.

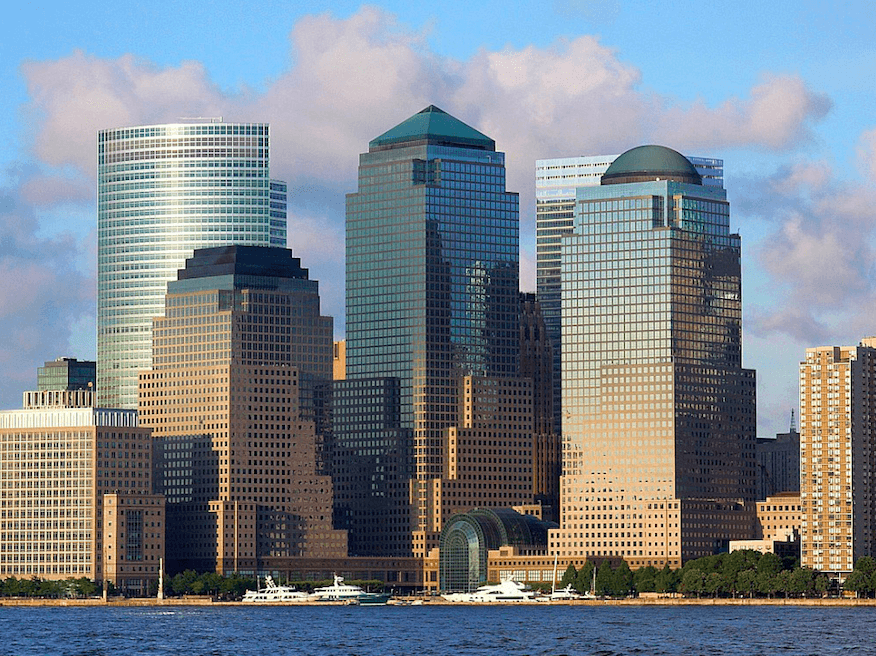

FTZs are commonly established around borders such as major airports and seaports that are strategically located for convenient trade. FTZs mainly promote free trade and economic growth by loosening complicated tax regulations and high tariff requirements between trading countries.

When Free Tree Zones Become Vulnerable to Money Laundering

Though many governments recognize the benefits of FTZs and support their proliferation, the same policies that enable free trade make it susceptible to malicious financial activities. With reduced or irregular customs checks, questionable individuals and crime syndicates consider FTZs as attractive areas for hiding and transporting illegal products. These criminals engage in trade-based money laundering which is unfortunately difficult for authorities to detect.

The following sections discuss factors that make FTZs susceptible to financial crimes:

Customs Control Varies Across Jurisdictions

Economic trade policies are unique for each country that participates in an FTZ. It enables more lenient customs control for certain goods specified in a trade agreement. And because there is no standard customs supervision for every shipment that enters the FTZ, authorities cannot closely inspect these products. Companies operating within an FTZ are also entitled to less stringent transparency duties compared to non-FTZ markets. As a result, malicious individuals and entities that evade custom checks might use FTZs as forts for money laundering and fraud.

Special Tax and Duty-Free Exemptions

FTZs offer special tax and duty arrangements to businesses to foster smoother trade and increase economic activity. However, criminals that take advantage of the system can use tax and duty exemptions to engage in trade-based money laundering schemes, which cover up illegal transactions, making it much harder for authorities to catch. Even large financial institutions with developed monitoring systems may have limited viewing capability into what happens within FTZ transactions.

Lack of Financial Transparency Between Participating Trade Groups

Besides legitimate commercial businesses that participate in FTZ markets, many entities that operate in these zones are part of family businesses and religion-based networks. These entities do not exercise the same transparency when it comes to transaction records compared to other large commercial corporations. This makes it highly difficult for authorities to trace transactions and cross-check relationships between businesses.

And because there is no way to view both internal and external financial activities in an FTZ, identifying suspicious financial patterns is usually not possible for authorities. Financial criminals may even use multiple names and addresses in their accounts to cover their tracks. Once authorities trace these false names and addresses, the criminals may have already escaped.

All these factors, such as loose customs supervision, tax and duty exemptions, and lack of financial transparency create an intricate system for building a complex crime network. Thus, many nefarious individuals and crime syndicates might easily get away with financial schemes within an FTZ.

The Importance of Advanced Transaction Monitoring for Banks

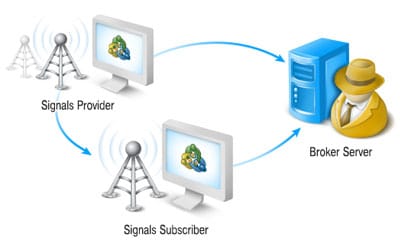

To detect money laundering and other financial crimes in an FTZ, companies based in the FTZ and financial institutions alike must be more diligent in checking more risk indicators that provide telling information about transactions. This can be done by gathering more data and using an advanced transaction monitoring system with graph analytics that can help banks draw significant connections between potentially bad actors.

When detecting money laundering and fraud in FTZs, it’s not enough to, for example, simply oversee inconsistent shipping records in high-risk areas. Banks should look out for risk indicators that might suggest suspicious financial activities. Some of these risk indicators include having one person or business connected to several other businesses, a person owning and running more than one company in the same area, and businesses shipping into one country.

Apart from risk indicators, banks should also take note of external data that they can collect legally to cross-check individuals and businesses with other FTZ companies. Some external information they can gather includes business names and addresses operating in an FTZ, other banks serving in an FTZ, and trend reports about the products received and shipped from an FTZ. Once a financial institution gathers the necessary information, it’s also important for banks to have a centralized monitoring system that carefully checks how transactions are linked with each other.

Financial crimes become harder to detect, especially when individuals participate in complex systems that cover their tracks. Now, more than ever, banks should invest in effective anti-money laundering transaction tracking systems that perform target monitoring to detect financial crimes. Having a reliable platform that identifies suspicious financial patterns is crucial for keeping up with financial criminals.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading