Last week saw the anticipated BOJ announcement which disappointed the market. The BOJ decided not to take any action on interest rates which was a surprise. Other than that, the market had a relatively sideways week.

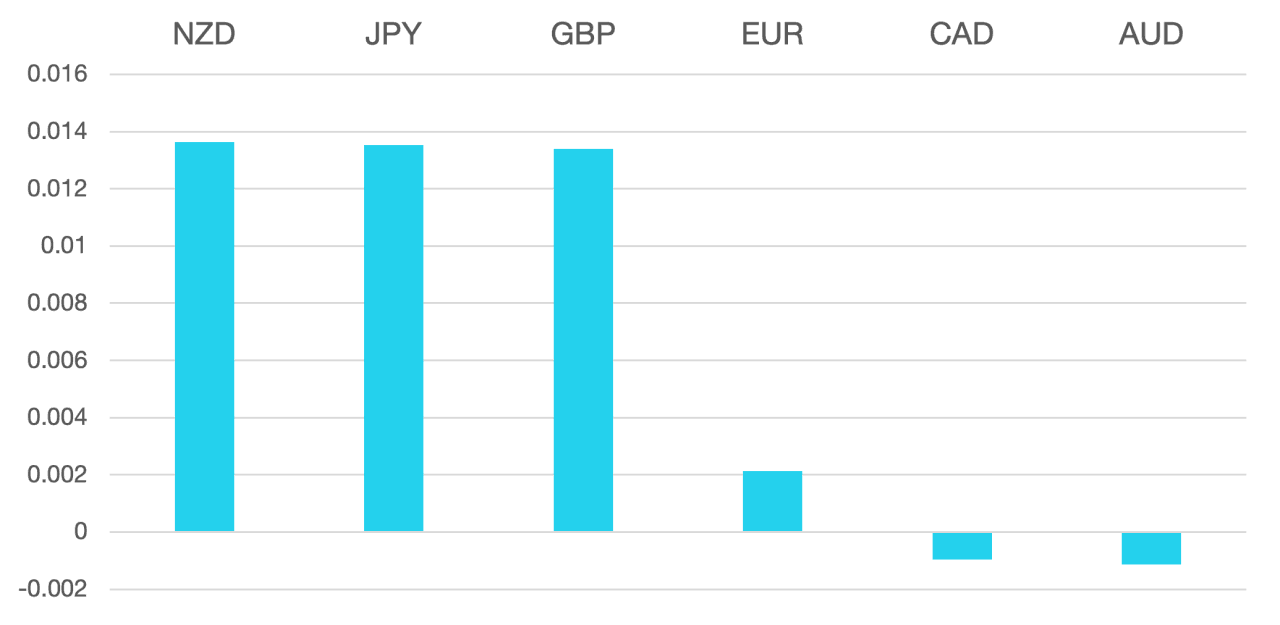

The Euro should have performed better as ECB members continue to beat the hawkish drum. Projections are more 50bps rate rises going forward bringing a level of policy divergence between the ECB and other central banks. However, the singles currency is still capped to the upside gaining just 0.2% on the week.

GBP was one of the best performers as the CPI came in at 10.5% YoY. this led the GBP to rally 1.4% to close just shy of the 1.24 level.

Commodity currencies had a mixed week with most trading flat with the exception of NZD which rallied 1.4%.

Oil remained strong gaining a further 2% to close just shy of $82.

The week ahead could be interesting as markets near major levels. 10y Yields are around important support and any move could move the USD higher and for a risk off move.

Coupled with mainland China closed for the lunar new year all week markets could be more susceptible to moves. In terms of data, we have GDP from the US as well as inflation data from Japan, Australia, and New Zealand.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

BOJ Disappoints

first appeared on trademakers.

The post Cromwell FX Market View BOJ Disappoints first appeared on JP Fund Services.

The post Cromwell FX Market View BOJ Disappoints appeared first on JP Fund Services.