· 68% of respondents see spreads as biggest challenge followed by access to liquidity

· Primary Market Execution has been most reliable execution method

· Market conditions is biggest home working challenge – significantly more challenging than banks and corporates

· Survey of hedge fund traders during May/June on impact of COVID-19

Managing forex spreads has been the biggest trading challenge for hedge fund traders since the pandemic and resulting lockdowns began according to a Refinitiv survey released today.

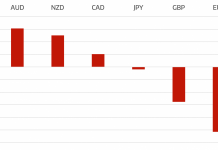

In the global survey of over 1,000 FX trading clients, which included responses from 44 traders at hedge funds, 68% percent of respondents felt spreads was the biggest challenge. This was followed by access to liquidity with 18% of respondents cited this as their biggest challenge. 14% of respondents had no issues.

The issue of spreads was felt more significantly at hedge funds compared to corporates where only 35% saw this as their biggest challenge.

Jim Kwiatkowski, Global Head of Transaction Sales at Refinitiv, comments: “The changes to spreads during this period have been well documented. Spreads widened as volatility increased and providers became concerned about client credit. This was clearly a market-wide impact, but one that was mitigated, at least partially, by the utilization of trading tools to aggregate available relationship pricing and find that elusive ‘best price’.

“Many clients have taken advantage of auto execution capabilities for smaller orders so that they can focus on their larger, more difficult to execute orders.”

Reliability of execution methods

The survey also asked which execution method was the most reliable during the crisis period. The most popular answer was Primary Market Execution, chosen by 45%, followed by Streaming Risk Transfer, chosen by 41% of respondents. In contrast, over 70% of corporates and asset managers favoured Streaming Risk Transfer.

Jim continues: “The balance of the answers highlighted an increased use of tools to automate the workflow around a voice trade and algorithmic execution.

“The results also clearly show that the request for quotation is the most reliable way of getting FX business done for a very significant proportion of the market.

“The increased use of Send Details, which allows trades to be agreed by voice, but then automates the booking through normal Straight Through Processing, suggests that a fully integrated electronic solution is the lowest risk method to execute FX.”

Market conditions having a more significant impact compared to banks and corporates

When asked about working from home, 61% of all respondents cited market conditions as the biggest challenge. This was followed by a lack of home working capability for critical systems and communication with colleagues – both on 11%. Market conditions was significantly more important for hedge funds compared to banks (23%), corporates (18%), and asset managers (27%).

Jim concludes: “We expect that hedge funds have found it much more challenging due to the spreads in the market. While they enjoy volatility, they like to profit on small changes and may have struggled to execute profitable trades.

“Difficulties in communicating could be part of the reason why electronic trading was found from the survey to be far more reliable for our participants than ‘Voice risk transfer’.

“It also shows that instead of reverting to old-world methods (voice), the market is now so far down the path of electronification that it pushed even further in this direction as the crisis evolved.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading