The UK’s economic recovery stalled in September, with businesses reporting that profits were down 21% – unchanged from a month earlier.

Perhaps more concerningly, business sentiment has deteriorated significantly over the past four weeks, as the spectre of renewed lockdown restrictions looms over the economy. 35% of businesses described trading conditions as good at the end of September – down from 39% in the previous wave of the Opinium-Cebr Business Distress Tracker four weeks prior. The share with a positive outlook for the next 12 months has also dropped from 52% to 45%.

Conditions deteriorated significantly for the hospitality sector following the end of the Eat Out to Help Out scheme in August. Indeed, profits in the sector were down by 42% in the latest wave of the Business Distress Tracker, compared to a figure of 36% four weeks earlier.

Businesses are expecting to lay-off more than a third (35%) of furloughed workers after the scheme expires at the end of October. Crucially, the survey was carried out after the new Job Support Scheme was announced as a replacement for the furlough scheme. The survey results show that the share of furloughed employees that businesses plan to retain was not affected by the announcement of this scheme.

Business insolvency risks

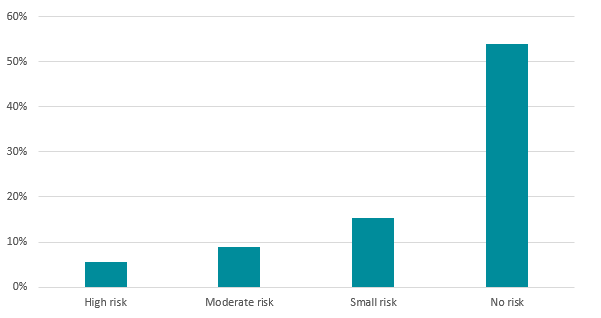

Insolvency risks continue to hang over millions of businesses, although these have become less severe in recent weeks. Just under a third (30%) of businesses state that there is a risk of entering insolvency as a result of coronavirus-related disruption, which is down from 34% four weeks prior. However, this still equates to 1.7 million businesses across the country, which includes 330,000 that feel there is a high risk of entering insolvency as a result of the crisis.

Figure 1 Risk of entering insolvency as a result of coronavirus-related disruption

Employment impacts

As the government’s Coronavirus Job Retention Scheme expires at the end of the month, companies continue to roll back the number of employees who are currently furloughed, with the average percentage dropping from to 21% at the end of July to 18% in late September. Firms state that currently a quarter of workers (25%) are facing reduced hours which is roughly the same proportion recorded at the end of August. A similar proportion (26%) have had their salary/wages cut which again remains unchanged since late August.

Business activity rates

After improving significantly in August, progress in rebuilding profits stalled in September. Profits over the past 30 days were 21% lower as a result of the coronavirus crisis at the end of September – unchanged from the previous wave four weeks’ previously. After a relatively strong August for the hospitality sector, profits slumped in September, with businesses on average reporting that profits were 42% lower than they would have expected at this time of year.

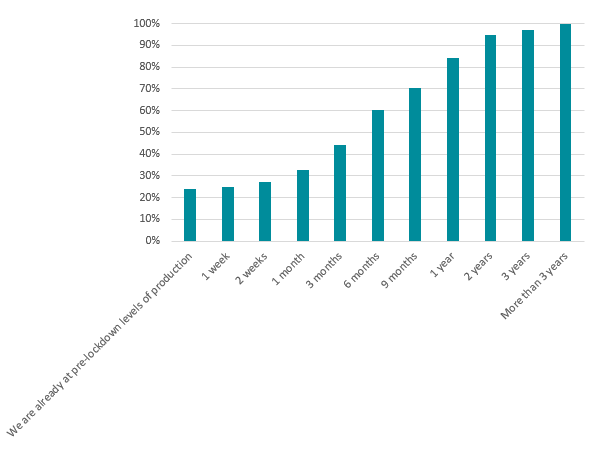

Economic recovery

The share of businesses that had reached pre-lock down levels of production fell from 21% in the previous wave of the Business Distress Tracker to 20% in the latest wave. This suggests that some businesses that had fully recovered over the summer months have since seen their production fall below pre-crisis levels. Meanwhile, the majority (56%) of businesses stated that it will be at least six months before they return to pre-lockdown levels of production, including 29% who expect this will take at least one year.

Responses have been weighted based on the number of micro, small, medium and large firms among the UK’s business population.

James Endersby, CEO at Opinium said “The loosening of restrictions over the summer allowed many businesses to make a start on the road to recovery – this has halted in September. The reimposition of restrictions for millions of people across the country has had a marked impact on the UK’s economic recovery, as well as the levels of optimism with regards to businesses’ future outlook. With the Job Retention scheme due to expire at the end of the month, many firms continue to reduce the number of employees on it, however, the steady rates of reduced hours and cut wages since August suggests that businesses are nowhere near ready yet for a return to ‘normal’.”

Pablo Shah, Managing Economist at Cebr said “The results from the latest wave of the Business Distress Tracker show that the UK’s economic recovery stalled in September, as a result of the re-imposition of restrictions as well as the end of the Eat Out to Help Out scheme. This highlights that for every two steps forward that the UK takes in its economic rebuilding, it will have to take one step back in response to flare ups of coronavirus and the gradual withdrawal of government stimulus.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading