One of the biggest stumbling blocks when it comes to programming and calibrating trading algorithms is the time it can take to back-test these strategies to see how well they work and identify potential problems. Even on a powerful desktop PC, a standard back-test can take several days to compute, which slows down the process significantly and makes it hard to evolve strategies in a timely fashion.

However, a new type of solution, which uses cloud computing technology to process the millions of calculations required by a back-test in a matter of minutes, has recently emerged. These platforms also offer a range of additional features, such as community-building to attract investment, specialized coding environments, and the ability to execute algorithmic trading strategies on the live markets. Here, we look at three of the main contenders in this fast-developing arena.

However, a new type of solution, which uses cloud computing technology to process the millions of calculations required by a back-test in a matter of minutes, has recently emerged. These platforms also offer a range of additional features, such as community-building to attract investment, specialized coding environments, and the ability to execute algorithmic trading strategies on the live markets. Here, we look at three of the main contenders in this fast-developing arena.

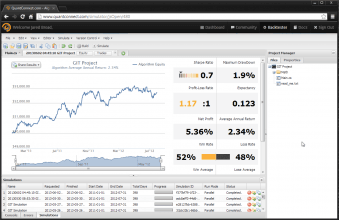

QuantConnect is one of a new breed of automated trading platforms that offers users the chance to backtest their algorithms on historical data quickly using cloud computing technology. Like the high-end OpenQuant platform, which we looked at in part 2 of this series, it uses the C# programming language for programming algorithms, which is an object orientated offshoot of the C/C+/C++ series of languages. This allows programmers to create much more complex algorithms than they might be able to in a dedicated algo trading language such as MQL4, for example, but the flipside of this is that the learning curve is a fair bit steeper.

The USP for this service is the fact that it provides so many high-end resources for free. Users can test algorithms out on up to five year’s worth of historical forex tick data in a matter of minutes, rather than the several days it would take to process using their own computer’s processor. This makes it much easier to develop and refine strategies quickly, without losing momentum while waiting for the results of a long backtest. As well as providing a free coding and backtesting environment with access to market data, the service is also designed to provide successful coders with a platform for attracting investment, and investors with a way to leverage the programming skills of quants via the QuantConnect community.

The USP for this service is the fact that it provides so many high-end resources for free. Users can test algorithms out on up to five year’s worth of historical forex tick data in a matter of minutes, rather than the several days it would take to process using their own computer’s processor. This makes it much easier to develop and refine strategies quickly, without losing momentum while waiting for the results of a long backtest. As well as providing a free coding and backtesting environment with access to market data, the service is also designed to provide successful coders with a platform for attracting investment, and investors with a way to leverage the programming skills of quants via the QuantConnect community.

Although it is primarily a free service, users who wish to put their scripts into practice on the markets can do so via a tie-in with Interactive Brokers. This is currently how the service is monetized, although there are plans to provide other paid services for investors such as a fund aggregating the most successful users of the platform.

Quantopian

This service launched around the same time as QuantConnect, and offers very similar facilities, with free backtesting on historical market data. It uses the popular programming language Python, for which there are many trading algorithms already available. The community aspect of the service is very up-front, with a stream of posts by programmers within the community visible on the homepage. At the moment, the historical data available is limited to stocks, although there are plans to introduce other asset classes including forex in the near future.

RIZM

Another recent entrant to the cloud-based algo programming environment arena is RIZM, from EquaMetrics Inc. Unlike many platforms that require users to code their own algorithms, RIZM provides a visual interface that makes it possible for traders and investors to create scripts without any prior programming knowledge or know-how. This interface, which is known as Algobuilder, allows users to simply drag and drop widgets to set key indicators, actions, and methods in a logical and intuitive way.

Having been in development for over two years, RIZM provides a comprehensive range of pre-programmed fundamental and technical indicators which can be set for intervals of one minute to 24 hours. Algorithms can be back-tested quickly using cloud computing power, and implemented on live markets through FXCM or Interactive Brokers, although there are plans to make it compatible with all major brokerages. At the moment, it supports equities, forex, and futures, but there are plans to make it compatible with other forms of trading such as fixed income securities and options.

Having been in development for over two years, RIZM provides a comprehensive range of pre-programmed fundamental and technical indicators which can be set for intervals of one minute to 24 hours. Algorithms can be back-tested quickly using cloud computing power, and implemented on live markets through FXCM or Interactive Brokers, although there are plans to make it compatible with all major brokerages. At the moment, it supports equities, forex, and futures, but there are plans to make it compatible with other forms of trading such as fixed income securities and options.

The service is charged on a monthly basis, although you can use it for free for two weeks on a trial basis. For $99 per month users can perform up to 100 back tests, run two live strategies simultaneously, and execute with 5 symbols per algorithm. For $249 per month, you can make unlimited use of the platform’s facilities. These prices put it into closer competition with platforms such as NinjaTrader and TradeStation than the free services offered by QuantConnect and Quantopian, but if you find the prospect of coding in C# or Python daunting, then it may be well worth the investment.

Other articles in this series:

- Guide to Automated Forex Trading Software Part 1

- Guide to Automated Forex Trading Software Part 2

- Forex Trading Automated Robots and Systems

- Advantages and Disadvantages of Automated Forex Trading

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading